Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

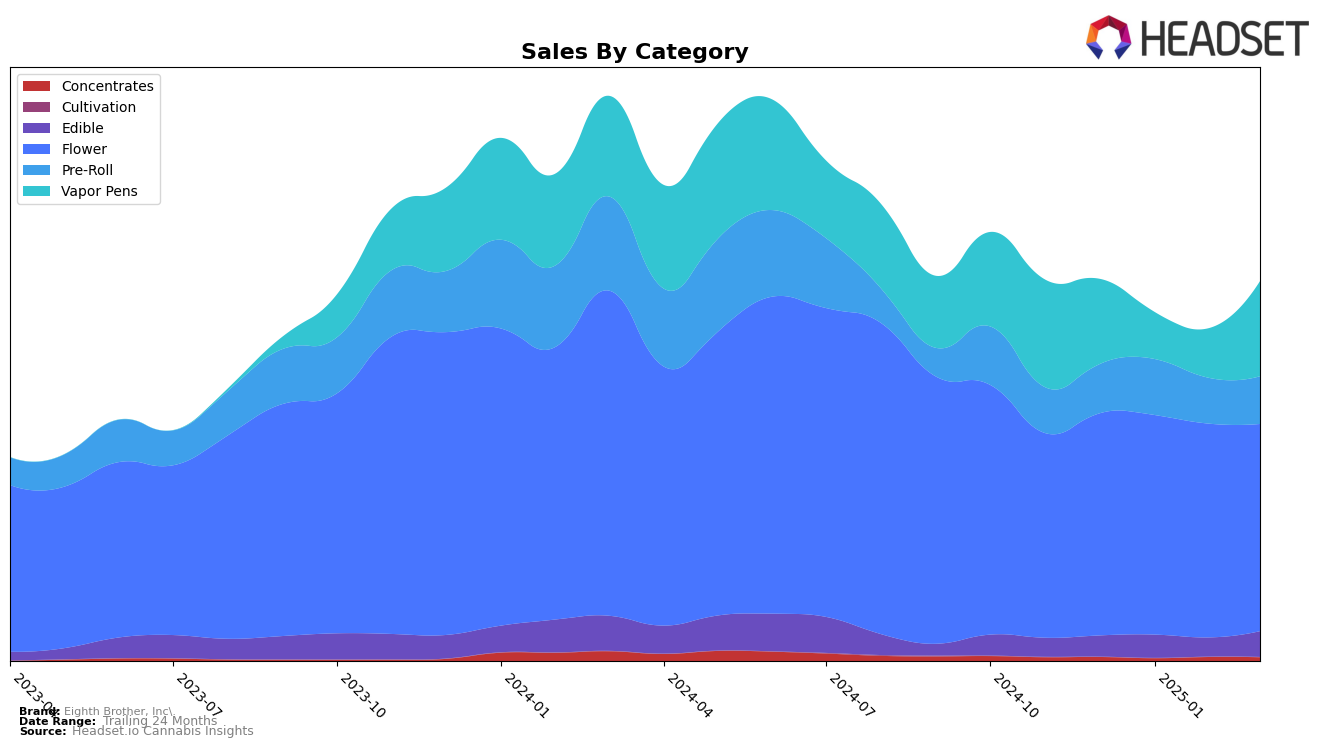

Eighth Brother, Inc. has shown notable performance across various product categories in California. In the Edible category, the brand has managed to break into the top 30 as of March 2025, moving up from a consistent 31st position in the preceding months. This upward trend suggests a growing acceptance or preference for their edible products among consumers. Meanwhile, in the Flower category, Eighth Brother, Inc. has maintained a relatively stable presence, fluctuating slightly but staying within the top 20. This consistency indicates a strong foothold in the Flower market, despite a gradual decrease in sales figures over the months.

In contrast, the Pre-Roll category has seen Eighth Brother, Inc. struggle to reach the top 30, with the brand only achieving a rank of 32 in March 2025 after briefly touching 30 in January. This indicates potential challenges in gaining traction in this segment. However, the Vapor Pens category paints a more dynamic picture. After a dip in January 2025, the brand resurged to reach the 30th position by March, reflecting a significant recovery and possibly an effective strategy or product launch. The fluctuation in rankings across categories highlights both the competitive nature of the cannabis market in California and Eighth Brother, Inc.'s varying performance across its product lines.

Competitive Landscape

In the competitive landscape of the California flower category, Eighth Brother, Inc. has shown a dynamic presence with fluctuating rankings over the months. Starting from December 2024, Eighth Brother, Inc. was ranked 18th, improved to 14th in January 2025, and then saw a slight decline to 15th in February and 17th in March. This indicates a competitive pressure from brands like Quiet Kings, which made a significant leap from 42nd in December to 16th in March, showcasing a robust growth trajectory that could pose a threat to Eighth Brother, Inc.'s market share. Meanwhile, Alien Labs experienced a downward trend from 8th to 15th, suggesting potential vulnerabilities that Eighth Brother, Inc. could capitalize on. Additionally, brands like Dime Bag (CA) and Coastal Sun Cannabis maintained relatively stable positions, indicating consistent performance. For Eighth Brother, Inc., maintaining its competitive edge will require strategic initiatives to counter the rising momentum of emerging competitors and leverage any weaknesses in established brands.

Notable Products

In March 2025, Blackberry Kush Distillate Disposable (1g) emerged as the top-performing product for Eighth Brother, Inc., climbing to the number one rank in the Vapor Pens category with sales of 14,531 units. Snickerdoodlez Pre-Roll (1g) secured the second position in the Pre-Roll category, maintaining strong performance despite fluctuating ranks in previous months. Mendo Fuel Distillate Disposable (1g) held steady at the third rank, showing consistent sales growth since its introduction. Blue Dream Pre-Roll (1g), although dropping to fourth place, continued to be a popular choice among consumers. Cherry Pie Distillate Disposable (1g) made its debut in fifth place, indicating potential for future growth in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.