Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

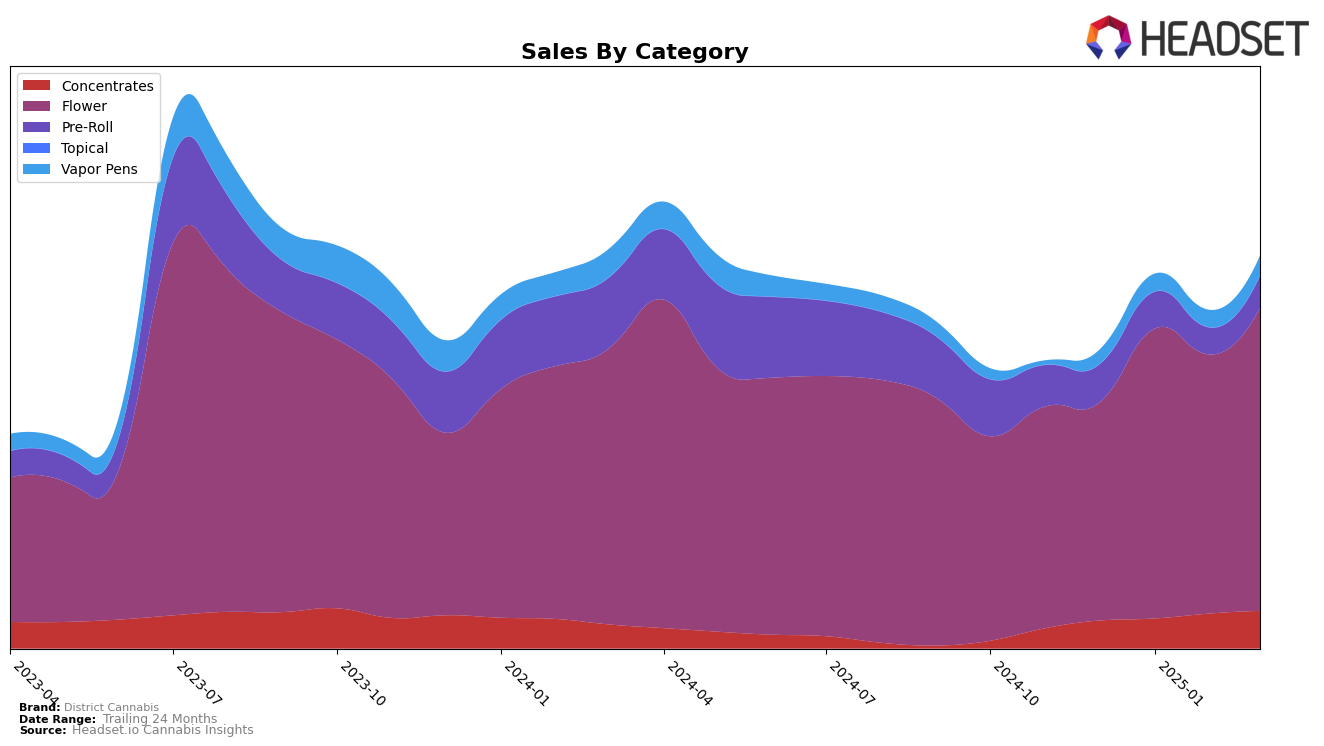

District Cannabis has shown impressive performance in the Maryland market across various product categories. Notably, the brand has made significant strides in the Concentrates category, climbing from a rank of 4th in December 2024 to securing the top spot by February 2025, and maintaining this position in March. This upward trajectory is indicative of strong consumer demand and effective market strategies. In the Flower category, District Cannabis has also demonstrated resilience, moving from 5th to 3rd position from December 2024 to March 2025, showcasing consistent growth despite a slight dip in February. However, the brand's performance in the Pre-Roll category has been more volatile, with rankings fluctuating between 8th and 11th over the same period, suggesting potential areas for improvement or increased competition.

In the Vapor Pens category, District Cannabis has managed to improve its standing from 28th in December 2024 to 24th in February and March 2025, indicating a slow but positive trend. Despite this progress, not being in the top 20 suggests that there is still considerable room for growth in this segment. The brand's absence from the top 30 in any category would be a cause for concern; however, District Cannabis has maintained its presence in the rankings across all categories in Maryland. Such consistent presence across multiple product lines speaks to the brand's robust market positioning and potential for further growth, albeit with some categories requiring more strategic focus to enhance their market share.

Competitive Landscape

In the competitive landscape of the Maryland flower category, District Cannabis has shown a dynamic performance from December 2024 to March 2025. Initially ranked 5th in December, District Cannabis climbed to 3rd place in January, demonstrating a significant improvement in market positioning. However, it experienced a slight dip to 4th in February before regaining the 3rd spot in March. This fluctuation in rank is indicative of a competitive market where District Cannabis is vying closely with brands like Strane and SunMed, which also experienced shifts in their rankings. Notably, Rythm and Fade Co. consistently held the top two positions, with Rythm leading the pack. The sales trends for District Cannabis reveal a robust growth trajectory, particularly from December to January, which likely contributed to its improved ranking during that period. This competitive analysis highlights the importance for District Cannabis to maintain its upward momentum to solidify its position against strong contenders in the Maryland market.

Notable Products

In March 2025, Gelato Cake (3.5g) emerged as the top-performing product for District Cannabis, climbing from its consistent second-place ranking in previous months to first place with impressive sales of 19,844 units. Cherry Limeade Cake (3.5g), previously holding the top spot, slipped to second place despite maintaining strong sales figures. Layer Cake (3.5g) remained stable in third place, showing resilience in its category. Pavé (3.5g) experienced a slight decline, moving from third in February to fourth in March. Notably, Hazy Face (3.5g) entered the rankings for the first time in fifth place, indicating a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.