Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

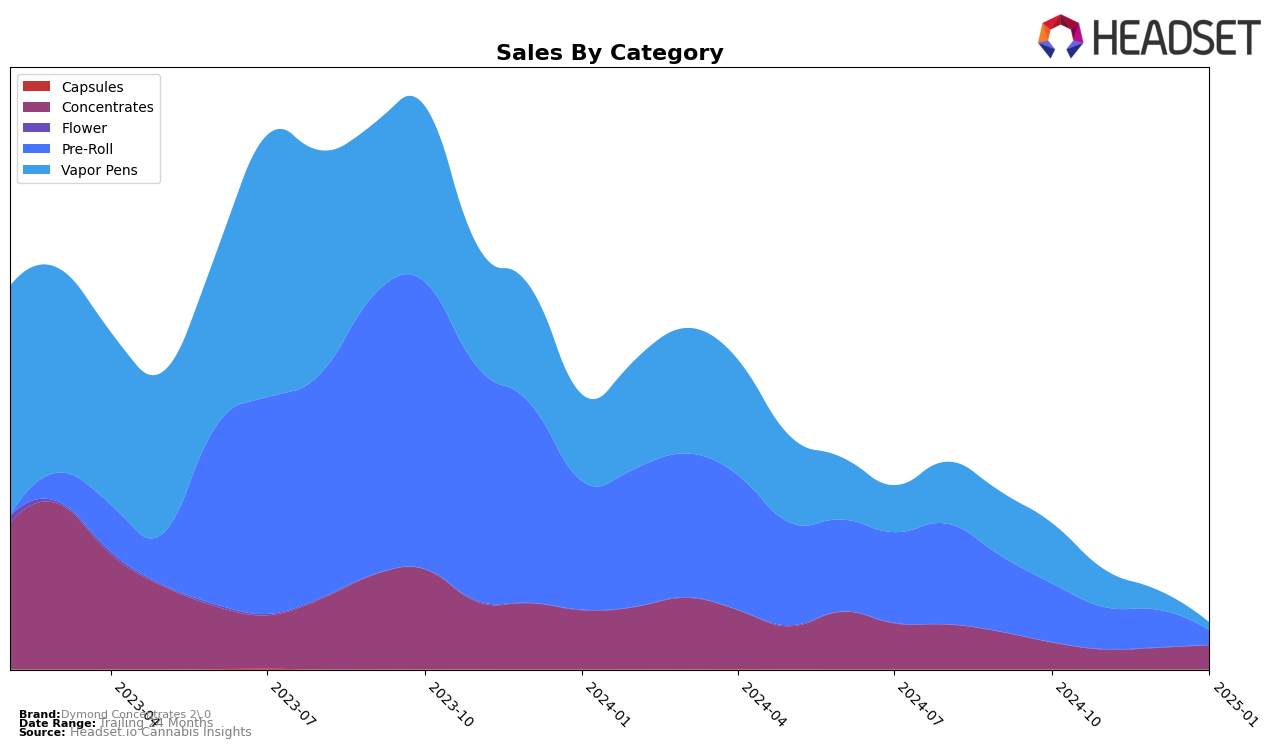

Dymond Concentrates 2.0 has shown a varied performance across different categories and regions, particularly in British Columbia. In the Concentrates category, the brand experienced a significant improvement in its ranking from November 2024 to January 2025, moving from 36th to 30th. This upward trend suggests a growing consumer interest in their products in this category, despite a dip in sales in November. However, the brand did not maintain a top 30 position in the Vapor Pens category in January 2025, indicating a potential area for growth or increased competition. The fluctuation in rankings across months highlights the dynamic nature of the market and the challenges brands face in maintaining a consistent presence.

In Ontario, Dymond Concentrates 2.0's performance in the Vapor Pens category was less favorable, as the brand did not rank in the top 30 by December 2024. This absence from the rankings could signal a need for strategic adjustments or increased marketing efforts to regain market share. The sales figures in October and November 2024 show a steep decline, which might have contributed to the drop in rankings. These movements underline the importance of market adaptability and consumer engagement for maintaining competitive standings. As the brand continues to navigate these challenges, it will be interesting to see how they strategize to improve their market position across different regions and categories.

Competitive Landscape

In the competitive landscape of concentrates in British Columbia, Dymond Concentrates 2.0 has experienced fluctuating rankings and sales, which reflect the dynamic nature of this market. Despite not breaking into the top 20, Dymond Concentrates 2.0 showed a slight improvement in rank from December 2024 to January 2025, moving from 33rd to 30th, accompanied by a modest increase in sales. In contrast, Good Buds managed to enter the top 20 in December 2024, although it fell out again by January 2025, indicating a volatile performance. Meanwhile, Herbal Dispatch Craft achieved a notable leap in December 2024, reaching 19th place, but experienced a decline to 29th in January 2025. Rosin Heads also saw a significant drop from 16th in November 2024 to 34th by January 2025, highlighting the competitive pressure in the market. These shifts suggest that while Dymond Concentrates 2.0 faces stiff competition, there are opportunities for strategic positioning and growth in this evolving market.

Notable Products

In January 2025, the top-performing product for Dymond Concentrates 2.0 was the Shatter Tasting 2-Pack (1.2g) in the Concentrates category, which ascended to the number 1 rank from the 2nd position in December 2024, achieving sales of 706 units. The Death Bubba Diamond Infused Pre-Roll 3-Pack (1.5g), previously holding the top spot for three consecutive months, fell to the 2nd position. The Slurricane Live Rosin Cartridge (1g) made a notable entry at the 3rd rank, having not been ranked in December. Do-Si-Dos Shatter (1g) emerged as a new entry in January, securing the 4th position. Meanwhile, the Peach Rings Live Resin Cartridge (1g) dropped from 4th in December to 5th in January, reflecting a downward trend in its sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.