Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

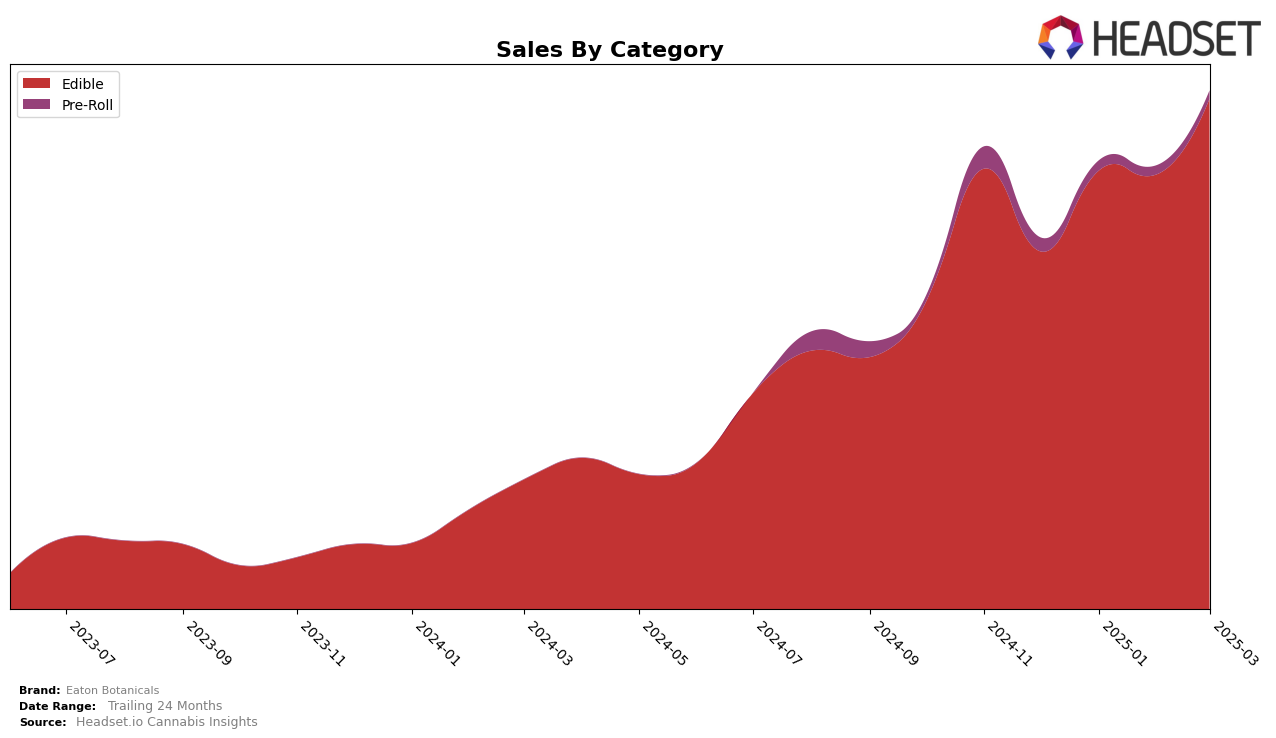

In the rapidly evolving cannabis market, Eaton Botanicals has demonstrated notable growth, particularly in the New York edibles category. Over the course of four months from December 2024 to March 2025, the brand climbed from 13th to 8th place. This upward trajectory indicates a strong consumer preference and effective market strategies. The brand's sales in this category increased significantly, with a marked rise in March 2025, suggesting successful product offerings and possibly increased brand recognition. However, Eaton Botanicals' absence from the top 30 in other categories or states during this period signals potential areas for growth and expansion.

While Eaton Botanicals has made strides in the New York edibles market, its performance in other states and categories remains less visible, as indicated by their absence from the top 30 rankings. This could be interpreted as a challenge or an opportunity, depending on the strategic direction the brand chooses to take. The consistent improvement in their ranking within New York's edibles category suggests a solid foothold in that market, which could serve as a springboard for broader category or geographic expansion. As the cannabis market continues to grow, Eaton Botanicals' ability to replicate its New York success elsewhere will be a key factor in its long-term performance.

Competitive Landscape

In the competitive landscape of the Edible category in New York, Eaton Botanicals has shown a promising upward trajectory in its rankings over the past few months. Starting from a rank of 13 in December 2024, Eaton Botanicals has climbed steadily to reach the 8th position by March 2025. This ascent is notable when compared to competitors such as Lost Farm, which maintained a stable rank of 7, and Mfny (Marijuana Farms New York), which consistently held a higher position at rank 6. Despite Jaunty experiencing a decline from rank 7 to 9, Eaton Botanicals' sales have shown a positive trend, closing the gap with these established brands. This upward movement in both rank and sales suggests a growing consumer preference for Eaton Botanicals, positioning it as a rising contender in the New York Edible market.

Notable Products

In March 2025, Eaton Botanicals' top-performing product was Nightly Nightcap - THC/CBN 1:1 Dark Cherry Gummies 20-Pack, maintaining its leading position since December 2024 with notable sales of 3956 units. The Daily Elevation- CBG/THC 1:1 Peach Gummies 20-Pack held steady at the second rank across the same period. Serenity Now - CBD/THC 4:1 Lemon Lavender Gummies 20-Pack saw a significant climb from fifth place in December 2024 to third by January 2025, maintaining this position through March. Fixer Upper - CBD/THC 1:1 Mango Ginger Gummies consistently ranked fourth, with a slight increase in sales to 2062 units in March. Gal Pal - CBD/THC 1:1 Watermelon Gummies remained in fifth place, showing consistent performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.