Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

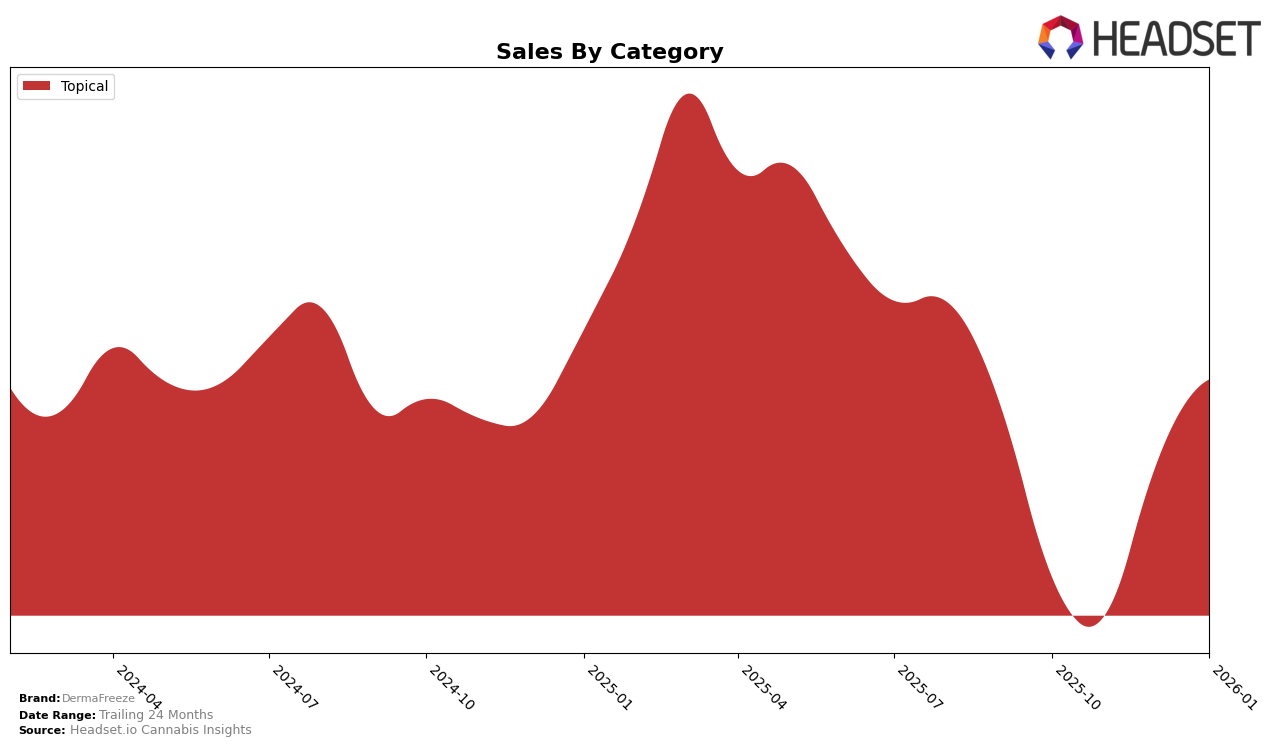

DermaFreeze has shown a noteworthy trajectory in the topical category within the state of Arizona. Notably absent from the top 30 rankings in October and November 2025, DermaFreeze made a significant entrance by securing the 7th position in December 2025 and advancing to the 6th position by January 2026. This upward movement suggests a strong growth momentum and increasing consumer interest in their topical products. The leap into the top 10 indicates a potential strategic shift or successful marketing campaign that resonated well with their target audience.

Despite the absence of DermaFreeze in the top 30 rankings for the initial months of the observed period, their rapid ascension in Arizona's topical category highlights a positive trend. The brand's sales trajectory, marked by a jump from $11,607 in December 2025 to $15,549 in January 2026, underscores this positive movement. However, their presence and performance in other states remain undisclosed, which could suggest varying levels of market penetration or strategic focus. This information could be crucial for stakeholders aiming to understand the brand's overall market strategy and potential areas for expansion.

