Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

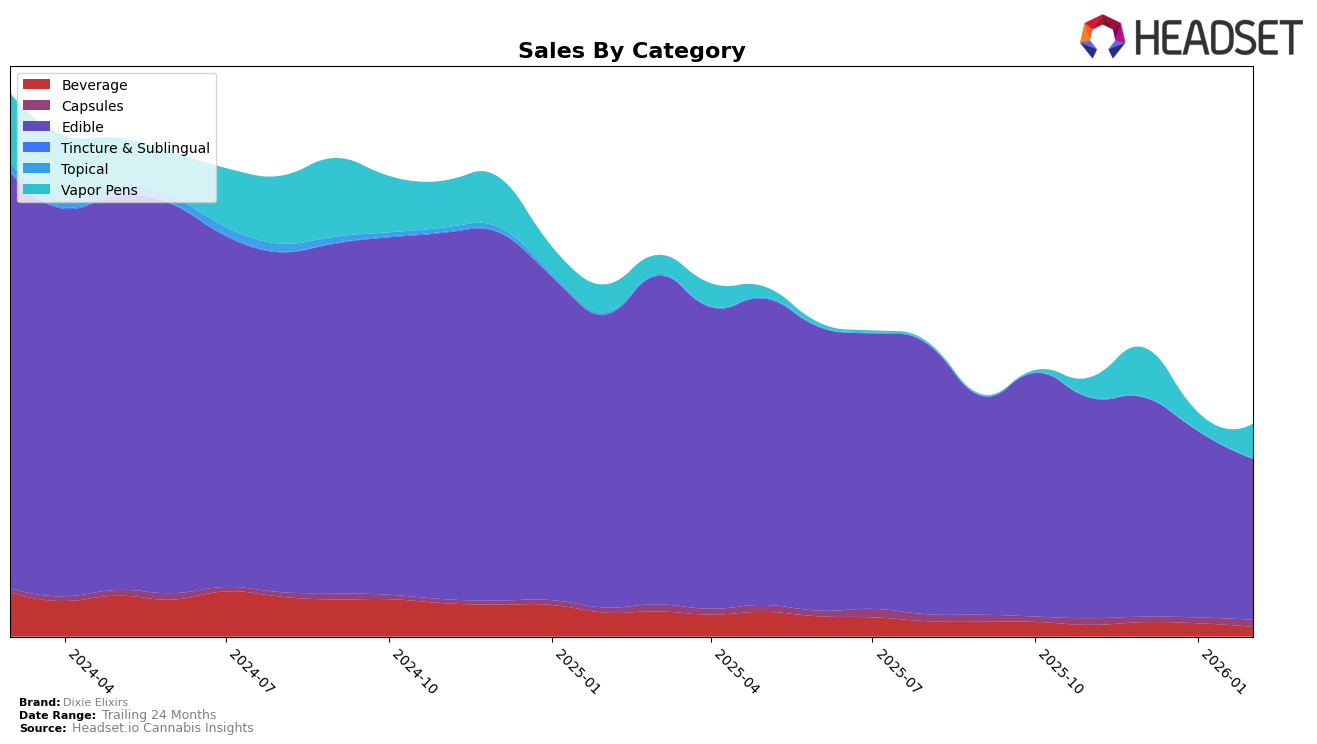

In the competitive landscape of cannabis products, Dixie Elixirs has shown varied performance across different states and categories. In California, the brand's presence in the Edible category did not make it to the top 30 rankings from November 2025 to February 2026, indicating a potential area for growth or increased competition. Conversely, in Maryland, Dixie Elixirs has consistently maintained a strong position in the Beverage category, holding the 4th rank throughout the same period. This stability in Maryland suggests a solid consumer base and effective market strategies for beverages.

In Maryland, Dixie Elixirs also demonstrated resilience in the Capsules category, improving from a 4th rank in January 2026 to 3rd in February 2026, highlighting a positive trend in consumer preference or product acceptance. The Edible category in Michigan saw a drop in rankings, from 19th in November 2025 to 24th by January 2026, before stabilizing, which could suggest increased competition or market shifts. Meanwhile, in Missouri, the brand's Vapor Pens category experienced fluctuations, moving from the 39th rank in December 2025 to 54th in January 2026, then back to 40th in February 2026, indicating volatility in consumer demand or competitive dynamics in the state.

Competitive Landscape

In the Missouri edibles market, Dixie Elixirs has experienced fluctuations in its competitive positioning, maintaining a consistent rank of 17th in November and December 2025, slipping to 18th in January 2026, and recovering to 17th by February 2026. This stability is challenged by brands like Curio Wellness, which improved from 18th to 16th, and Smokey River Cannabis, consistently holding the 15th spot. Meanwhile, Vibe Cannabis (MO) showed a decline, dropping out of the top 20 in December before climbing back to 18th by February. Smackers also demonstrated volatility, starting outside the top 20 in November, reaching 16th in January, but falling to 19th by February. These dynamics suggest that while Dixie Elixirs maintains a stable presence, it faces strong competition, particularly from brands like Curio Wellness and Smokey River Cannabis, which have shown more consistent upward trends in rank and sales.

Notable Products

In February 2026, the top-performing product from Dixie Elixirs was the CBN/CBD/THC 2:1:1 Synergy Sleepberry Gummies 10-Pack, which maintained its number one rank for four consecutive months, with sales figures reaching 4,991 units. Berry Blaze Gummies 10-Pack held the second position, mirroring its January rank, although its sales saw a slight decrease. Indica Tropic Twist Gummies remained steadily in third place, showing a consistent ranking since January despite a drop in sales figures. Sour Smash Gummies 10-Pack secured the fourth position, maintaining the same rank as in January, but with a continued decline in sales. The THC/CBN/CBD 2:1:1 Synergy Cherry Chill Gummies reappeared in the rankings at fifth place, showing a notable re-entry after being unranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.