Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

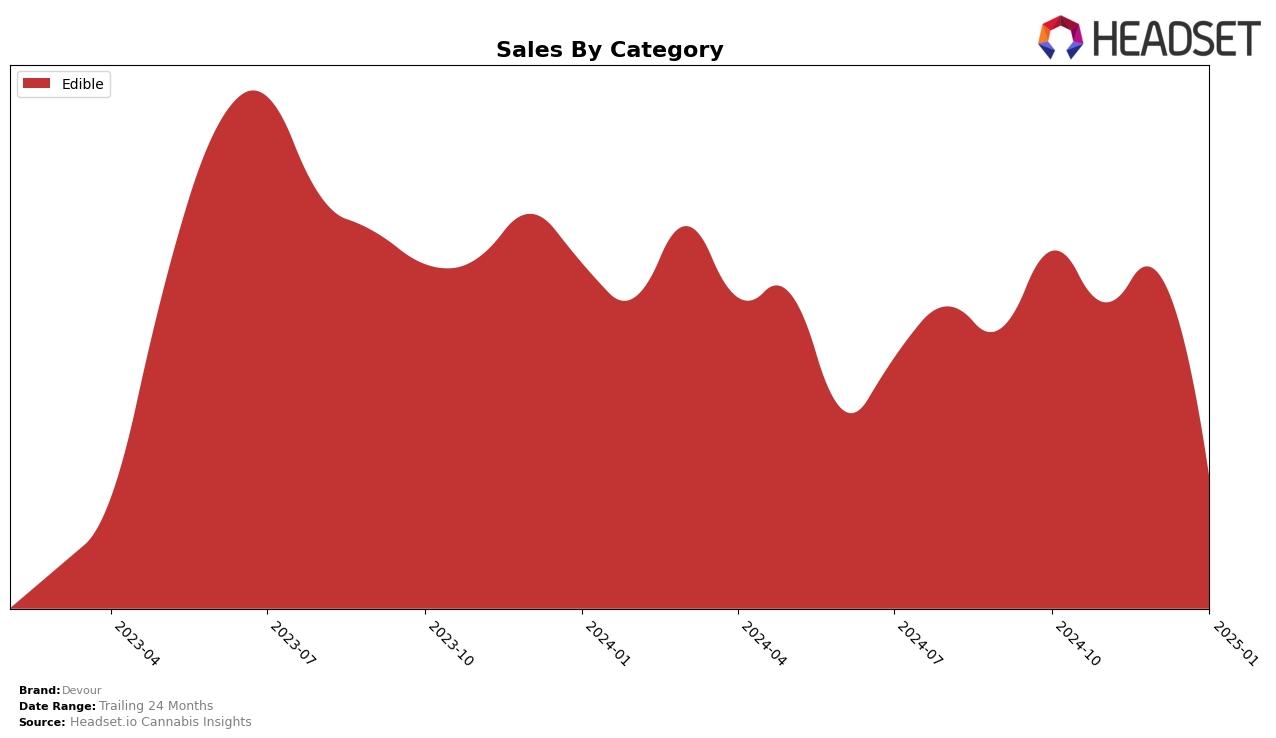

Devour's performance in the Edible category in Colorado has shown notable fluctuations over the past few months. Starting from a rank of 21 in October 2024, the brand experienced a slight decline, dropping to 23 in both November and December, and further slipping to 30 by January 2025. This downward trend suggests potential challenges or increased competition in the market. The sales figures also reflect this trend, with a significant decrease from $77,752 in October to $31,468 by January. Such a drop could indicate seasonal factors or shifting consumer preferences impacting the brand's position.

Interestingly, the absence of Devour from the top 30 rankings in any other states or provinces within the Edible category during this period highlights a potential area for growth or concern. While the data does not provide insights into other regions, the brand's presence solely in Colorado suggests a focused market strategy or possibly limited geographical reach. This information could be crucial for stakeholders looking to understand the regional dynamics and competitive landscape of the Edible category, potentially signaling opportunities for expansion or the need for strategic adjustments.

Competitive Landscape

In the competitive landscape of the Edible category in Colorado, Devour has experienced notable fluctuations in its rank and sales over the past few months. Starting from a relatively strong position in October 2024 at rank 21, Devour saw a decline to rank 30 by January 2025. This downward trend is mirrored in its sales, which dropped significantly from October to January. In contrast, Dutch Girl has shown a positive trajectory, improving its rank from 32 to 29 and increasing its sales, indicating a growing consumer preference. Meanwhile, Nove Luxury Chocolate also experienced a decline in rank, similar to Devour, but managed to maintain a closer sales figure to Devour's January performance. Additionally, Edun has made significant strides, climbing from rank 40 to 28, with a consistent increase in sales, potentially posing a future threat to Devour's market position. These dynamics suggest that while Devour remains a key player, it faces increasing competition and must strategize to regain its standing in the Colorado Edible market.

Notable Products

In January 2025, Fruity Stash Gummies maintained their top position as the best-selling product for Devour, despite sales dropping to 1404 units. The CBD:THC 1:1 Blue Raspberry Gummies 10-Pack climbed to the number one spot alongside Fruity Stash Gummies, marking a significant rise from its consistent second place in the previous months. Tropical Sunrise Gummies 10-Pack moved up to the second rank, showing a slight improvement in its standing from third place in the last three months. Watermelon Gummies saw a modest increase in rank, moving up to third position from fourth in December 2024. Overall, the product rankings for Devour in January 2025 reflect a dynamic shift, with notable movements in the top positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.