Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

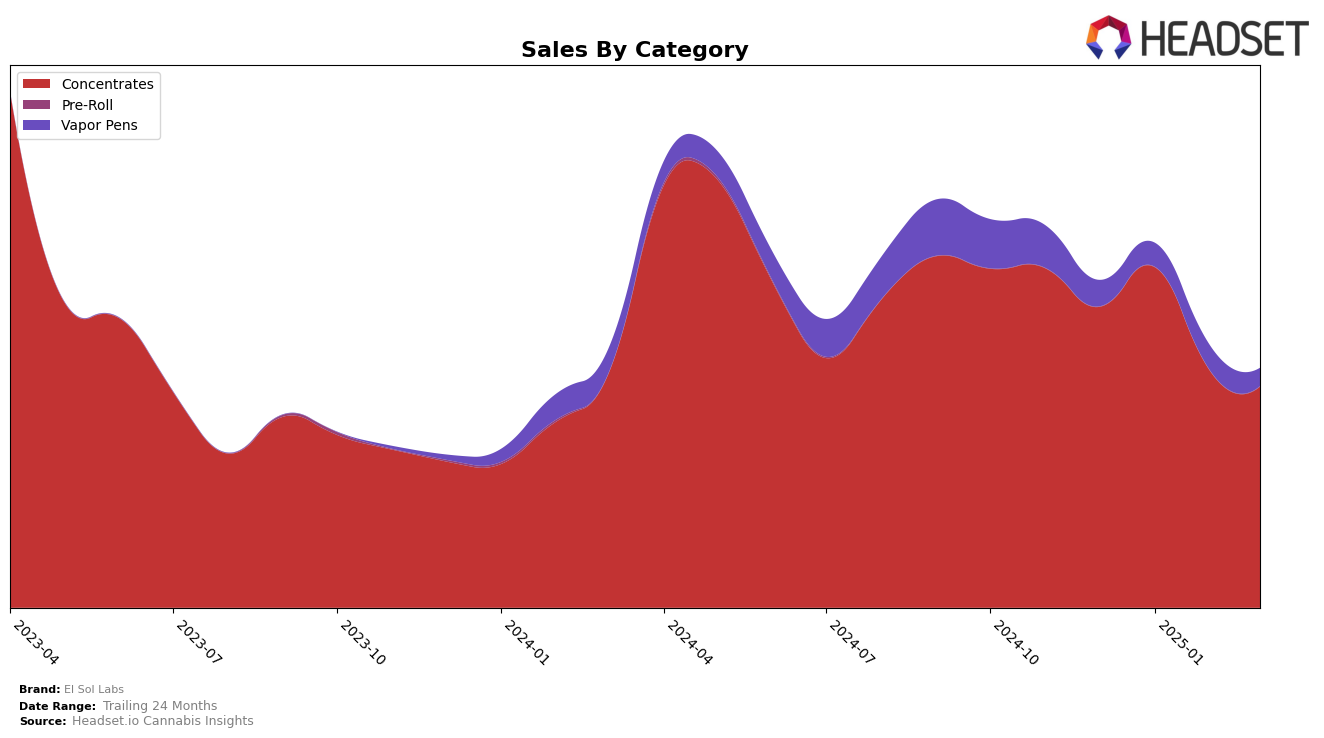

El Sol Labs has shown a mixed performance across different categories in the state of Colorado. In the Concentrates category, they maintained a presence in the top 15, fluctuating slightly from a rank of 12 in December 2024 to 14 by March 2025. This suggests a relatively stable position in a competitive market, although there is room for improvement given the decline in sales from January to March. In contrast, their performance in the Vapor Pens category was less consistent, with rankings outside the top 30, indicating that El Sol Labs faces significant challenges in this segment within Colorado.

One notable trend is the decline in sales for both categories from January to March 2025, which could be indicative of seasonal variations or increased competition. While the Concentrates category saw a decrease in sales, it managed to maintain a relatively stable ranking, which may suggest strong brand loyalty or effective market positioning. On the other hand, the Vapor Pens category did not manage to break into the top 30, highlighting a potential area for strategic improvement. These insights provide a glimpse into El Sol Labs' performance, with opportunities for growth and strategic adjustments particularly in the Vapor Pens category in Colorado.

Competitive Landscape

In the competitive landscape of Colorado's concentrates market, El Sol Labs has experienced fluctuations in its ranking over the past few months, indicating a dynamic competitive environment. Starting from December 2024, El Sol Labs held the 12th position, slightly improving to 11th in January 2025, but then dropping to 15th in February and stabilizing at 14th in March. This movement reflects a competitive pressure from brands like West Edison, which consistently maintained a higher rank, peaking at 11th in December and ending at 12th in March. Meanwhile, AO Extracts closely trailed El Sol Labs, showing a similar pattern of rank fluctuation, ending March at 16th. Notably, Colorado's Best Dabs (CBD) and Billo demonstrated significant upward momentum, with Billo climbing from 31st in December to 13th in March, surpassing El Sol Labs. These shifts suggest that while El Sol Labs has maintained a competitive position, it faces increasing challenges from both established and emerging brands, necessitating strategic adjustments to enhance its market standing.

Notable Products

In March 2025, Wild Tsunami Wax (1g) emerged as the top-performing product for El Sol Labs, leading the sales charts in the Concentrates category with 505 units sold. Following closely, Alabama Slammer Wax (1g) secured the second position, while Power Plant Wax (1g) took the third spot. Band Aid Wax (1g) and Super Lemon Cream Wax (1g) rounded out the top five, ranking fourth and fifth, respectively. Notably, Wild Tsunami Wax (1g) maintained its top position consistently from previous months, whereas Alabama Slammer Wax (1g) and Power Plant Wax (1g) climbed the ranks from lower positions. These shifts in rankings highlight a dynamic change in consumer preferences within the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.