Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

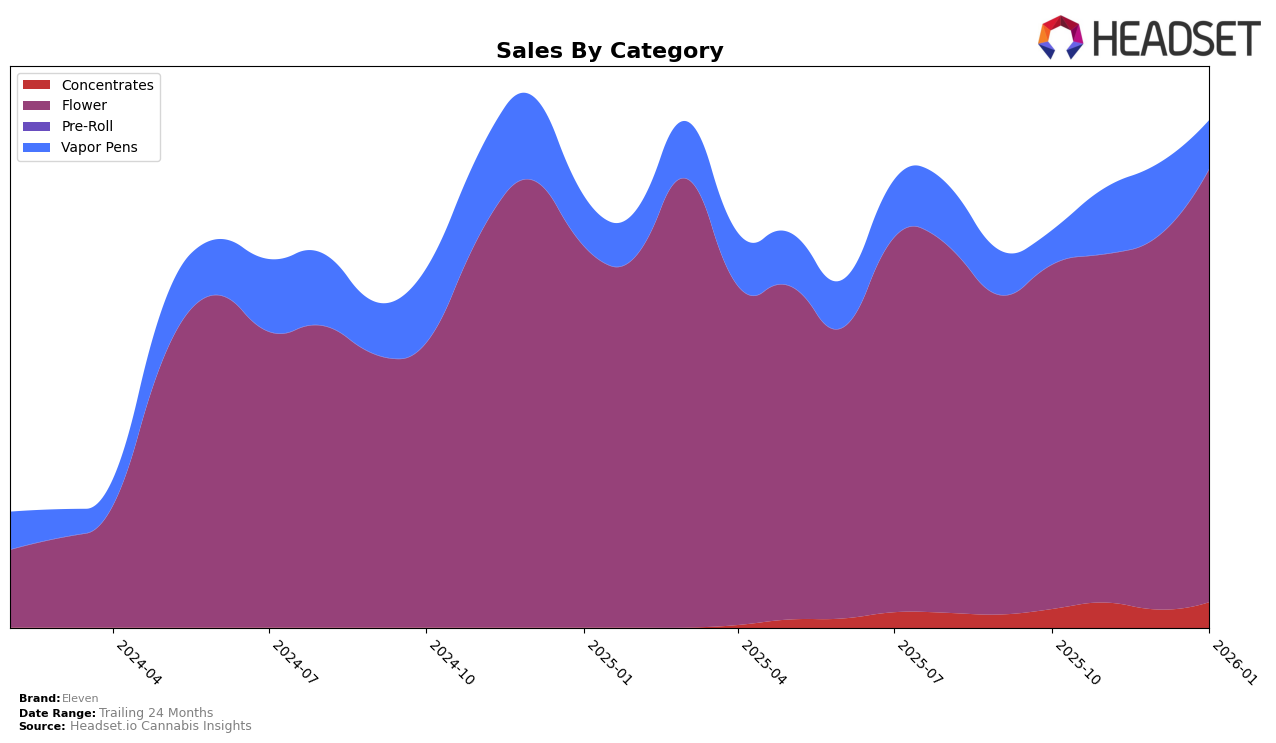

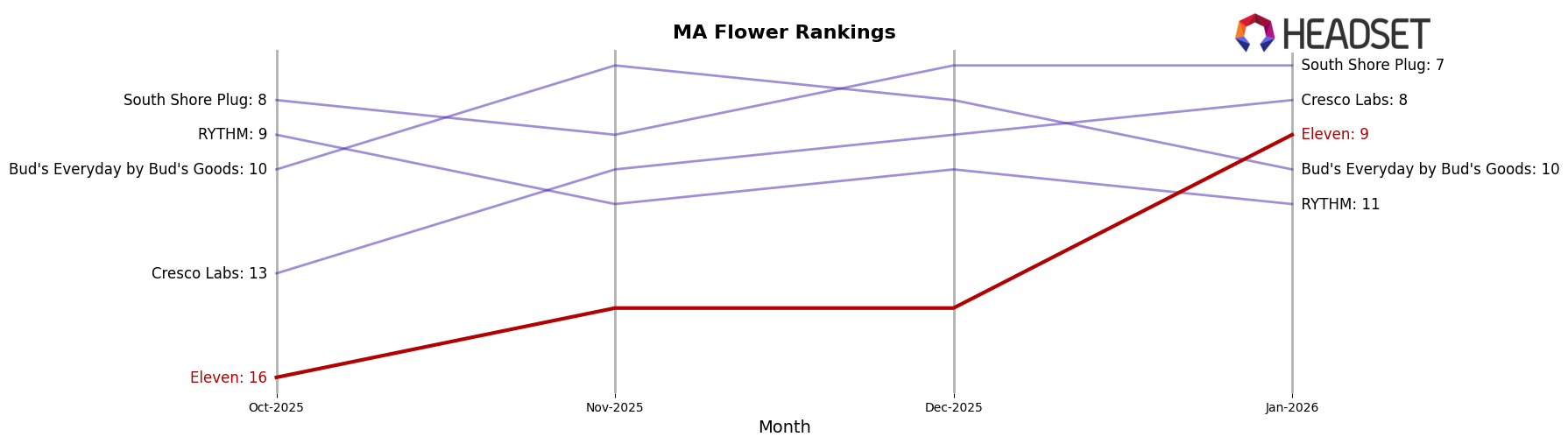

In the Massachusetts market, Eleven has shown notable volatility across different product categories. In the Concentrates category, the brand experienced a significant improvement from October 2025 to November 2025, moving from 23rd to 12th place. However, this was followed by a dip in December before bouncing back slightly in January 2026 to 16th place. This fluctuation indicates a competitive landscape where Eleven is making strides but still faces challenges in maintaining a consistent top-tier position. The Flower category tells a more optimistic story, with Eleven climbing from 16th in October 2025 to an impressive 9th place by January 2026, suggesting strong consumer demand and effective market strategies in this segment.

On the other hand, Eleven's performance in the Vapor Pens category in Massachusetts reveals a more challenging scenario. The brand did not break into the top 30 in October 2025, ranking 59th, and although there was some progress with a peak at 37th place in December, it slipped back to 46th by January 2026. This inconsistency highlights potential issues in market penetration or consumer preference that Eleven may need to address. The overall sales trajectory across these categories suggests that while Eleven is gaining ground in some areas, particularly Flower, it still has significant work to do in others like Vapor Pens to secure a more dominant position in the Massachusetts cannabis market.

Competitive Landscape

