Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

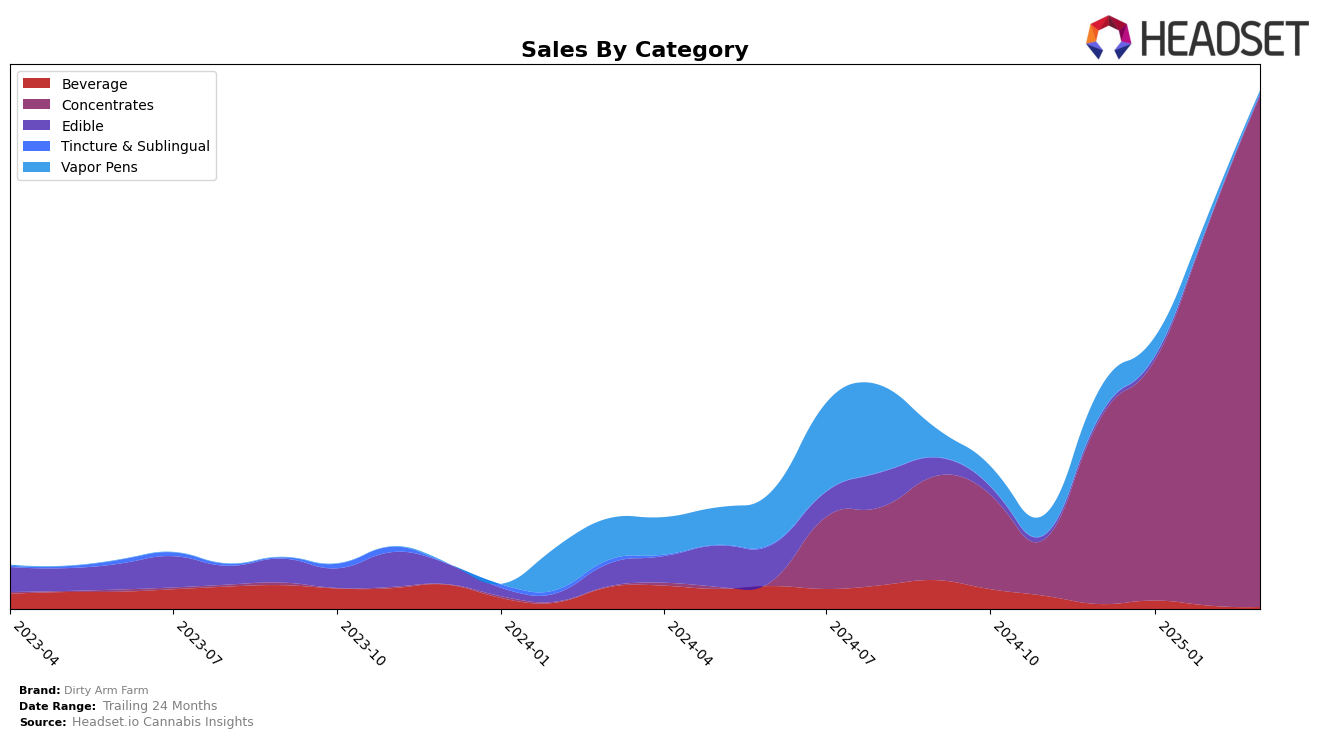

Dirty Arm Farm has shown significant growth in the Concentrates category in Oregon from December 2024 through March 2025. Initially ranked outside the top 30 in December, the brand made a notable entrance into the top 30 in January, securing the 24th position. By February, Dirty Arm Farm had climbed to the 13th spot, and by March, it had broken into the top 10, reaching the 10th position. This upward trajectory in the rankings indicates a strong market presence and increasing consumer demand for their products in the Concentrates category.

The sales data for Dirty Arm Farm in Oregon corroborates their rise in rankings, with a steady increase in sales from December to March. The brand has successfully capitalized on market opportunities, as evidenced by the substantial growth in their sales figures over this period. However, it's important to note that while they have made impressive gains in Oregon, Dirty Arm Farm's absence from the top 30 in other states or provinces could suggest a more localized success or a strategic focus on the Oregon market. This focused growth strategy may be key to their success, but it also highlights areas for potential expansion or increased competition.

Competitive Landscape

In the Oregon concentrates market, Dirty Arm Farm has shown a remarkable upward trajectory in rank and sales over the past few months. Starting from a rank of 32 in December 2024, Dirty Arm Farm climbed to 10 by March 2025, indicating a significant improvement in market presence. This rise is particularly notable when compared to competitors like NW Kind, which saw a decline from rank 6 to 9 in the same period, and Beehive Extracts, which only improved slightly from 16 to 11. Meanwhile, Buddies maintained a relatively stable position, moving from rank 10 to 8. The sales figures for Dirty Arm Farm also reflect this upward trend, with a consistent increase each month, culminating in a substantial rise by March 2025. This growth suggests that Dirty Arm Farm is effectively capturing market share from its competitors, positioning itself as a formidable player in the Oregon concentrates category.

Notable Products

In March 2025, the top-performing product from Dirty Arm Farm was Tropicanna Live Rosin (1g) in the Concentrates category, which soared to the number one rank with sales reaching 629 units. Strawberry Pie Solventless Live Rosin (1g) followed closely behind, securing the second position. Dantes Inferno #8 Live Hash Rosin (1g) came in third, while both Straw Guava Live Rosin (1g) and Tropicanna Live Rosin (2g) tied for fourth place. Notably, Tropicanna Live Rosin (1g) showed a significant improvement, climbing from third place in the previous months to the top spot. This shift highlights a strong consumer preference for Tropicanna Live Rosin (1g) in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.