Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

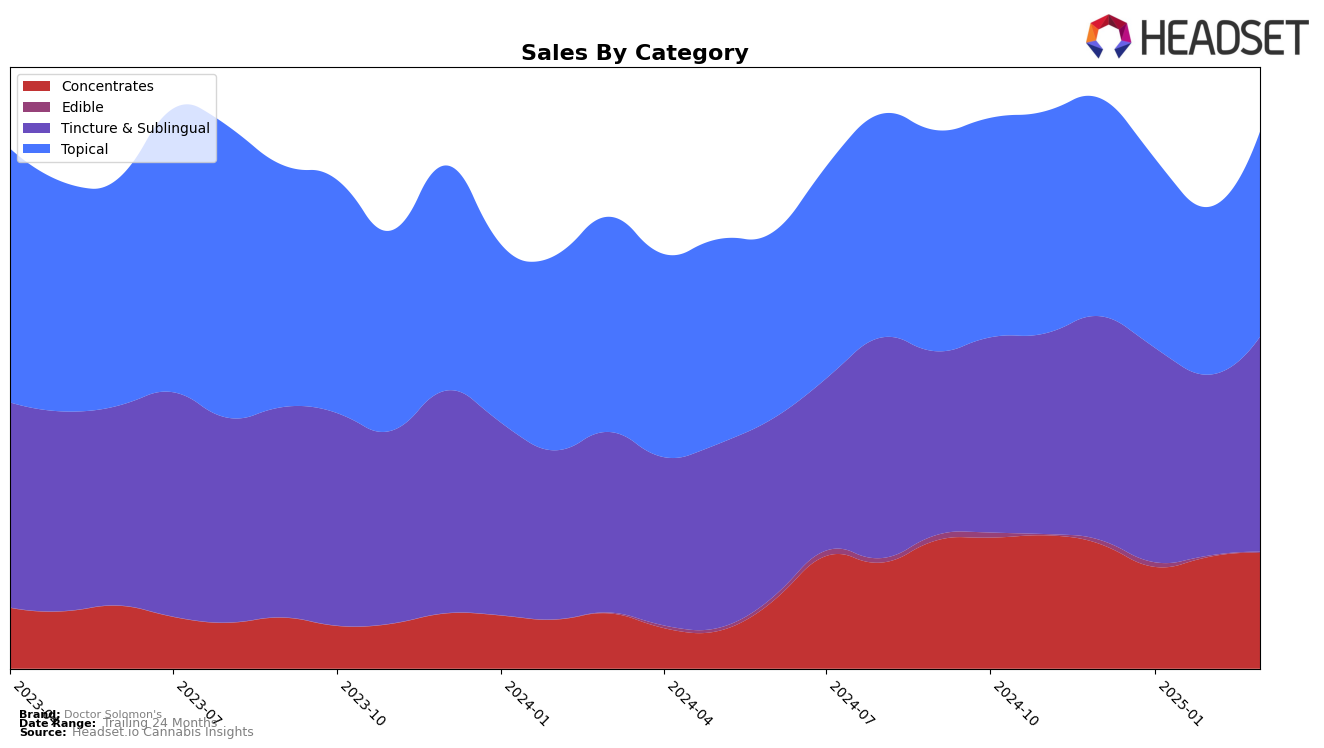

Doctor Solomon's has shown consistent performance across several states, particularly in the Illinois market, where it has maintained the top position in the Tincture & Sublingual category from December 2024 through March 2025. Despite a decline in sales from December to February, the brand rebounded in March, suggesting effective sales strategies or market adaptations. In the Topical category, Doctor Solomon's improved its ranking from third to second, maintaining this position through March, indicating a solid foothold in this segment. However, in Massachusetts, the brand has remained steady at sixth place in the Tincture & Sublingual category, with a slight increase in sales over the months, pointing to gradual market penetration or consumer loyalty in the region.

In Maryland, Doctor Solomon's has demonstrated notable performance in the Tincture & Sublingual category, alternating between the first and second ranks, which reflects a competitive edge or strong consumer preference. The Topical category in Maryland also shows stability, holding a consistent second place, which could be attributed to sustained consumer demand or effective marketing. Conversely, in Nevada, the brand's presence in the Concentrates category fluctuated, dropping out of the top 30 in January and February, before reappearing in March, suggesting challenges in maintaining a competitive position. Meanwhile, Doctor Solomon's maintained the top spot in the Tincture & Sublingual category in Nevada, showing a strong market presence. In Ohio, the brand showed resilience in the Tincture & Sublingual category, moving between second and third ranks, while maintaining a steady second position in the Topical category, indicating solid performance and consumer trust.

Competitive Landscape

In the Maryland concentrates market, Doctor Solomon's experienced fluctuating rankings from December 2024 to March 2025, indicating a dynamic competitive landscape. Doctor Solomon's started at rank 12 in December 2024, dropped to 15 in January 2025, and then regained its position at 12 by March 2025. This oscillation suggests a competitive struggle, particularly against brands like Alchemist, which consistently maintained a higher rank, peaking at 9 in February 2025. Meanwhile, Equity Extracts showed a remarkable rise from rank 16 in December 2024 to 10 in January and February 2025, before slightly falling to 13 in March. Verano and CULTA also presented competitive pressures, with Verano improving its rank to 11 by March 2025 and CULTA maintaining a close range. These shifts highlight the intense competition Doctor Solomon's faces, emphasizing the need for strategic adjustments to improve its market position and capitalize on sales opportunities.

Notable Products

In March 2025, the top-performing product from Doctor Solomon's was the THC/CBN 1:1 Doze Drops Tincture, maintaining its first-place rank from February with notable sales of 2192 units. The CBD/THC 1:1 Restore Transdermal Lotion made a significant leap to second place, showing a strong recovery from its absence in the February rankings. The CBD/THC 3:1 Unwind Transdermal Balm, which had been a consistent leader in previous months, slipped to third place. Meanwhile, the CBD/THC 1:3 Rescue Transdermal Balm, although dropping to fourth place, showed an improvement in sales from February. The CBD:THC 1:1 Restore Drops Tincture entered the rankings for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.