Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

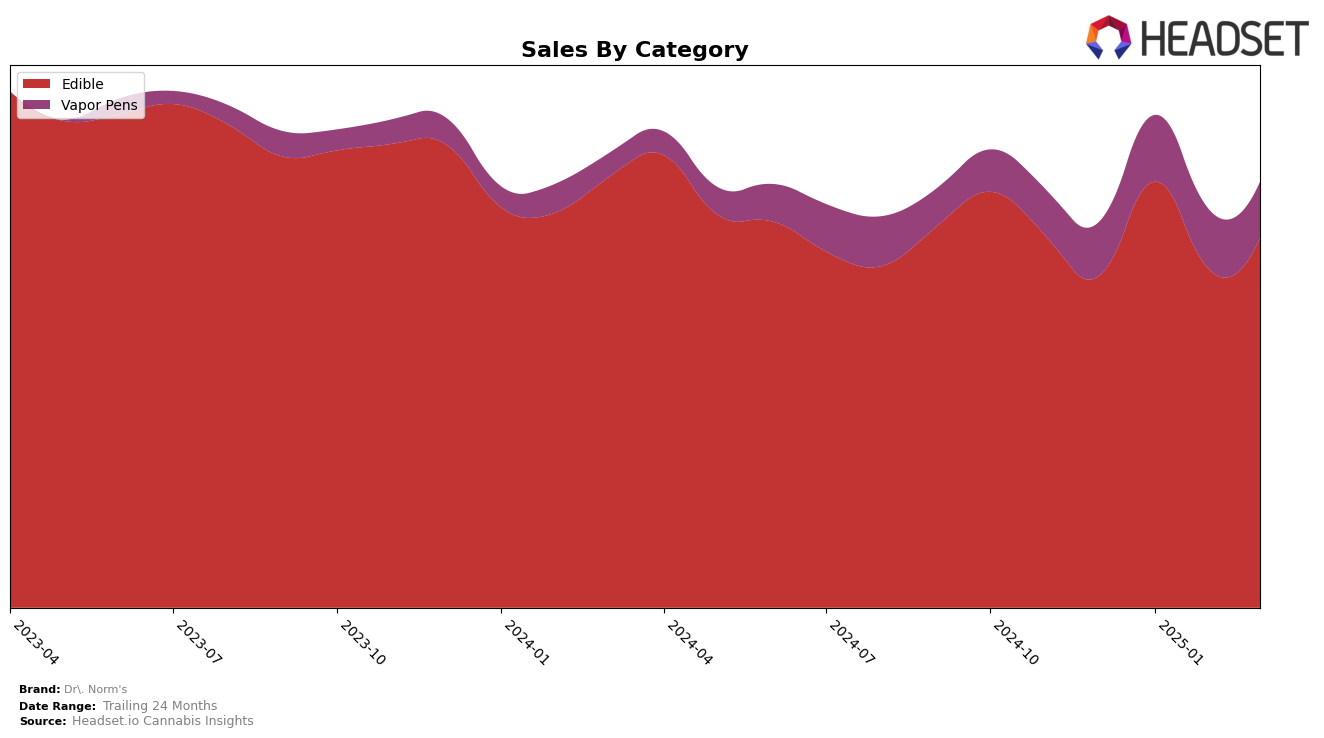

Dr. Norm's has shown a steady presence in the California edibles market, maintaining a consistent rank within the top 20 brands from December 2024 through March 2025. Starting at rank 19 in December, the brand improved to rank 15 by January, indicating a positive reception and likely successful marketing or product offerings during that period. However, the brand's rank slightly declined to 16 in February and maintained this position through March. This stability suggests that while Dr. Norm's has a solid foothold in the California market, there might be competitive pressures or market dynamics affecting further upward movement.

Notably, Dr. Norm's performance is limited to California in the data provided, as the brand does not appear in the top 30 rankings for any other state or province for the edibles category during the same timeframe. This absence in other markets might indicate a strategic focus on California or challenges in penetrating other regions. The brand's sales figures in California reveal a peak in January 2025, with a subsequent dip in February before a slight recovery in March. This fluctuation could be attributed to seasonal trends, promotional activities, or changes in consumer preferences, offering a rich area for further exploration and analysis.

Competitive Landscape

In the competitive landscape of the California edible market, Dr. Norm's has shown a consistent presence, maintaining a rank of 16th in both February and March 2025. This stability contrasts with the fluctuating ranks of competitors such as Smokiez Edibles, which dropped from 7th in December 2024 to 13th by March 2025, and Kiva Chocolate, which has hovered around the 14th and 15th positions. Notably, Gold Flora has made significant strides, climbing from 54th in December 2024 to 18th by March 2025, indicating a potential emerging threat. Meanwhile, Clsics has seen a slight decline, moving from 15th to 17th over the same period. Dr. Norm's relatively stable rank amidst these shifts suggests a steady consumer base, but the rise of Gold Flora could signal increased competition in the near future.

Notable Products

In March 2025, Dr. Norm's top-performing product was the Sleep Well THC/CBN 2:1 - Elderberry Nano Sleep Gummies 10-Pack, maintaining its first-place rank from February and achieving sales of 2,745 units. The Hybrid Fruity Pebbles Crispy Rice Bar held steady in second place, showing consistent performance across the months. The Sleepwell Nano - THC:CBN 2:1 Raspberry Dream Gummies entered the rankings for the first time in March, securing the third position. Sleepwell - THC/CBD/CBG/CBN Sweet Dreams Distillate Disposable dropped slightly to fourth place from its previous third-place ranking in February. Key Lime High Max Gummy, which was ranked second in January, fell to fifth place in March, indicating a significant shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.