Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

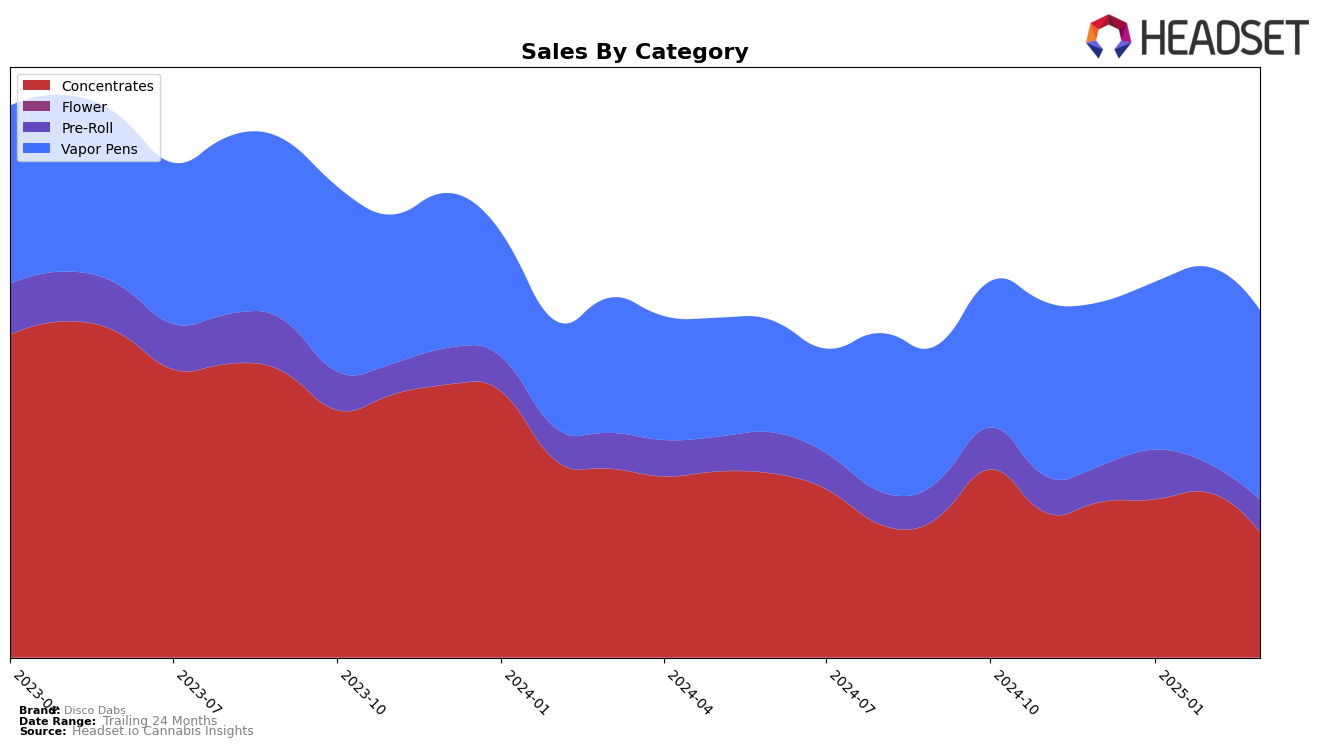

Disco Dabs has shown mixed performance across its product categories in Oregon. In the Concentrates category, the brand demonstrated a strong presence, maintaining a position within the top 20 throughout the observed months, although it experienced a dip from 11th to 20th place by March 2025. This decline could indicate increased competition or changing consumer preferences. The Vapor Pens category saw a more stable performance, with Disco Dabs consistently ranking within the top 30, though it slightly slipped from 27th to 32nd place in March. The Pre-Roll category, however, remains a challenge for Disco Dabs, as it failed to break into the top 50, indicating potential areas for growth or repositioning in this segment.

In Washington, Disco Dabs made its debut in the Concentrates category in March 2025, entering at the 98th position. This initial entry suggests a tentative foothold in the market, potentially paving the way for future growth. The absence of previous rankings in Washington indicates that the brand was not in the top 30 prior to March, highlighting the competitive landscape of the state. The brand's performance in Washington could benefit from strategic marketing and distribution efforts to enhance its visibility and consumer base in the state. Overall, while Disco Dabs has shown resilience in certain categories, there are clear opportunities for expansion and increased market penetration across different states and product lines.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Disco Dabs has demonstrated a dynamic shift in its market position from December 2024 to March 2025. Initially ranked 33rd in December, Disco Dabs climbed to 27th by February, before slightly dropping to 32nd in March. This fluctuation highlights a competitive environment, with brands like Orchid Essentials and Altered Alchemy also vying for market share. Notably, Orchid Essentials showed a strong performance, improving its rank from 29th in December to 28th in February, ultimately reaching 30th in March with a significant sales boost in the same month. Meanwhile, Altered Alchemy, despite a dip in January and February, regained momentum by March. Disco Dabs' sales trajectory, peaking in February, suggests a potential for growth if they can capitalize on the momentum and address the competitive pressures from these brands.

Notable Products

In March 2025, the top-performing product from Disco Dabs was Lebanese Gold Hashish (1g) in the Concentrates category, reclaiming its number one rank with notable sales of 808 units. Auto Purple Shatter (1g) emerged as the second-ranked product, making a strong debut in the same category. Big Bro x Gas Face Infused Pre-Roll (1g) secured the third position in the Pre-Roll category, while Sugar Berry Shatter (1g) followed closely in fourth place. Lebanese Red Hashish Infused Pre-Roll (1g) rounded out the top five, maintaining a consistent presence from December 2024. Compared to previous months, Lebanese Gold Hashish (1g) regained its top spot after temporarily dropping to second place in February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.