Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

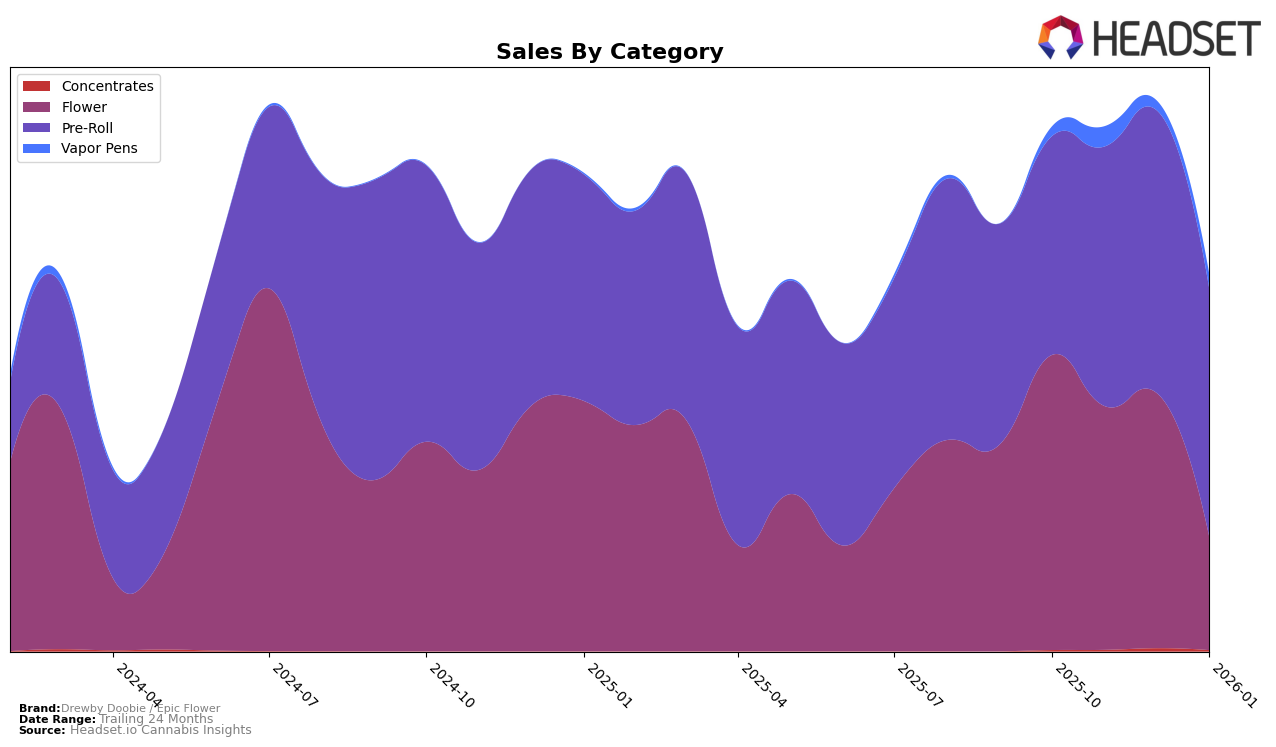

In the state of Oregon, Drewby Doobie / Epic Flower has shown varied performance across different product categories. In the Flower category, the brand experienced a notable decline, dropping from the 30th position in October 2025 to 73rd by January 2026. This significant drop is reflected in their sales, which fell from $196,552 in October to $75,059 in January, indicating potential challenges in maintaining market share in this category. Conversely, the Pre-Roll category tells a different story, with the brand improving its ranking from 24th in October to 17th by December, before stabilizing at this position through January. This upward movement in rank, along with a steady increase in sales from October to December, suggests a growing consumer preference for their pre-roll products.

Interestingly, Drewby Doobie / Epic Flower's presence in the Vapor Pens category in Oregon was limited, with the brand only appearing in the rankings in November 2025 at the 77th position. This absence from the top 30 in other months indicates a struggle to gain a foothold in this competitive segment. The lack of sustained ranking could suggest either a strategic focus on other categories or challenges in product differentiation and market penetration for vapor pens. These insights highlight the brand's need to assess its strategy across different product lines to optimize its market performance in Oregon.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Drewby Doobie / Epic Flower has shown a notable improvement in its market position over recent months. Starting from a rank of 24 in October 2025, the brand climbed to 18 by November and maintained a steady position at 17 through December and January 2026. This upward movement indicates a positive trend in sales performance, contrasting with the fluctuating ranks of competitors like Rebel Spirit, which dropped out of the top 20 in December, and Feel Goods, which saw a decline from 16 to 18 over the same period. Meanwhile, Cabana and Derby's Farm have maintained relatively stable ranks, with Cabana even improving its sales figures significantly. Drewby Doobie / Epic Flower's consistent rank improvement suggests a strengthening brand presence, potentially driven by strategic marketing efforts or product innovations, positioning it as a rising contender in the Oregon Pre-Roll market.

Notable Products

In January 2026, the top-performing product for Drewby Doobie / Epic Flower was Jack Herer Pre-Roll 10-Pack (5g), maintaining its leading position from November 2025 with sales of 1,719 units. Ice Cream Cake Pre-Roll 10-Pack (5g) climbed to the second position, showing a consistent improvement from third in December 2025. Supreme Lee Hi Pre-Roll 10-Pack (5g) held steady at third place, having been ranked second the previous month. Gush Mints Pre-Roll 10-Pack (5g) remained in fourth place, despite a decrease in sales compared to December 2025. Trap Fuel Pre-Roll 10-Pack (5g) entered the rankings for the first time in fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.