Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

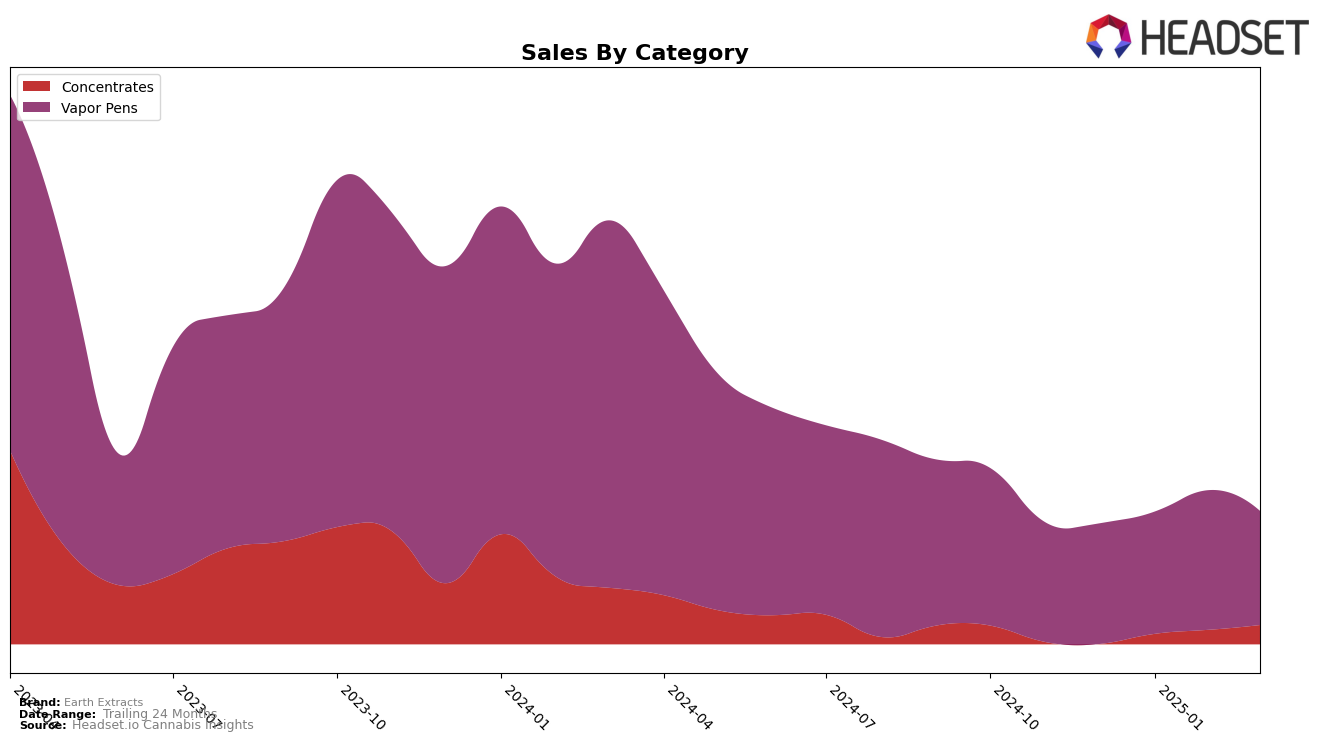

In the Arizona market, Earth Extracts has demonstrated a notable performance in the Concentrates category. The brand has shown consistent improvement in its rankings from December 2024 through March 2025, moving up from the 23rd position to the 17th. This upward trajectory is indicative of a growing consumer preference for their products, as evidenced by the steady increase in sales over these months. The positive movement in the Concentrates category suggests that Earth Extracts is effectively capturing market share and gaining traction among consumers in Arizona.

Conversely, in the Vapor Pens category within Arizona, Earth Extracts has experienced more fluctuation. Starting at the 22nd position in December 2024, the brand saw a slight dip in January 2025, slipping to 24th, before recovering to 21st in February. However, by March 2025, the brand fell back to 25th, indicating a volatile performance in this category. This inconsistency could be a point of concern, suggesting potential challenges in maintaining a stable market position against competitors. Despite a decline in sales from February to March, the overall performance in the Vapor Pens category highlights areas for potential strategic adjustments to stabilize and improve their market standing.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Earth Extracts has experienced some fluctuations in its market position from December 2024 to March 2025. Initially ranked 22nd in December, Earth Extracts saw a slight dip to 24th in January, before climbing to 21st in February, and then dropping to 25th in March. Despite these changes, Earth Extracts remains a strong contender in the market. Comparatively, Mohave Cannabis Co. maintained a relatively stable position, hovering around the 21st to 24th ranks, indicating consistent performance. Meanwhile, Tru Infusion showed a notable recovery from 31st in January to 22nd in February, surpassing Earth Extracts briefly. Other competitors like NugRun Concentrates and Cure Injoy have shown upward trends, with NugRun Concentrates improving from 42nd to 26th and Cure Injoy from 38th to 27th over the same period. These shifts highlight the dynamic nature of the vapor pen market in Arizona, suggesting that Earth Extracts must continue to innovate and adapt to maintain and improve its competitive standing.

Notable Products

In March 2025, the top-performing product from Earth Extracts was the Blue Dream Oil Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales of 735 units. The EV Maui Wowie Oil Cartridge (1g) also performed strongly, maintaining a high position at rank 2, slightly down from its top rank in January 2025. The EV Premium Pink Rozay Oil Cartridge (1g) debuted at rank 3, showing promising sales figures. Meanwhile, the EV Premium Watermelon Zkittlez Oil Cartridge (1g) held steady at rank 4, consistent with its previous performance in January 2025. Lastly, the Hybrid Blend FECO (1g) in the Concentrates category remained at rank 5, indicating stable sales over the past two months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.