Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

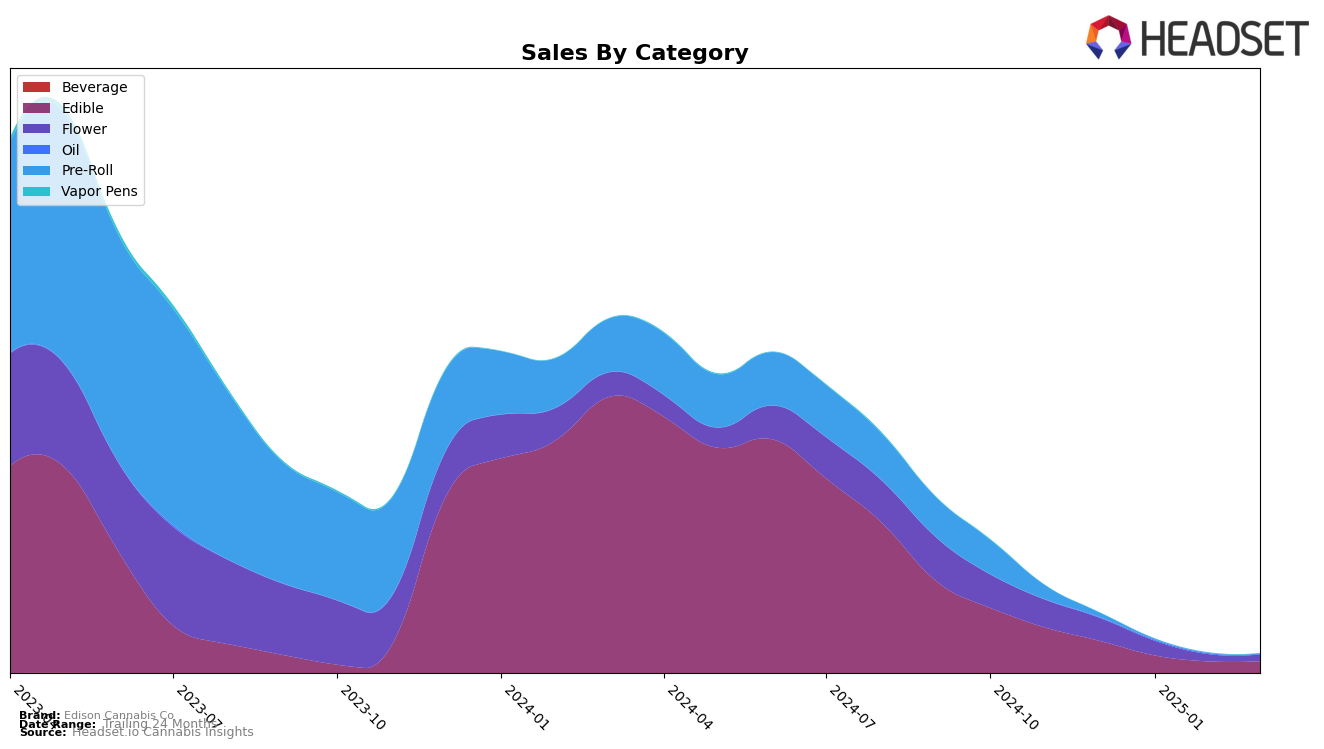

Edison Cannabis Co has shown varied performance across different Canadian provinces and product categories, particularly in the Edible category. In Alberta, the brand experienced a notable fluctuation in its rankings, starting at 11th place in December 2024 and dropping to 23rd by February 2025, before recovering slightly to 18th in March. This movement suggests a competitive market environment where Edison Cannabis Co is facing challenges in maintaining a stable position. Despite this, the brand's sales trajectory indicates some resilience, with a recovery in sales in March after a dip in February. In contrast, in British Columbia, Edison Cannabis Co maintained a consistent ranking of 20th from December 2024 through February 2025, but fell out of the top 30 by March, highlighting a potential area of concern for the brand in this province.

The absence of March rankings for the Edible category in British Columbia underscores a significant decline, suggesting that Edison Cannabis Co might need to reassess its strategies in this market to regain its standing. The brand's consistent presence in the top 30 in Alberta, albeit with fluctuating rankings, indicates a stronger foothold in this province compared to British Columbia. This regional disparity in performance could be attributed to various factors such as local consumer preferences, competitive dynamics, or distribution strategies. While the detailed sales figures provide some insights, the broader trends suggest that Edison Cannabis Co is navigating a challenging landscape with mixed success across these provinces.

Competitive Landscape

In the Alberta edible cannabis market, Edison Cannabis Co has experienced notable fluctuations in its competitive positioning over the past few months. Starting from December 2024, Edison held the 11th rank but saw a decline to 15th in January 2025 and further dropped to 23rd in February. However, by March, Edison rebounded to the 18th position. This volatility in rank is mirrored in its sales, which saw a significant decrease from December to February, before recovering slightly in March. In comparison, Lord Jones maintained a relatively stable position around the 17th and 18th ranks, while Aurora Drift consistently outperformed Edison, holding a higher rank throughout the period. Emprise Canada also showed resilience, briefly surpassing Edison in February. Meanwhile, Even Cannabis Company showed an upward trend, climbing from 23rd to 20th by March. These dynamics suggest that Edison Cannabis Co faces stiff competition and must strategize effectively to regain and sustain a higher market position in Alberta's edible category.

Notable Products

In March 2025, the top-performing product for Edison Cannabis Co was the Dark Chocolate Megabyte Truffle (10mg) in the Edible category, which secured the number one rank with sales of 1831 units. Following closely, the Jolts - Sativa Electric Lemon Lozenges 10-Pack (100mg) dropped to the second position from its consistent first-place ranking in the prior three months. The Jolts - Sativa Electric Lemon Lozenge (10mg) moved up to third place, showing a steady improvement from its fifth-place ranking in December 2024. The Jolts - Sativa Arctic Cherry Lozenge (10mg) experienced a decline, moving from second in December 2024 to fourth in March 2025. Lastly, Limelight (1g) maintained a stable performance, ranked fifth in March 2025, slightly dropping from its third-place position in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.