Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

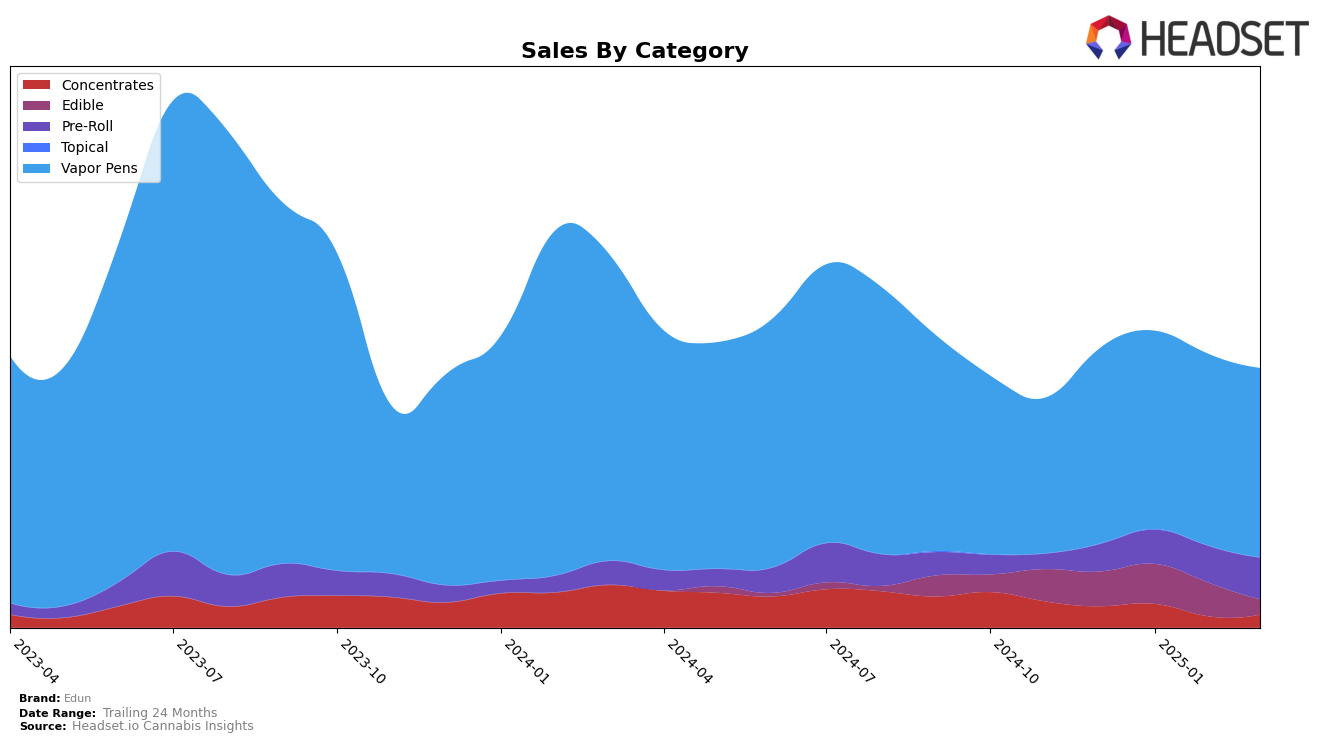

In the state of Colorado, Edun has shown varying performance across different cannabis product categories. Notably, the brand's presence in the Concentrates category has been inconsistent, as they failed to make it into the top 30 rankings from December 2024 through March 2025. This indicates a potential challenge in gaining traction or maintaining a competitive edge in this segment. On the other hand, Edun's performance in the Pre-Roll category has been on an upward trajectory, improving from the 41st position in December 2024 to 24th by March 2025, suggesting a strengthening market position in this category.

Edun's performance in the Edible category in Colorado also highlights some interesting dynamics. Despite starting at the 24th rank in December 2024 and improving slightly to 21st in January 2025, the brand experienced a decline to the 32nd position by March 2025, which could point to increased competition or shifting consumer preferences. Meanwhile, in the Vapor Pens category, Edun has maintained a relatively stable ranking, hovering around the 17th to 20th positions over the four-month period. This consistency suggests a solid foothold in the Vapor Pens market, although there may be room for growth to break into higher rankings.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Edun has demonstrated a consistent presence, maintaining a rank within the top 20 brands from December 2024 to March 2025. Notably, Edun's rank improved from 20th in December 2024 to 17th in January 2025, before settling at 19th by March 2025. This stability contrasts with the fluctuating ranks of competitors such as The Colorado Cannabis Co., which experienced a decline from 15th to 17th over the same period, and AiroPro, which dropped from 14th to 20th. Meanwhile, Harmony Extracts showed a significant rise in February 2025, reaching 13th place, indicating a potential threat to Edun's market position. Despite these shifts, Edun's sales figures remained relatively stable, suggesting a loyal customer base. However, the brand may need to strategize to counter the upward momentum of brands like Binske, which climbed to 19th in February 2025, closely matching Edun's rank. Overall, while Edun maintains a solid footing in the market, the dynamic movements of its competitors highlight the need for continuous innovation and marketing efforts to sustain and improve its position.

Notable Products

In March 2025, Edun's top-performing product was the Trop City Live Rosin Cartridge (1g) in the Vapor Pens category, securing the first rank with sales of 908 units. The Cherry Paloma Live Rosin Cartridge (1g) improved its standing to second place from fourth in January, indicating a notable increase in demand, with sales reaching 740 units. The Peanut Butter Breath Live Rosin Cartridge (1g) maintained a steady third position from February to March. Jungle Mon Live Rosin Cartridge (1g) debuted at fourth place, showing strong initial sales of 487 units. The Hybrid RSO Gummies 20-Pack (100mg) experienced a drop, falling to fifth place from its previous consistent top positions, reflecting a significant decline in sales compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.