Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

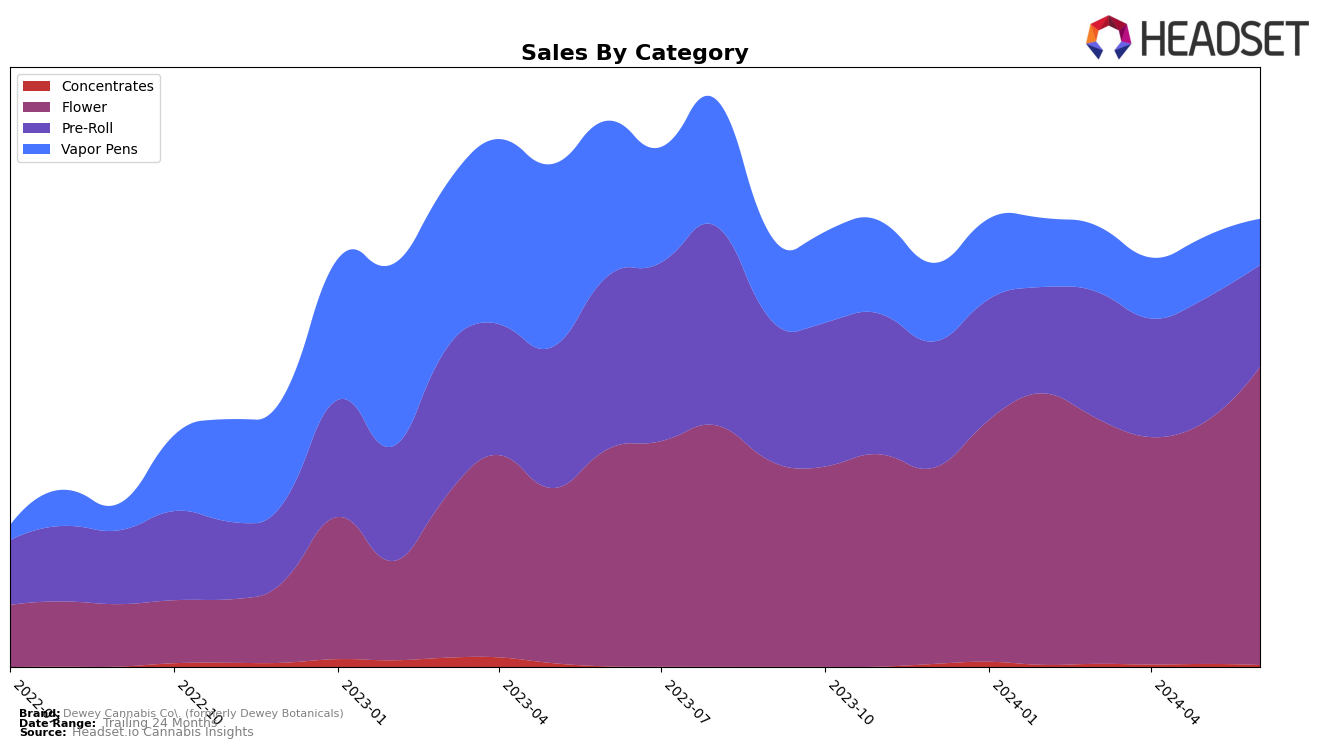

Dewey Cannabis Co. (formerly Dewey Botanicals) has shown notable movement in the Washington market, particularly in the Flower category. Over the past few months, the brand has climbed from a ranking of 46 in April 2024 to 23 in June 2024. This upward trajectory is significant, indicating a positive reception among consumers and a potential increase in market share. The sales figures for June 2024 reflect this trend, with a marked increase compared to previous months. Conversely, their performance in the Pre-Roll category has seen a slight decline, moving from a rank of 32 in March 2024 to 38 in June 2024, suggesting a potential area for strategic improvements.

In the Vapor Pens category, Dewey Cannabis Co. has struggled to maintain a competitive position, falling out of the top 30 brands entirely. The brand's rank dropped from 73 in March 2024 to 85 in June 2024, accompanied by a consistent decrease in sales. This decline highlights a challenge for the brand in maintaining its foothold in this segment. The contrasting performance across categories underscores the importance of targeted strategies to bolster their presence in underperforming areas while capitalizing on their strengths in the Flower category. For a deeper dive into the specifics of their market performance, further data analysis is essential.

Competitive Landscape

Dewey Cannabis Co. (formerly Dewey Botanicals) has shown a notable upward trend in the Washington flower market over the past few months. Starting from a rank of 42 in March 2024, the brand has climbed to 23 by June 2024, indicating a significant improvement in its market position. This upward trajectory is particularly impressive when compared to competitors like Sky High Gardens and Fireline Cannabis, which have experienced more fluctuating ranks. For instance, Sky High Gardens moved from 37 to 22, while Fireline Cannabis saw a dip before recovering to 25. Another competitor, Khush Kush, also showed a similar upward trend, moving from 46 to 24. Meanwhile, Falcanna maintained a relatively stable high rank, moving from 25 to 21. The consistent rise in Dewey Cannabis Co.'s rank, coupled with increasing sales figures, suggests a growing consumer preference and effective market strategies, positioning it as a strong contender in the Washington flower category.

Notable Products

In June 2024, the top-performing product for Dewey Cannabis Co. (formerly Dewey Botanicals) was Flora d'Explora (3.5g) in the Flower category, maintaining its first-place ranking with notable sales of 1866 units. Purple Mango (3.5g), also in the Flower category, climbed to the second position with 1585 units sold, showing a steady improvement from its fifth-place rank in March. Cosmic Pie (3.5g) advanced to third place, continuing its upward trend from May. Caribbean Chocolate (3.5g) entered the rankings for the first time in fourth place. Double Dewbies - Happy Trails Pre-Roll 2-pack (1g) in the Pre-Roll category rounded out the top five, although it dropped one spot from its previous ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.