Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

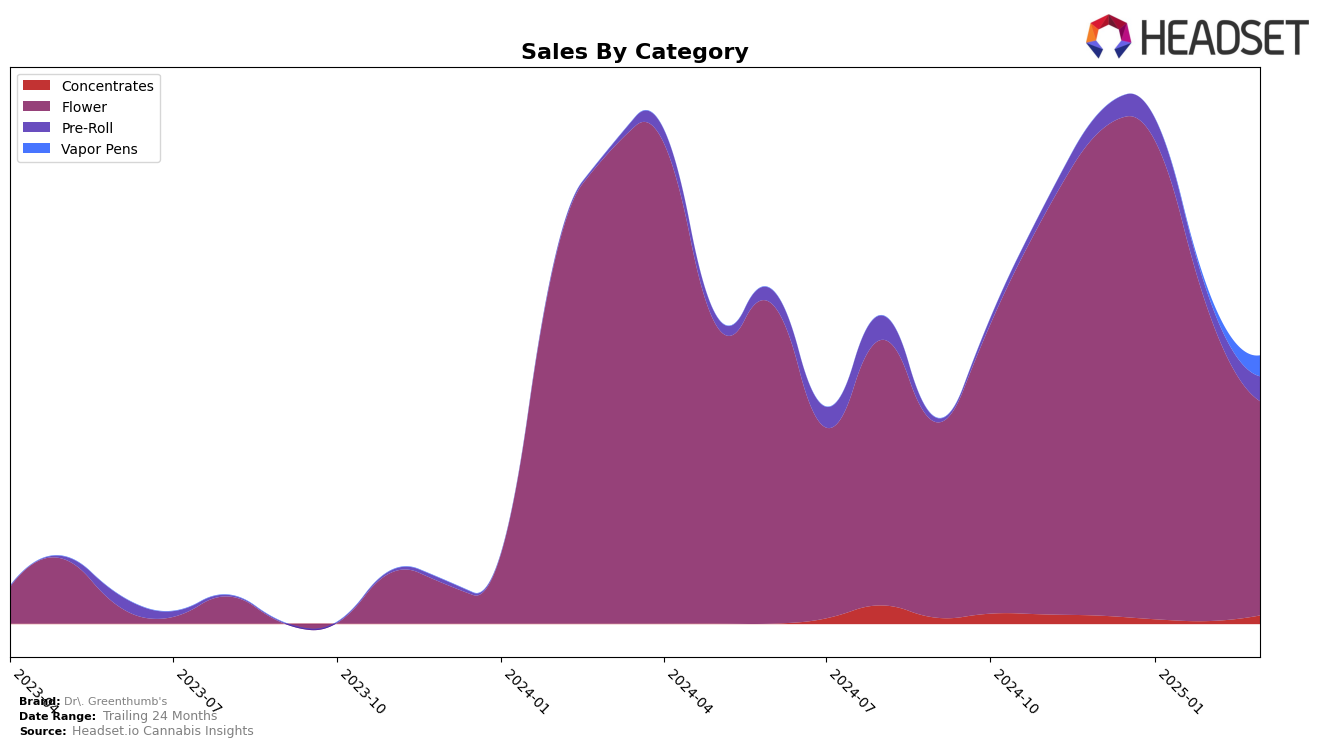

Dr. Greenthumb's has shown a varied performance across different product categories in Arizona. In the Concentrates category, the brand has managed to break into the top 30 by March 2025, securing the 34th position, which marks a positive trend since it was outside the top 30 in the previous months. However, the Flower category tells a different story. While Dr. Greenthumb's started strong in December 2024, holding the 6th position, there was a noticeable decline over the subsequent months, dropping to 21st by March 2025. This decline in ranking could suggest increased competition or a shift in consumer preferences within the Flower category.

The Pre-Roll category presents a more optimistic outlook, with Dr. Greenthumb's climbing from 38th in December 2024 to 33rd by March 2025. This upward movement indicates a strengthening presence in this segment, potentially driven by strategic changes or product improvements. Conversely, the Vapor Pens category saw the brand entering the rankings at 50th in March 2025, which, although outside the top 30, marks the first time Dr. Greenthumb's has been ranked in this category. This initial entry could be a foothold for future growth, suggesting that the brand is expanding its reach across various product lines within Arizona.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Dr. Greenthumb's has experienced a notable decline in its market position from December 2024 to March 2025. Initially ranked 6th in December 2024, Dr. Greenthumb's saw a steady drop to 21st by March 2025, indicating a significant shift in consumer preferences or competitive pressures. This decline contrasts with brands like Daze Off, which improved its rank from 32nd to 23rd, and Sublime, which fluctuated but ultimately improved to 19th. Meanwhile, MADE maintained a more stable performance, hovering around the 20th position, and FENO showed a gradual improvement, moving from 26th to 22nd. These shifts suggest that while Dr. Greenthumb's once held a strong position, the brand may need to reassess its strategies to regain its competitive edge in the Arizona market.

Notable Products

In March 2025, Forida Kush Pre-Roll (1g) emerged as the top-performing product for Dr. Greenthumb's, achieving the number one rank with sales of 1771 units. Motor Breath Pre-Roll (1g) closely followed, securing the second position, while Honey Banana Pre-Roll (1g) took third place. Notably, Red Bananas (14g) saw a slight decline in its ranking, moving from second place in February to fourth in March. Fig Taffy (3.5g) maintained a strong presence by securing the fifth position in March. The rankings indicate a competitive market for pre-rolls, with slight shifts in flower category preferences over recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.