Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

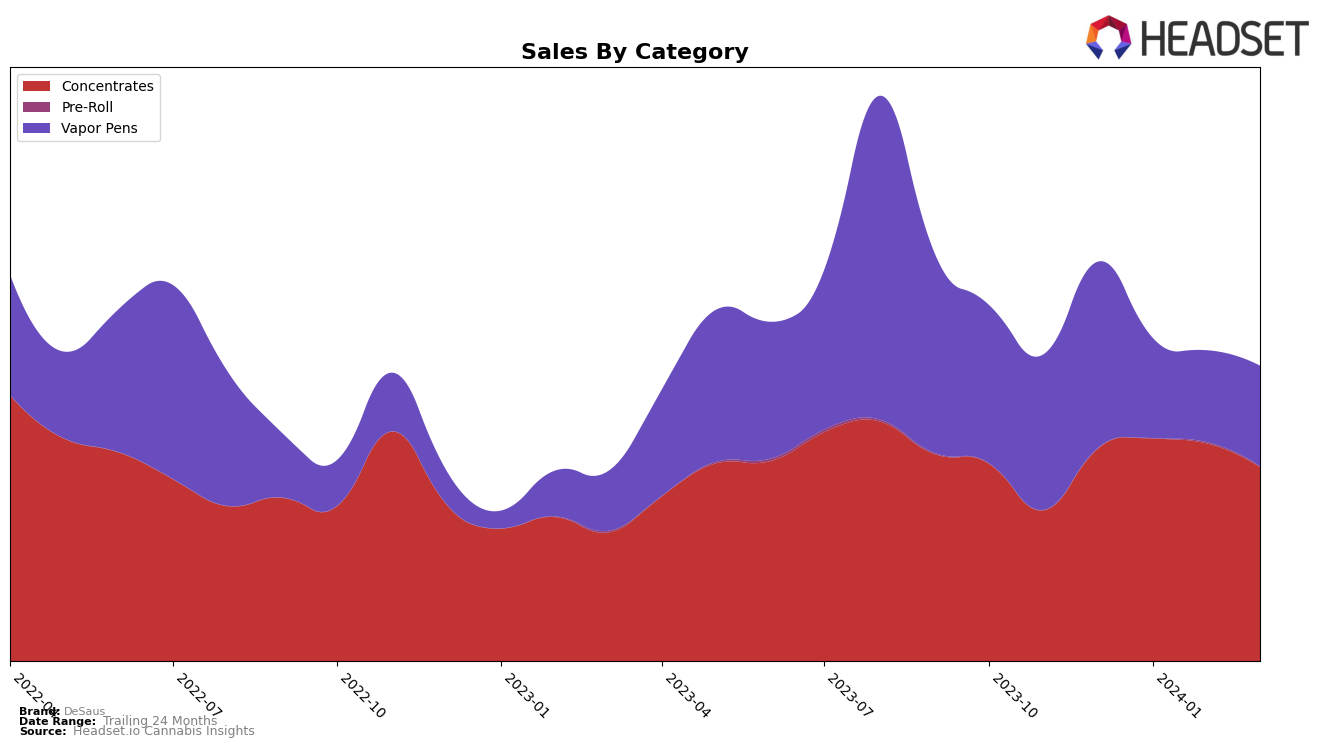

In the state of Washington, DeSaus has shown a notable presence in the cannabis market, particularly in the Concentrates category. The brand managed to maintain its position within the top 30 brands for December 2023 through February 2024, with rankings of 27th, 23rd, and again 23rd, respectively. However, there was a slight dip in March 2024, where it fell to the 28th rank. This movement indicates a consistent consumer interest in DeSaus' Concentrates, with a minor setback in March. The sales figures reflect this trend, with a peak in January 2024 at $92,603, followed by a slight decrease in February and a more noticeable drop in March to $81,217. This fluctuation in sales and rankings highlights the competitive nature of the cannabis concentrates market in Washington.

On the other hand, DeSaus' performance in the Vapor Pens category tells a different story. Starting from a lower rank of 58th in December 2023, the brand experienced a significant decline, moving down to 84th in January 2024, and further slipping to 87th in February 2024, before slightly recovering to 85th in March 2024. This trajectory suggests a challenging period for DeSaus in the Vapor Pens market segment within Washington. The sales figures correlate with these rankings, showing a sharp decline from December's $77,485 to $41,514 in January, and continuing to decrease through February. Although there was a minor increase in sales in March to $42,019, the brand's performance in this category indicates struggles to capture and retain a substantial market share amidst stiff competition.

Competitive Landscape

In the competitive landscape of the concentrates category in Washington, DeSaus has shown a fluctuating yet resilient performance against its competitors. Starting from December 2023, DeSaus ranked 27th, improved to 23rd in January and February 2024, but slightly declined to 28th by March 2024. This trajectory indicates a volatile market position but also highlights DeSaus's ability to maintain relevance amidst stiff competition. Notably, Agro Couture and Falcanna have shown similar fluctuations, with Agro Couture moving from being unranked in the top 20 to 20th and then out of the top 20 again, and Falcanna experiencing a slight improvement by March 2024. Dank Czar and Supernova (WA) have also seen significant rank changes, with Supernova (WA) making a notable jump into the top 30 by March 2024. These movements suggest a highly competitive environment where brands are closely contending for market share, with DeSaus needing to innovate and adapt to maintain and improve its market position.

Notable Products

In March 2024, DeSaus saw Peyote Purple Live Resin (1g) maintain its position as the top-selling product in the concentrates category, with sales figures reaching 605 units. Following closely behind, Reserve - Black Widow Live Resin (1g) secured the second rank, showcasing consistent performance improvement from its previous positions. Fruit Bus Live Resin (1g) made a notable jump to the third rank, indicating a growing consumer preference. Interestingly, Secret GMO Live Resin (1g), despite not being listed in earlier months, made a significant entry at rank four. Lastly, Grapefruit Skunk Live Resin (1g) experienced a slight decline, moving from the fourth to the fifth position, reflecting the dynamic nature of consumer demand within the concentrates category at DeSaus.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.