Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

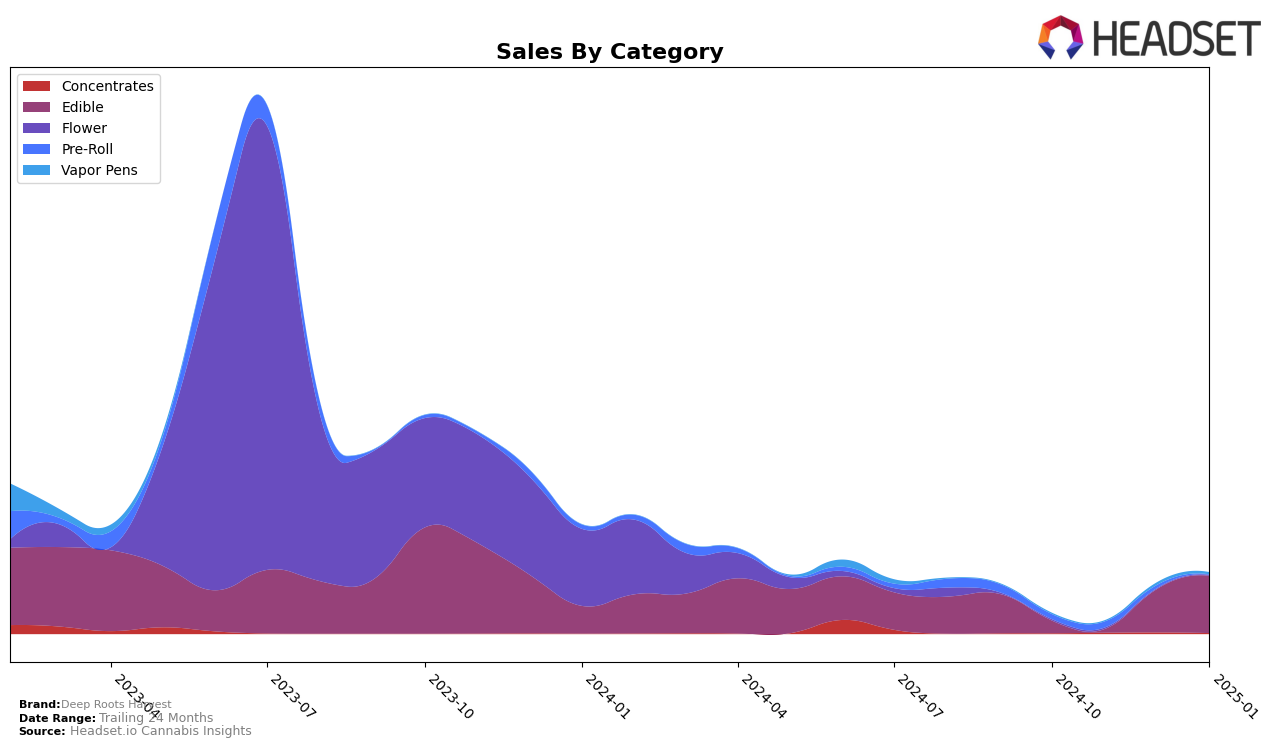

Deep Roots Harvest has shown notable improvements in the Edible category within Nevada over the span from October 2024 to January 2025. Initially absent from the top 30 brands in October and November 2024, they made a significant entry into the rankings by December, securing the 26th position, and further improved to 21st place by January 2025. This upward trajectory highlights a successful strategy or product offering that resonated well with consumers, particularly given the competitive nature of the edible market. The absence in the earlier months could suggest a period of restructuring or new product launches that eventually paid off by the end of the period.

The sales figures for Deep Roots Harvest in the Edible category reflect this positive trend, with a noticeable increase from December 2024 to January 2025. The sales in January 2025 were significantly higher than in the previous months, indicating strong consumer acceptance and possibly effective marketing or distribution strategies. While the exact factors contributing to this success are not fully detailed here, it is clear that Deep Roots Harvest is gaining momentum in the Nevada market, setting a foundation for potential future growth. Observers of the cannabis market might find it interesting to track whether this growth continues and if similar trends are observed in other states or product categories.

Competitive Landscape

In the Nevada edible cannabis market, Deep Roots Harvest has shown a notable upward trajectory in recent months. After not ranking in the top 20 from October to December 2024, Deep Roots Harvest made a significant comeback in January 2025, securing the 21st position. This resurgence is particularly impressive given the competitive landscape, where brands like Tyson 2.0 consistently maintained strong positions, ranking 16th to 17th from November 2024 to January 2025, with sales figures significantly higher than Deep Roots Harvest. Meanwhile, Just Edibles fluctuated between 17th and 20th place, showcasing a competitive edge with higher sales, especially in January 2025. The decline of Evergreen Organix, which dropped from 18th in October 2024 to 24th by January 2025, highlights a shift in consumer preferences that Deep Roots Harvest could capitalize on. As Deep Roots Harvest continues to climb the ranks, it will be crucial to monitor these dynamics and leverage advanced data insights to sustain and enhance its market position.

Notable Products

In January 2025, Helix Twist - Sour Cherry Gummies 10-Pack (100mg) emerged as the top-performing product for Deep Roots Harvest, boasting a significant sales figure of 845 units. This product climbed from a third-place rank in December 2024 to first place, demonstrating a notable increase in popularity. Helix Twist - Freestone Peach Gummy 10-Pack (100mg) maintained its position as the second-best seller, despite a decrease in sales compared to the previous month. Helix Twist - Key Lime Gummies 10-Pack (100mg) dropped one rank from December to January, now holding the third position. Meanwhile, Helix - Indica Sour Blue Raspberry Gummy 10-Pack (100mg) remained stable in fourth place, while Helix - Blood Orange Gummies 10-Pack (100mg) fell from first to fifth place since October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.