Competitive Landscape

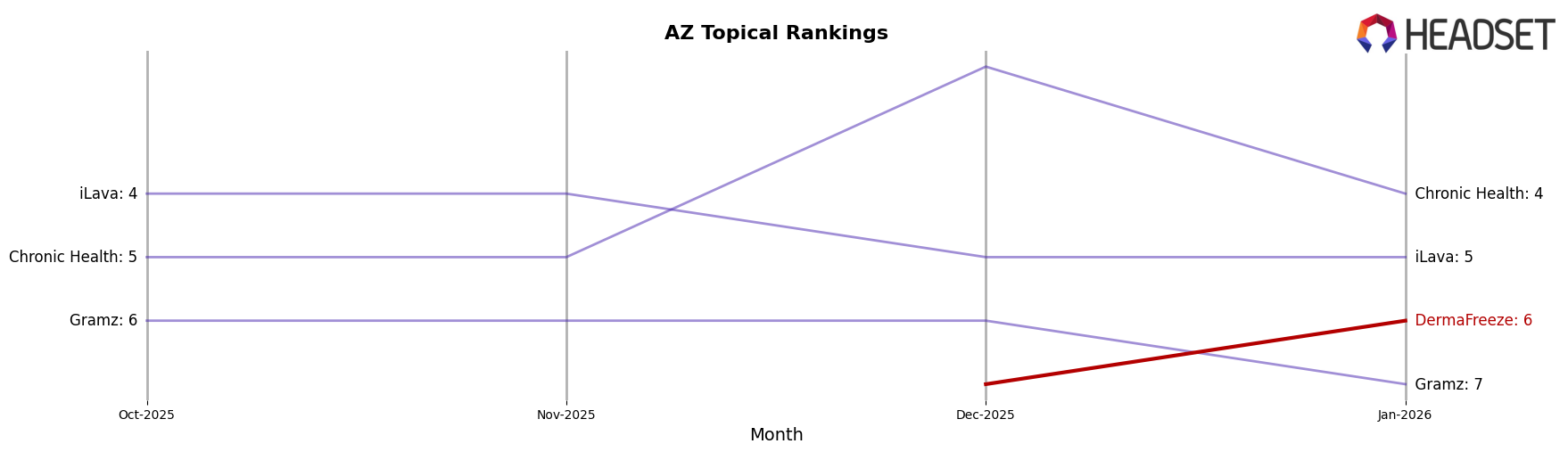

In the competitive landscape of the Topical category in Arizona, DermaFreeze has shown a notable upward trajectory in recent months. After not ranking in the top 20 in October and November 2025, DermaFreeze emerged at the 7th position in December 2025 and climbed to 6th in January 2026. This rise indicates a positive trend in consumer interest and market penetration. In contrast, iLava maintained a steady presence, holding the 4th position in October and November 2025, before slightly dropping to 5th in December and January 2026. Meanwhile, Chronic Health experienced a significant boost, jumping from 5th in November to 2nd in December 2025, before settling at 4th in January 2026, suggesting a strong seasonal demand. Gramz faced a decline, consistently dropping from 6th in October to 7th in January 2026, reflecting a decrease in sales momentum. DermaFreeze's recent performance demonstrates its growing competitiveness in the market, potentially capturing market share from its rivals.

Notable Products

In January 2026, DermaFreeze's top-performing product was the CBD/THC 5:1 Advanced Topical Nano-Gel (500mg CBD, 100mg THC, 4oz), maintaining its first-place rank from the previous three months with a notable sales figure of 755 units. The CBD/THC 1:1 Advanced Topical Lotion (300mg CBD, 300mg THC, 4oz) was not ranked in January 2026, having consistently held the second position from October to December 2025. This indicates a significant shift in consumer preference or availability. The Nano-Gel's consistent top rank and increased sales suggest a strong market demand and effective product positioning. Overall, DermaFreeze's topical category continues to lead in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.