In the competitive Massachusetts flower market, Eleven has shown a notable upward trajectory in recent months. Starting from a rank of 16 in October 2025, Eleven climbed to the 9th position by January 2026, reflecting a strategic improvement in market presence and sales performance. This ascent is particularly significant when compared to competitors like Cresco Labs, which also improved its rank from 13 to 8, and Bud's Everyday by Bud's Goods, which fluctuated but ultimately fell to 10th place. Meanwhile, RYTHM experienced a decline, dropping from 9th to 11th, and South Shore Plug maintained a relatively stable position around the 7th rank. Eleven's sales growth, particularly in January 2026, indicates a successful strategy in capturing market share and improving brand visibility among consumers, positioning it as a rising contender in the Massachusetts flower category.

Notable Products

In January 2026, Dulce De Uva (7g) emerged as the top-performing product for Eleven, leading the sales with a notable figure of 1737 units sold. Garlic Drip (7g) climbed significantly in the rankings from fifth in December 2025 to second place in January 2026, showing a strong upward trend. LA Kush Cake (7g) secured the third position, contributing to the dominance of the Flower category among the top products. Cranberry Z (7g) and Animal Mints (3.5g) followed closely, ranking fourth and fifth respectively. The data indicates a reshuffling in the top ranks, with Garlic Drip (7g) being the most notable mover, improving its position from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.