Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

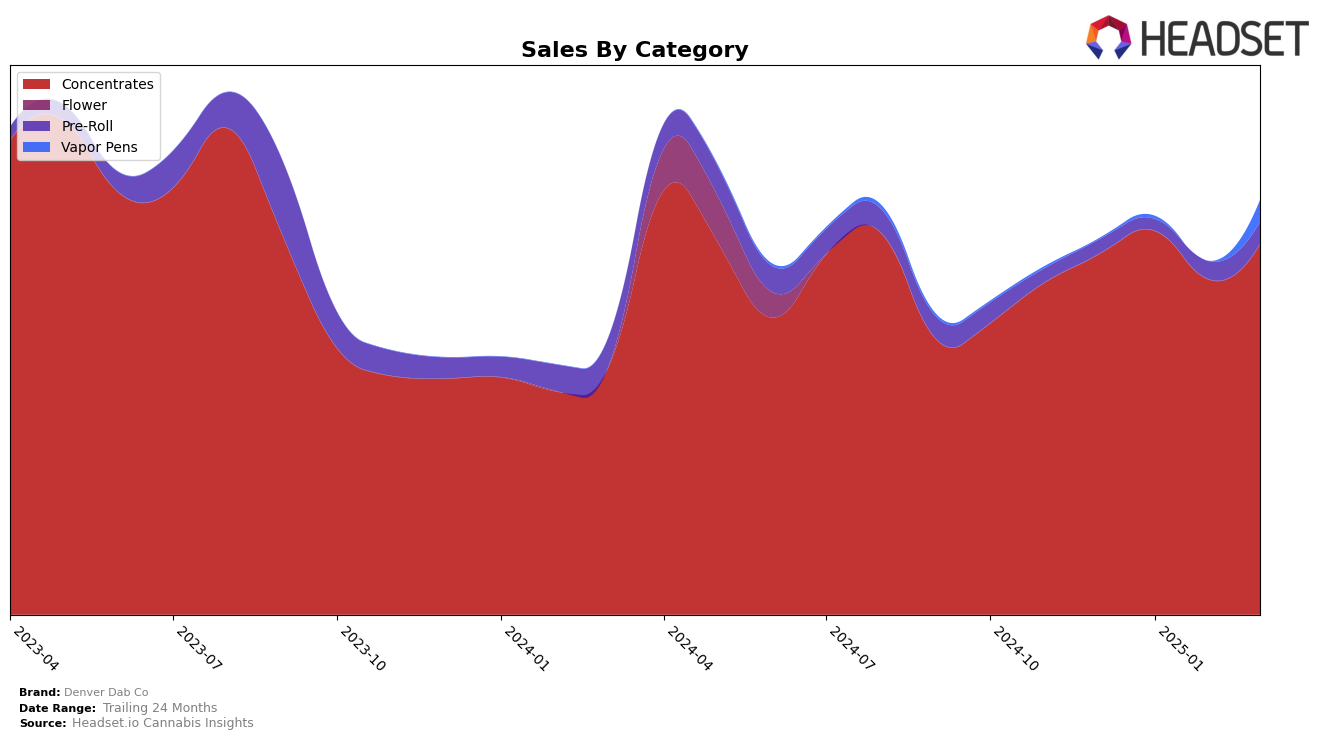

Denver Dab Co has demonstrated a strong presence in the Colorado market, particularly in the Concentrates category. Over the first quarter of 2025, the brand maintained a consistent ranking within the top 10, peaking at 5th place in January. This stability is indicative of a solid market position and consumer preference for their concentrates, despite a slight dip in sales in February. The Pre-Roll category saw more volatility, with Denver Dab Co not making the top 30 in January, but showing a significant improvement by March, climbing to 65th place. This upward trend in Pre-Rolls suggests potential growth opportunities if the brand can continue to capitalize on this momentum.

In contrast, Denver Dab Co's performance in the Vapor Pens category in Colorado is less remarkable, as they only entered the top 30 in March, ranking 79th. This late entry into the rankings might suggest challenges in gaining traction or a highly competitive market space. The initial sales figure for March indicates that while there is consumer interest, there is substantial room for growth. The brand's ability to maintain or improve its position in the Vapor Pens category will likely depend on strategic marketing and product differentiation efforts. Overall, Denver Dab Co's performance across categories in Colorado shows strengths in Concentrates, with emerging potential in Pre-Rolls and Vapor Pens.

Competitive Landscape

In the competitive landscape of Colorado's concentrates category, Denver Dab Co has demonstrated a strong performance, maintaining a consistent presence in the top 10 brands from December 2024 to March 2025. Notably, Denver Dab Co improved its rank from 8th in December 2024 to 5th in January 2025, before stabilizing at 7th in both February and March 2025. This upward movement in rank is indicative of a strategic push that has positively impacted their sales trajectory, despite a slight dip in February. In comparison, Concentrate Supply Co. has consistently trailed behind Denver Dab Co, holding the 8th position for most of the period. Meanwhile, Dabble Extracts and Nomad Extracts have shown competitive resilience, with Dabble Extracts maintaining a strong 5th position in March 2025, and Nomad Extracts closely following Denver Dab Co's rank. The fluctuations in rank and sales among these brands highlight the dynamic nature of the market, where Denver Dab Co's strategic initiatives have positioned it favorably against competitors like Next1 Labs LLC, which saw a decline in rank and sales over the same period.

Notable Products

In March 2025, the top-performing product for Denver Dab Co was Freedom Road Wax (1g) in the Concentrates category, maintaining its consistent position at rank 1 since December 2024 with sales of 3,221 units. FR Wax (1g) also performed well, holding steady at rank 2, though its sales figures saw a decline compared to previous months. Notably, Banana Daddy Sugar Wax (1g) debuted at rank 3, indicating a strong entry into the market. Spanish Moon Wax (1g) followed closely at rank 4, while Gary Poppins Sugar Wax (1g) secured the 5th position. These rankings suggest a competitive landscape within the Concentrates category, with new entries impacting the sales dynamics.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.