Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

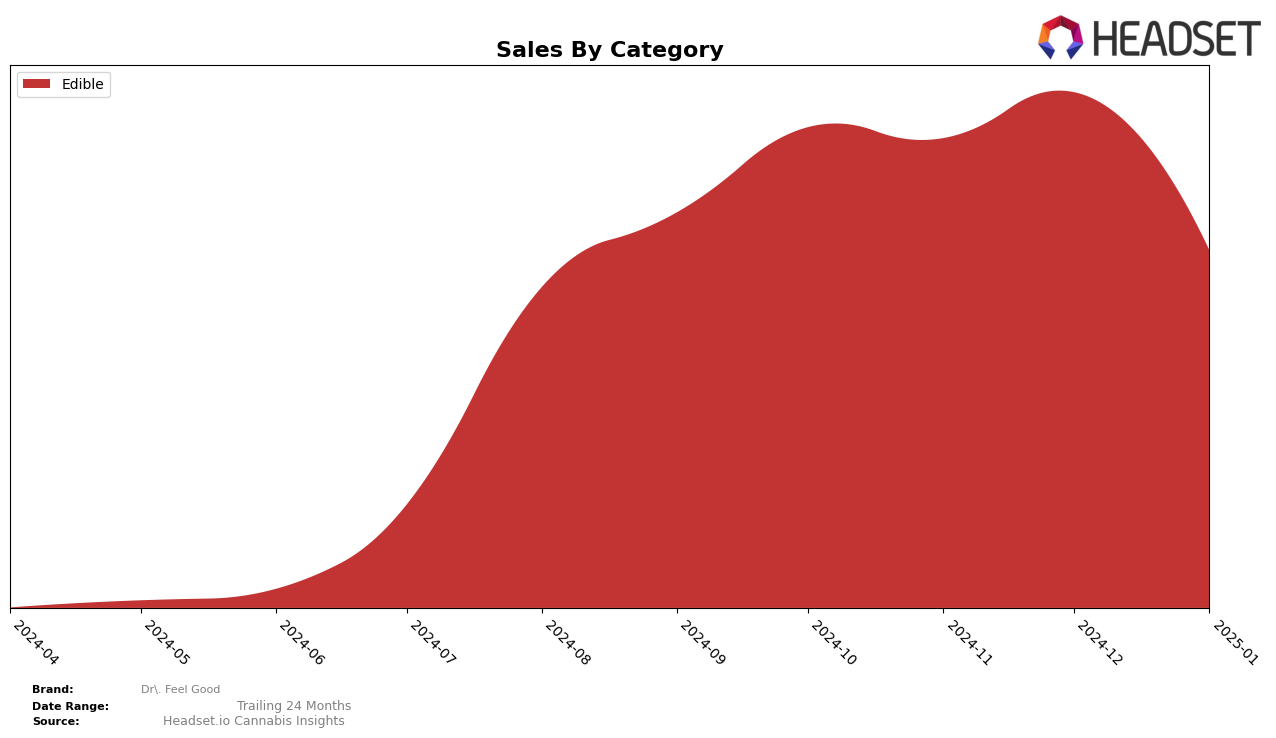

Dr. Feel Good has shown a steady presence in the Edible category in Oregon, maintaining a position within the top 30 brands. The brand experienced minor fluctuations in its rankings, moving from 19th place in October 2024 to 23rd by January 2025. This slight decline might be attributed to seasonal changes or increased competition within the market. Despite the drop in rank, Dr. Feel Good's sales figures have shown some resilience, with a notable peak in December 2024, where sales increased compared to the previous month, before declining in January 2025.

Interestingly, Dr. Feel Good's performance highlights the volatility of the cannabis market, especially in the Edible category. The brand's absence from the top 30 in other states or categories could suggest areas for potential growth or indicate strong competition in those regions. The performance in Oregon may serve as a benchmark for the brand as it evaluates its strategy in other markets. Understanding the dynamics in Oregon could provide insights into how Dr. Feel Good might enhance its market presence elsewhere.

Competitive Landscape

In the competitive landscape of the Oregon edible market, Dr. Feel Good has experienced fluctuations in its ranking, which could impact its sales momentum. Over the four-month period from October 2024 to January 2025, Dr. Feel Good's rank shifted from 19th to 23rd. This decline in rank may be attributed to the performance of competitors such as beaucoup, which consistently maintained a higher rank, starting at 13th in October and ending at 21st in January, despite a drop in sales. Meanwhile, Tasty's (OR) and Canna Crispy have shown resilience, with Tasty's maintaining a relatively stable rank around the mid-20s, and Canna Crispy improving slightly from 25th to 24th. Notably, She Don't Know made a significant leap from 28th to 22nd, potentially drawing market share away from Dr. Feel Good. These dynamics suggest that while Dr. Feel Good remains a recognizable brand, increased competition and strategic adjustments by rivals are influencing its market position.

Notable Products

In January 2025, Blueberry Lemonade Distillate Gummy (100mg) maintained its position as the top-performing product for Dr. Feel Good, despite a decrease in sales to 999 units. Ginger Pear Gummy (100mg) rose to second place, improving from fourth place in December 2024, with sales of 829 units. Peach Mango Distillate Gummy (100mg) slipped to third place, showing a consistent decline in sales over the months. Blood Orange Hash Rosin Gummies 10-Pack (100mg) re-entered the rankings at fourth place, having been absent in December 2024. Hybrid Blood Orange Rosin Gummy 10-Pack (100mg) remained in fifth place, experiencing a gradual decrease in sales from October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.