Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

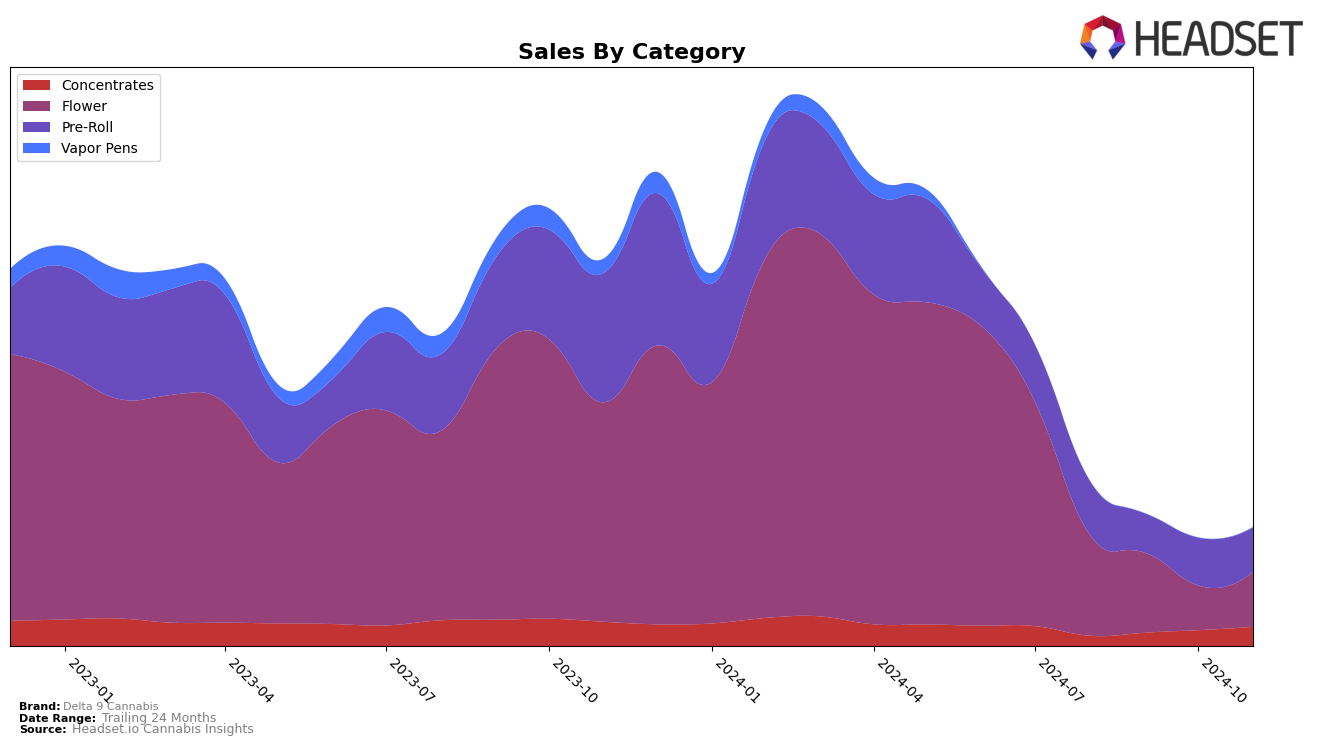

Delta 9 Cannabis has shown varied performance across different categories and provinces. In Alberta, their Concentrates category saw a slight improvement, moving from rank 39 in October 2024 to 37 in November 2024, accompanied by an increase in sales, suggesting a positive trend and potential growth in this segment. However, in the Flower category, they have struggled to maintain a strong position, with rankings fluctuating and never breaking into the top 30. This indicates a competitive market where Delta 9 Cannabis is yet to make a significant impact. Their Pre-Roll category performance in Alberta remained relatively stable, with a minor improvement in rank from 64 in October to 61 in November, reflecting a steady demand but not enough to reach the top tier of brands.

In British Columbia, Delta 9 Cannabis has shown promising growth in the Concentrates category, improving their rank from 33 in September to 29 in November 2024, which suggests increasing popularity and acceptance among consumers. This upward trend in ranking is further supported by rising sales figures. On the other hand, the Flower category in British Columbia presents a challenge, as Delta 9 Cannabis was not ranked in the top 30 for October, indicating a need for strategic adjustments to capture market share. The absence of a rank in October highlights the volatility and competitive nature of the Flower market in this region.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Delta 9 Cannabis has shown a fluctuating performance over recent months. Notably, Delta 9 Cannabis improved its rank from 73rd in September 2024 to 61st by November 2024, indicating a positive trend in market presence. This improvement contrasts with brands like Solei and San Rafael '71, which have seen a decline in their sales and rankings over the same period. Meanwhile, Pistol and Paris has also shown a notable rise, surpassing Delta 9 Cannabis in November 2024. Additionally, Coterie made a significant leap in October 2024, ranking 58th, but fell slightly to 62nd in November. These dynamics suggest that while Delta 9 Cannabis is gaining traction, it faces strong competition from brands that are also improving their market strategies and sales performance.

Notable Products

In November 2024, the Bliss Pre-Roll 2-Pack (1g) emerged as the top-performing product for Delta 9 Cannabis, reclaiming the number one rank it held in September after dropping to fifth in October, with a significant sales figure of 3876 units. The Twist Pre-Roll 2-Pack (1g) followed closely in second place, showing a strong upward movement from its third rank in October, with notable sales growth. Space Stix Infused Pre-Roll 2-Pack (1g) maintained a steady presence in the top three, though its sales slightly decreased from the previous month. Sapphire Kief (2g) consistently held the fourth position from September to November, indicating stable performance within the Concentrates category. Prairie Blaze Pre-Roll 2-Pack (1g) re-entered the rankings in fifth place, showing a resurgence in sales after being unranked in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.