Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

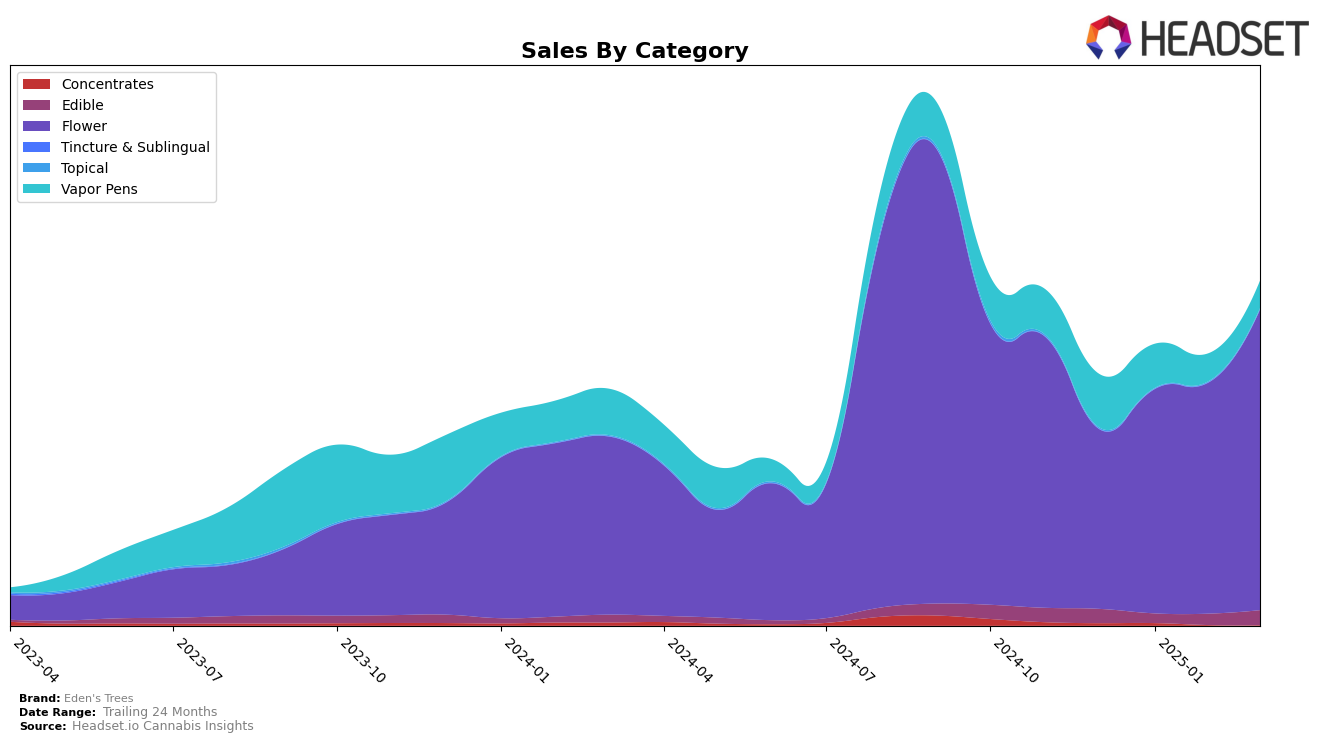

Eden's Trees has demonstrated a varied performance across different categories in Ohio. In the Edible category, the brand maintained a steady position, ranking 22nd in both February and March 2025, showing a recovery from the 26th position in January. This indicates a positive trend in their edible sales, which is further supported by the increase in sales figures from January to March. However, in the Vapor Pens category, Eden's Trees faced challenges as it slipped from 18th place in December 2024 to 27th by March 2025, consistently staying at the lower end of the top 30. This suggests potential issues in maintaining competitive edge within the vapor pen market.

The Flower category, however, tells a different story for Eden's Trees in Ohio. Here, the brand showed impressive upward momentum, climbing from 13th place in December 2024 to a notable 7th place by March 2025. This upward trajectory indicates strong consumer demand and effective market strategies in the flower segment. The significant growth in sales figures for this category supports this trend, highlighting it as a key area of strength for the brand. Overall, while Eden's Trees faces challenges in some categories, its robust performance in the Flower segment in Ohio suggests a strategic focus that could be leveraged for further growth.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Eden's Trees has demonstrated a notable upward trajectory in its rankings from December 2024 to March 2025. Starting at rank 13 in December 2024, Eden's Trees climbed to rank 7 by March 2025, showcasing a consistent improvement in its market position. This upward movement is significant, especially when compared to competitors like Grassroots, which maintained a relatively stable position around rank 8, and Certified (Certified Cultivators), which fluctuated between ranks 7 and 11. Meanwhile, Seed & Strain Cannabis Co. rose impressively from rank 12 to 5, indicating a strong competitive presence. Despite this, Eden's Trees' sales growth trajectory suggests a robust competitive edge, with a significant sales increase in March 2025, positioning it closer to top-tier brands like Butterfly Effect - Grow Ohio, which consistently held a top 6 position. This trend highlights Eden's Trees' potential to further enhance its market share and rank in the coming months.

Notable Products

In March 2025, Cadillac Rainbows (2.83g) emerged as the top-performing product for Eden's Trees, with notable sales of 8,085 units. This product climbed to the number one rank without being ranked in previous months, indicating a significant surge in popularity. Alien Mints (2.83g), which held the top position from December 2024 through February 2025, dropped to the second rank with sales slightly decreasing to 3,246 units. Jungle Fuel (2.83g) reappeared in the rankings at the third position, having been absent in January and February. Sour K (2.83g) and Gusher Mintz (2.83g) rounded out the top five, with Gusher Mintz showing consistent performance by maintaining its fifth rank from February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.