Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

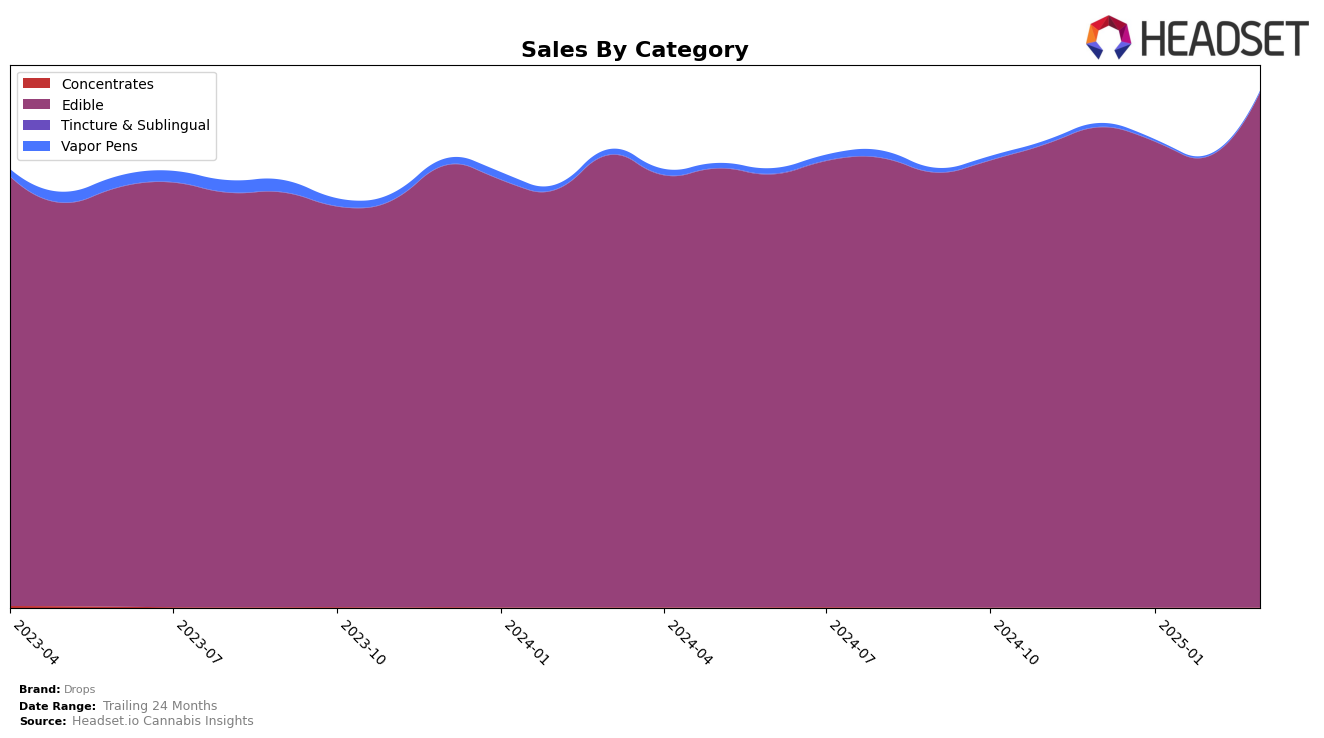

In the California market, Drops has shown a stable performance in the Edible category, maintaining its position at rank 9 from January through March 2025. This consistency suggests a strong foothold in the state, with sales steadily increasing from $813,900 in January to $857,606 by March. Meanwhile, in Oregon, Drops has consistently held the 3rd rank in the same category over the same period. Despite a slight dip in sales in February, the brand experienced a rebound in March, indicating resilience and a robust consumer base in Oregon.

In Washington, Drops has demonstrated upward mobility in the Edible category rankings, moving from 16th place in December 2024 to 13th by March 2025. This positive trend is accompanied by an increase in sales, particularly noticeable in March. Drops' absence from the top 30 brands in other states or categories suggests areas for potential growth or a more focused strategy in their current strongholds. Understanding these dynamics could be key for stakeholders looking to optimize performance across different regions.

Competitive Landscape

In the Oregon edible cannabis market, Drops consistently held the third position from December 2024 through March 2025, demonstrating a stable performance amidst a competitive landscape. Despite a decrease in sales from December 2024 to February 2025, Drops experienced a rebound in March 2025, indicating resilience and potential for growth. The brand is positioned behind Wyld, which maintained the top rank with significantly higher sales, and Gron / Grön, which also consistently held the second spot. Notably, Mule Extracts and Smokiez Edibles remained stable at fourth and fifth ranks, respectively, with sales figures considerably lower than Drops. This stability in ranking suggests that while Drops faces strong competition, particularly from the top two brands, it remains a formidable player in the market with opportunities to capitalize on its current standing and potentially close the gap with its leading competitors.

Notable Products

In March 2025, Drops' top-performing product was Cherry Rosin Gummies 2-Pack (100mg), maintaining its first-place rank for the third consecutive month with sales of $18,589. The CBD/THC 2:1 Blackberry Jellies 20-Pack (200mg CBD, 100mg THC) climbed to the second position, showing notable improvement from its fifth-place rank in February. Active - Lemon Live Rosin Jellies 2-Pack (100mg) consistently held the third position, indicating stable performance. Active - Lemon Jelly (100mg) dropped to fourth place, despite a slight increase in sales. The CBD:THC 2:1 Heavy Blackberry Jelly 2-Pack (200mg CBD, 100mg THC, 0.42oz) entered the top five, marking its first appearance in the rankings since January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.