Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

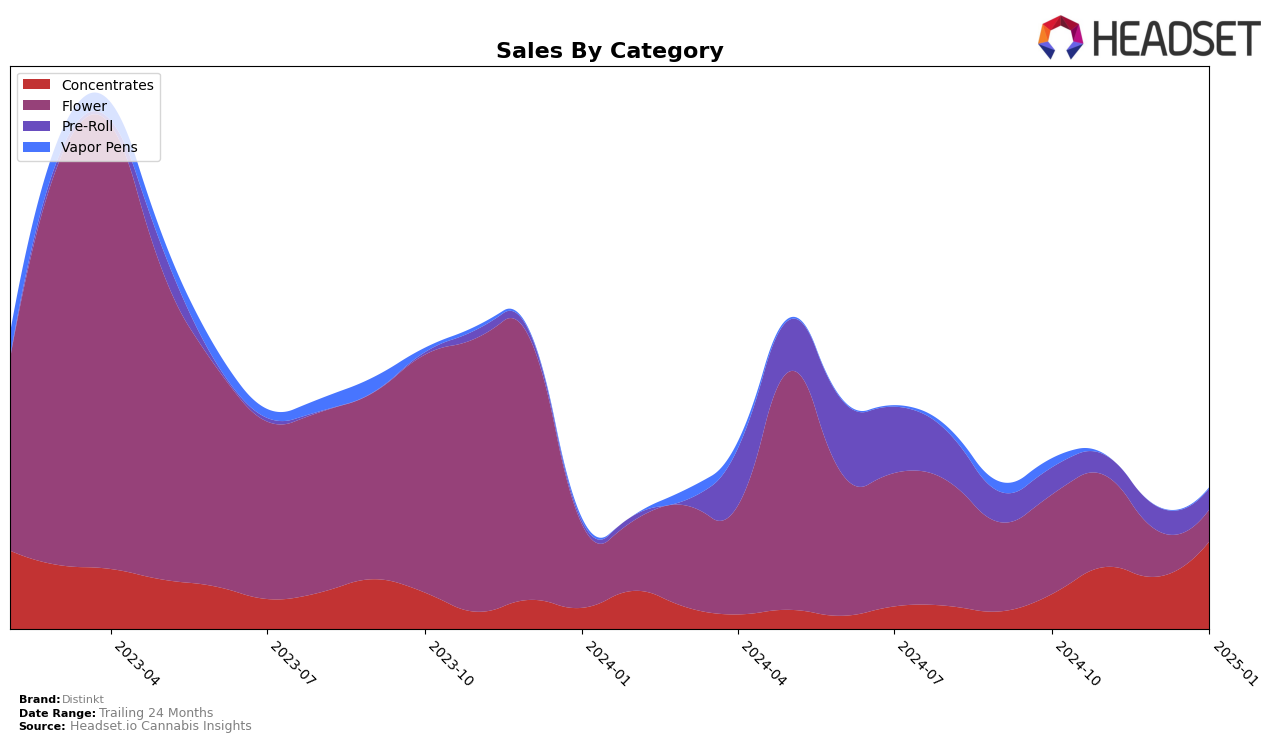

In the Alberta market, Distinkt has shown notable progress in the Concentrates category. Starting from a rank of 37 in October 2024, the brand improved its position to 20 by January 2025. This upward trend suggests a positive reception of their products in this category, with sales more than doubling during this period. On the other hand, Distinkt's performance in the Flower category in Alberta was less remarkable, as it did not appear in the top 30 rankings from December 2024 onward, indicating a potential area for improvement or increased competition in this segment.

The absence of Distinkt in the top 30 for the Flower category in Alberta during December and January could be considered a setback, especially given their strong performance in Concentrates. This contrast highlights the varying consumer preferences and market dynamics within different product categories. Such insights could guide the brand in strategizing its offerings and marketing efforts to bolster its presence across all categories. Keeping an eye on these movements can provide valuable context for understanding Distinkt's overall market positioning and potential growth areas.

Competitive Landscape

In the Alberta concentrates market, Distinkt has demonstrated a notable upward trajectory in its rankings and sales over the past few months. Starting from a rank of 37 in October 2024, Distinkt climbed to the 20th position by January 2025, indicating a significant improvement in market presence. This upward trend is particularly impressive when compared to competitors like RAD (Really Awesome Dope), which slipped from 17th to 21st over the same period, and The Goo!, which remained relatively stable yet lower in the rankings. Meanwhile, Kolab re-entered the top 20 in January 2025, but Distinkt's consistent rise suggests a strong competitive edge. Additionally, while 3Saints experienced fluctuations, Distinkt's steady increase in sales, especially from November 2024 to January 2025, highlights its growing consumer appeal and market penetration in Alberta.

Notable Products

In January 2025, the top-performing product for Distinkt was Guava Cool Live Rosin Jam (1g) in the Concentrates category, reclaiming its position as the number one bestseller with notable sales of 1,273 units. Temple Ball Hash (1g), also in the Concentrates category, ranked second, showing a slight decline from its first-place position in December 2024. Lemon Razz Pre-Roll 5-Pack (2.5g) maintained its consistent third-place ranking from the previous month. Monaco Octane Pre-Roll 5-Pack (2.5g) rose to the fourth position, showing an improvement from its fifth-place rank in December. Lastly, Monaco Octane (7g) entered the top five in January, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.