Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

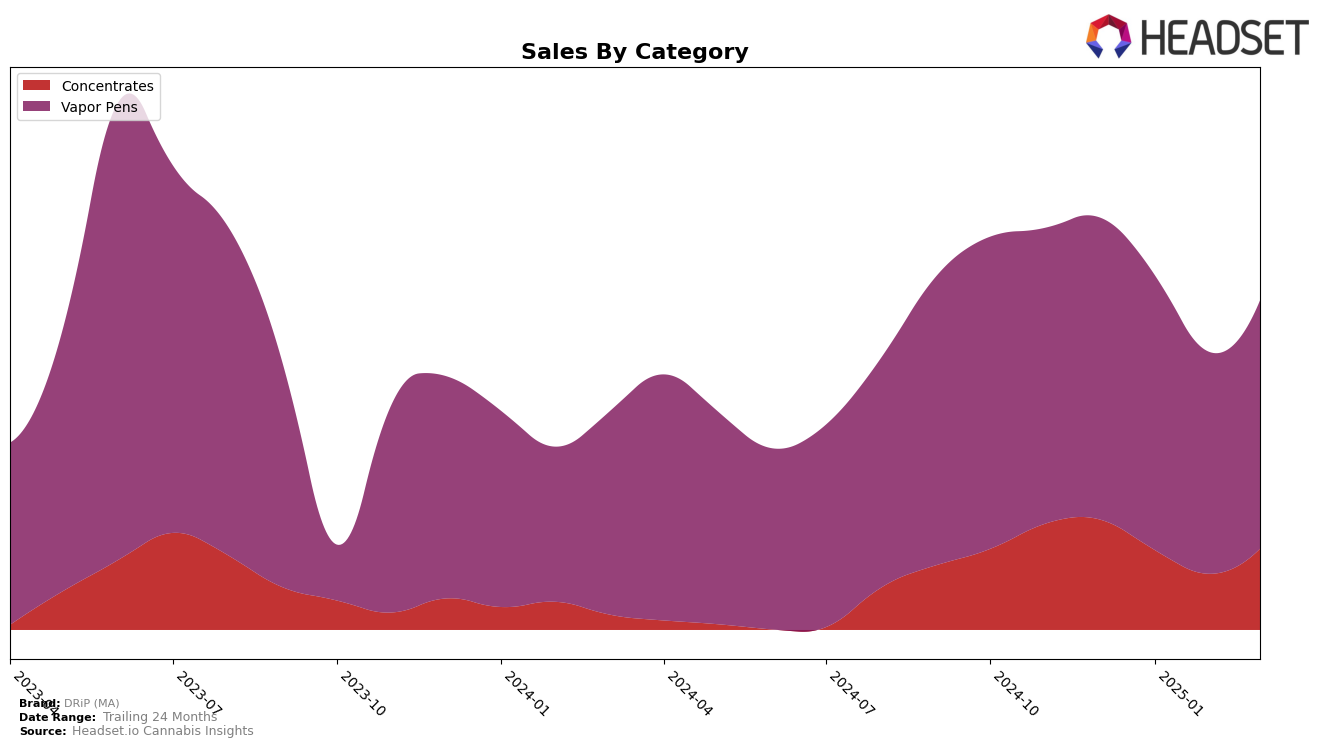

DRiP (MA) has shown a consistent presence in the Massachusetts market, particularly in the Concentrates category. Their ranking fluctuated slightly from December 2024 to March 2025, with positions ranging from 9th to 12th. Despite these variations, DRiP (MA) managed to maintain its position within the top 15 brands in this category, indicating a stable demand for their concentrates. The sales trend for this period reflects a dip in February 2025, followed by a recovery in March 2025, suggesting a potential seasonal effect or market adjustment. The ability to stay within the top ranks, despite these fluctuations, highlights the brand's resilient market presence in Massachusetts.

In contrast, DRiP (MA) faced more challenges in the Vapor Pens category within Massachusetts. Their ranking remained at the lower end, hovering around the 27th and 28th positions from December 2024 to March 2025. This consistent position outside the top 25 suggests a competitive market landscape where DRiP (MA) might need to strategize further to gain a stronger foothold. The sales figures in this category also show a downward trend from December 2024 through February 2025, with a slight uptick in March 2025. This could indicate potential areas for growth or the need for innovation to capture more market share. Overall, while DRiP (MA) exhibits strength in Concentrates, there is room for improvement in their Vapor Pens performance.

Competitive Landscape

In the Massachusetts Vapor Pens category, DRiP (MA) has shown a consistent rank of 27th in December 2024 and January 2025, before slipping to 28th in February and March 2025. This slight decline in rank coincides with a decrease in sales from December to February, with a minor recovery in March. In contrast, Sapura experienced a notable improvement, climbing from 41st in December to 27th in March, surpassing DRiP (MA) in the process. Meanwhile, Galactic maintained a stronger position, although it also saw a slight drop from 22nd to 26th over the same period. The competitive landscape is further intensified by Treeworks and Marmas, both of which have shown varying degrees of improvement in their ranks, indicating a dynamic market where DRiP (MA) faces challenges to maintain and improve its standing amidst fluctuating sales trends and competitive pressures.

Notable Products

In March 2025, the top-performing product for DRiP (MA) was Snow Wax (1g) in the Concentrates category, maintaining its first-place position for four consecutive months with a sales figure of 1,333 units. GMO Live Resin Badder (1g), also in the Concentrates category, emerged as the second-best seller, marking its debut in the rankings. Mangopaya Live Resin Cartridge (1g) and Tequila Sunrise Live Resin Cartridge (1g), both from the Vapor Pens category, secured the third and fourth positions respectively, showcasing strong initial performances. Croissant Live Crumble (1g) rounded out the top five, also debuting in the Concentrates category. These new entries in March reflect a dynamic shift in product preferences compared to previous months, where Snow Wax (1g) was the sole ranking product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.