Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

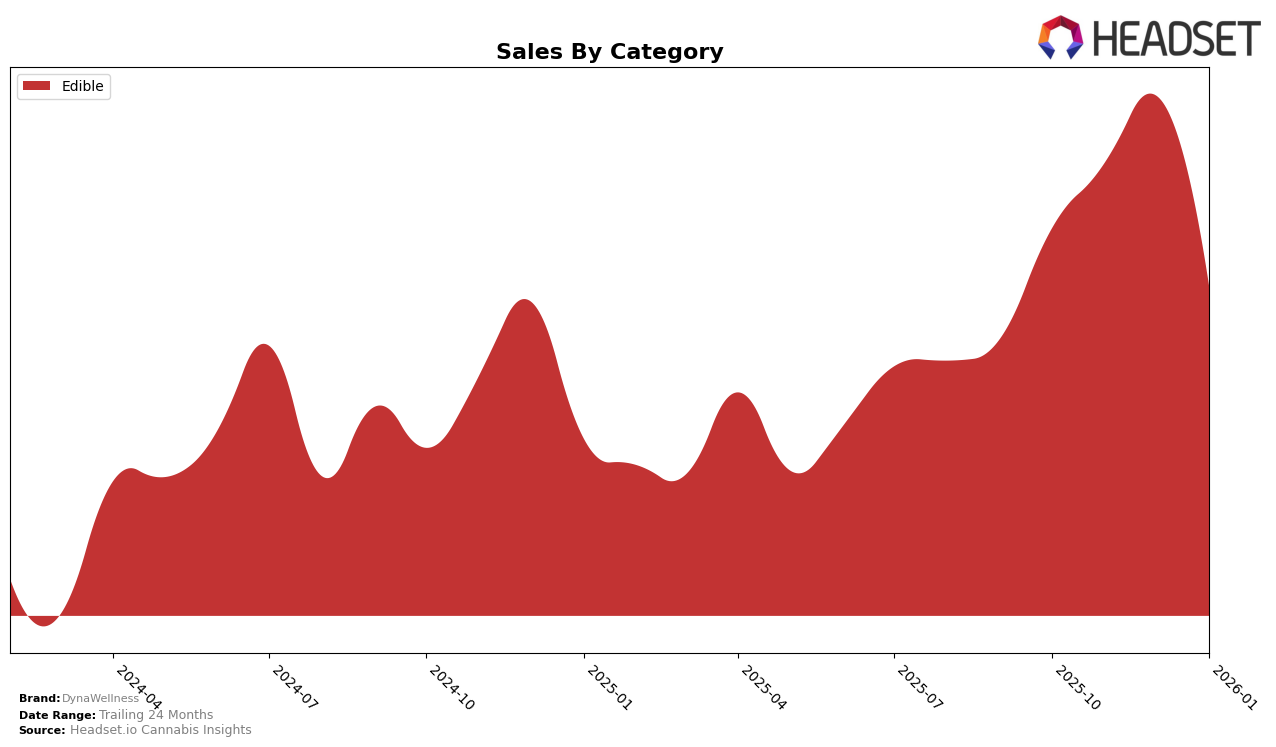

DynaWellness has shown a consistent performance in the Edible category within Saskatchewan over the past few months. The brand maintained a steady ranking, fluctuating slightly from 12th to 13th place between October 2025 and January 2026. This indicates a stable presence in the market, although the slight drop in January could suggest increased competition or seasonal changes affecting consumer preferences. Notably, DynaWellness achieved its highest sales in December 2025, suggesting a possible spike in holiday demand, although sales dipped in January, which might be worth investigating further.

The absence of DynaWellness from the top 30 rankings in other states or provinces highlights a potential area for growth and expansion. Their focused presence in Saskatchewan suggests a strong local strategy, but it also points to opportunities in untapped markets. This could be a strategic decision to consolidate their market share in one region before expanding. However, the lack of presence in other markets might also indicate challenges in scaling operations or adapting to different regional demands and regulations. Understanding these dynamics could be key for stakeholders looking to evaluate the brand's future prospects.

```Competitive Landscape

In the Saskatchewan edible cannabis market, DynaWellness has experienced fluctuating rankings over the past few months, moving from 12th in October 2025 to 13th by January 2026. This slight decline in rank is notable given the competitive landscape, particularly with brands like Foray and Emprise Canada maintaining consistent top 10 positions. Despite the drop in rank, DynaWellness saw a peak in sales in December 2025, although sales decreased significantly by January 2026. The brand faces stiff competition from Olli, which re-entered the top 10 in December 2025 with no prior ranking in October and November, indicating a strong market presence that could impact DynaWellness's future performance. Meanwhile, Lord Jones also shows a declining trend, which may provide an opportunity for DynaWellness to reclaim lost ground if they can capitalize on their sales peaks and address the factors contributing to their recent decline.

Notable Products

For January 2026, the top-performing product from DynaWellness is Dyna Thrive Pro - CBD Blueberry Acai Soft Chews 30-Pack, maintaining its number one rank consistently since October 2025. Despite a slight decrease in sales to 409 units, it remains the leader in the Edible category. Dynathrive - CBD Apple Cider Vinegar Soft Chews 30-Pack reappeared in the rankings at position eight, after not being ranked in December 2025, indicating a resurgence in interest. This change suggests a possible shift in consumer preference or availability, as it was ranked second in October and November 2025. Overall, DynaWellness continues to dominate in the Edible category with these key products.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.