Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

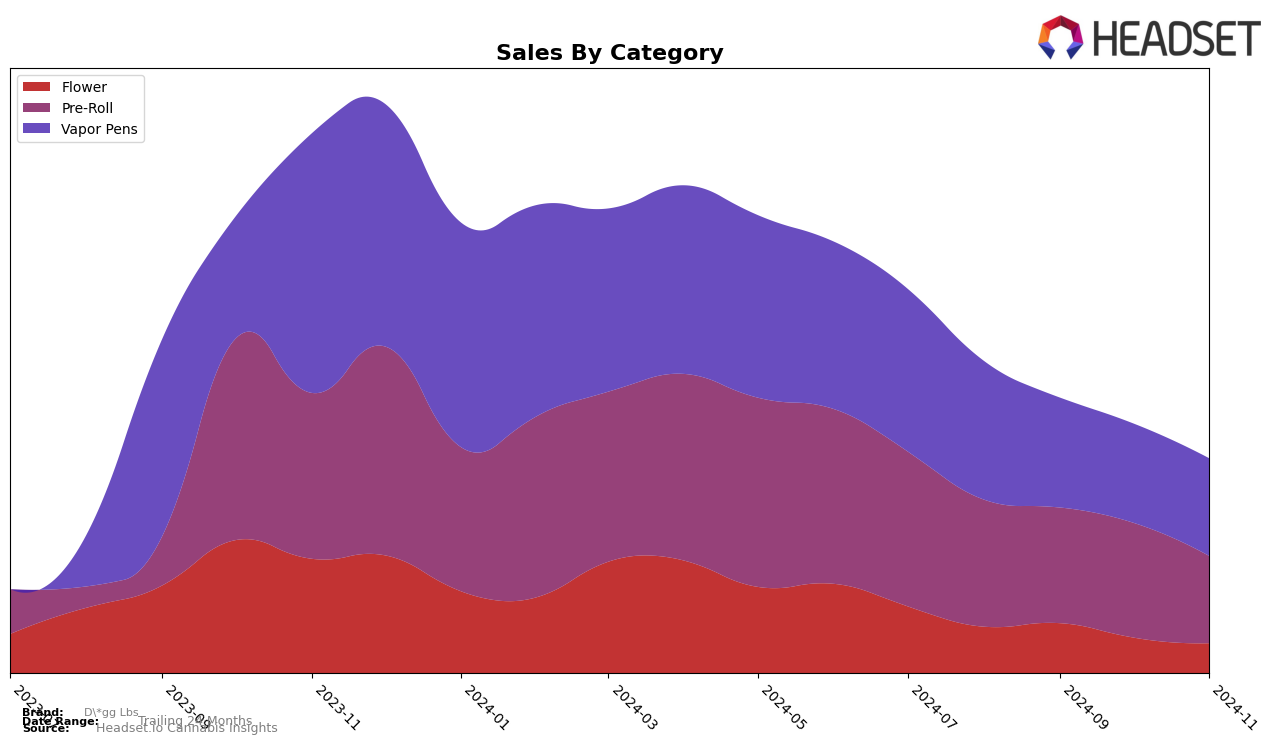

In the cannabis market, D*gg Lbs has shown varied performance across different categories and regions. In British Columbia, the brand's presence in the Flower category has seen a decline, with rankings slipping from 69th in August to 93rd by November. This downward trend is reflected in their sales numbers as well. Conversely, their performance in the Pre-Roll category in British Columbia has been more stable, although they did not manage to break into the top 50 rankings, indicating a competitive market. Meanwhile, in Ontario, D*gg Lbs has maintained a consistent presence in the Vapor Pens category, staying within the top 30 throughout the observed months, suggesting a stronger foothold in this segment compared to others.

In Ontario, the Pre-Roll category reveals a gradual decline in rankings from 72nd in August to 89th in November, accompanied by a decrease in sales figures. This trend might indicate increasing competition or shifting consumer preferences in this region. On the other hand, in Saskatchewan, D*gg Lbs entered the Pre-Roll rankings in October at 69th and improved slightly to 61st by November, suggesting a positive reception in this emerging market. However, the absence of rankings for the Vapor Pens category in the latter months of the period could be a signal of challenges in maintaining market share or visibility in that segment. Overall, these movements highlight the dynamic nature of the cannabis market and the varying levels of success D*gg Lbs experiences across different regions and product categories.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, D*gg Lbs has experienced notable fluctuations in its market positioning from August to November 2024. Initially ranked 27th in August, D*gg Lbs saw a dip to 33rd place by October, before recovering slightly to 30th in November. This fluctuation is indicative of a competitive market where brands like Sherbinskis and Tasty's (CAN) have maintained relatively stable positions, with Sherbinskis consistently ranking around 28th and Tasty's (CAN) experiencing a slight decline from 24th to 29th. Despite a drop in sales from August to October, D*gg Lbs managed a slight recovery in November, suggesting potential resilience in its market strategy. Meanwhile, Platinum Vape and Phyto Extractions have shown varying trends, with Platinum Vape climbing from 43rd to 31st, indicating a significant upward trajectory that could pose a challenge to D*gg Lbs if the trend continues. Understanding these dynamics is crucial for stakeholders looking to navigate the competitive vapor pen market in Ontario effectively.

Notable Products

In November 2024, the top-performing product for D*gg Lbs was the Juicy OooWeee Distillate Infused Pre-Roll 2-Pack (1g), reclaiming its position at rank 1 with sales of 2308 units. The Cryptic Blueberry Distillate Infused Blunt (1g) followed closely at rank 2, maintaining its strong performance from the previous month. The G Pooch Blunt (1g) held steady at rank 3, showing consistent demand. Notably, the Cryptic Blueberry Distillate Cartridge (1g) improved its ranking from 5th to 4th, indicating a rise in popularity. Meanwhile, the Juicy OooWeee Distillate Disposable (1g) entered the rankings at 5th place, suggesting a successful product launch or marketing campaign.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.