Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

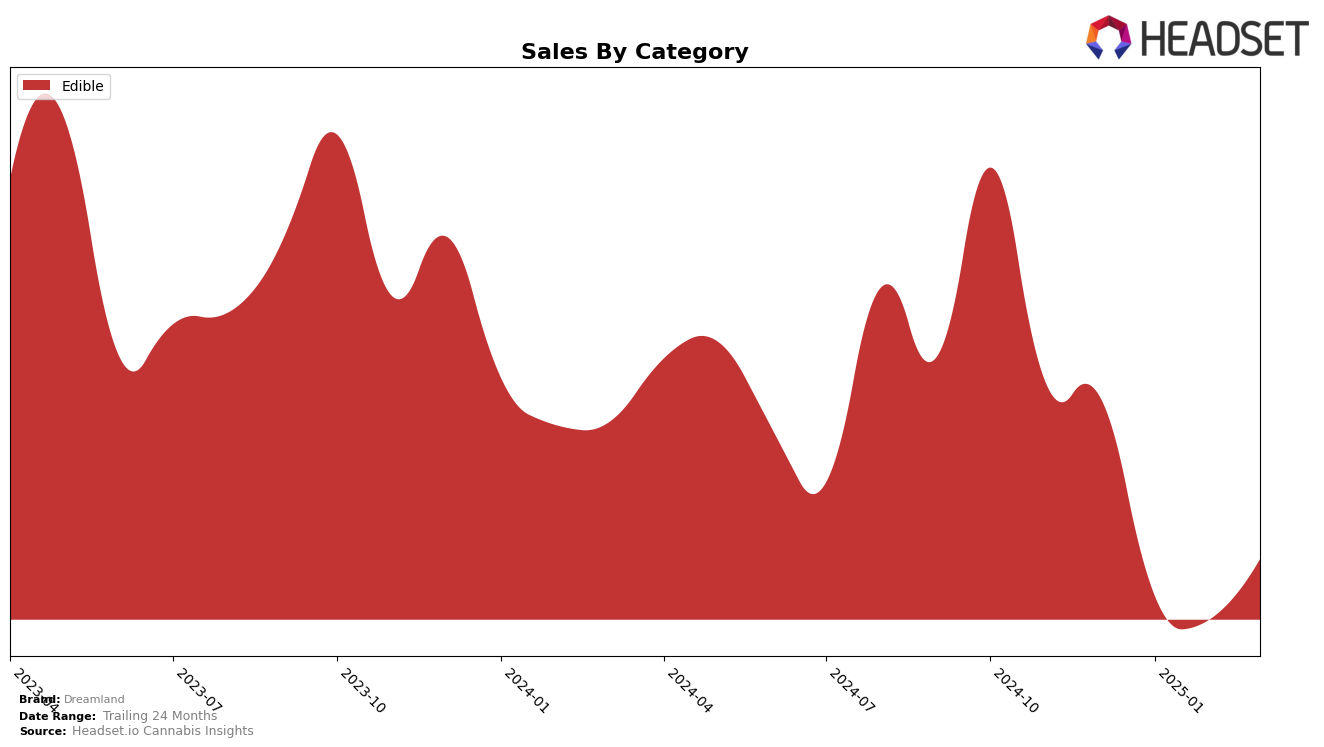

Dreamland has shown a consistent presence in the Nevada edible market, maintaining a steady ranking within the top 15 brands from December 2024 through March 2025. Although there was a slight dip in January 2025, where Dreamland fell from the 10th to the 12th position, the brand quickly rebounded to the 11th spot in February before slipping back to 12th in March. This fluctuation suggests that while Dreamland is a strong contender in the Nevada market, it faces stiff competition that affects its ability to consistently climb higher in the rankings.

Notably, Dreamland's sales figures in Nevada's edible category showed a downward trend from December to February, with a slight recovery in March 2025. This could indicate seasonal variations or shifts in consumer preferences that the brand needs to address to regain its earlier momentum. The absence of Dreamland in the top 30 brands in other states or provinces could be seen as a missed opportunity for expansion or a strategic focus on maintaining and growing its market share in Nevada. This concentration might be beneficial in solidifying its position locally, but it also highlights potential growth areas if Dreamland were to consider diversifying its geographical footprint.

Competitive Landscape

In the Nevada edible market, Dreamland has experienced some fluctuations in its competitive positioning from December 2024 to March 2025. Initially ranked 10th in December, Dreamland saw a dip to 12th place in January, briefly climbed to 11th in February, and then returned to 12th in March. This indicates a slight instability in its market position, potentially influenced by the performance of competitors. Notably, Jams consistently maintained a higher rank, starting at 7th and ending at 10th, suggesting a strong market presence despite a slight decline in sales. Meanwhile, Kanha / Sunderstorm showed a stable performance, hovering around the 11th and 12th positions, directly competing with Dreamland. Beboe also demonstrated competitive resilience, improving its rank from 15th in December to 13th in March. The fluctuating ranks of these brands highlight the dynamic nature of the Nevada edible market, where Dreamland faces both challenges and opportunities to enhance its market share.

Notable Products

In March 2025, Dreamland's top-performing product was the Peanut Butter Milk Chocolate Cubes 4-Pack (40mg), maintaining its first-place rank from February with sales of 2,194 units. The Peppermint Dark Chocolate Bar 10-Pack (100mg) followed closely in second place, consistent with its February rank, though its sales slightly decreased. The Mystical Milk Chocolate Bar (100mg) secured the third position, climbing from its previous third-place rank in February, showing a notable sales recovery. The Milk Chocolate Salted Toffee Bar 10-Pack (100mg) remained stable in fourth place, with a slight decline in sales compared to February. The Cool Mint Chocolate Bar (100mg) consistently held the fifth position but experienced a drop in sales, indicating a need for potential marketing adjustments.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.