Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

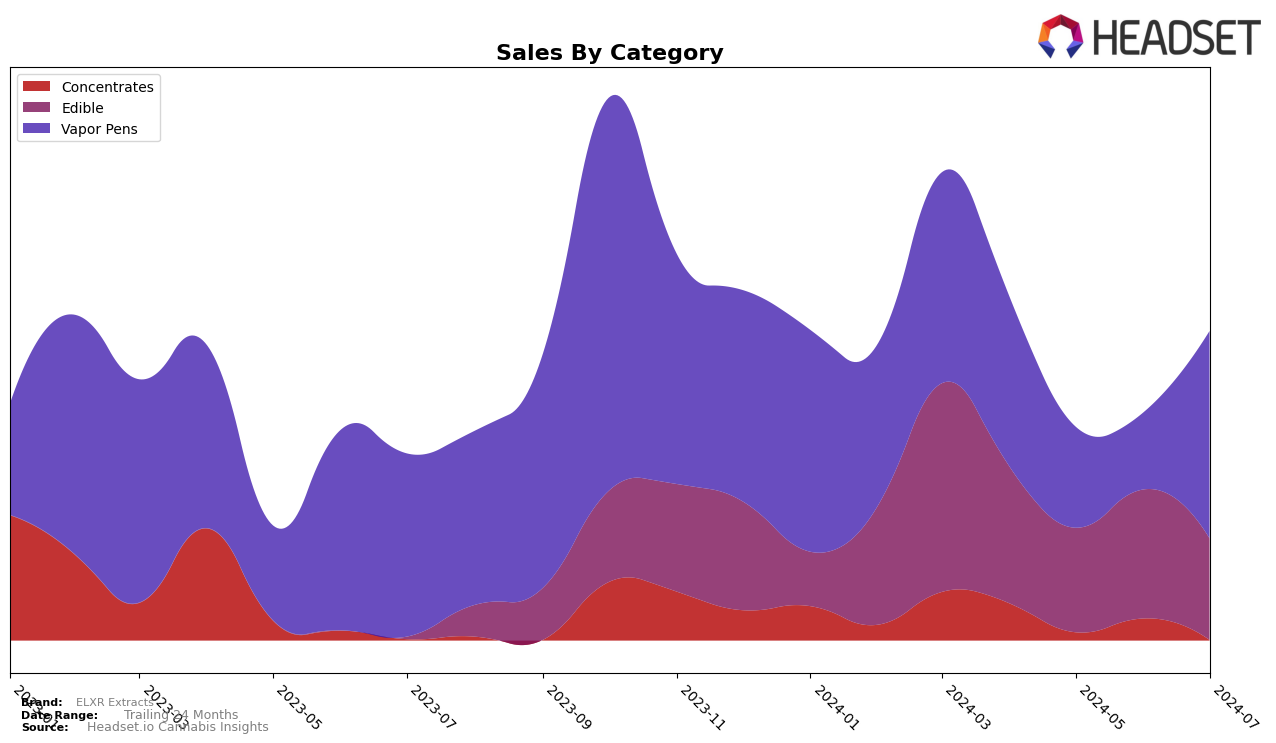

ELXR Extracts has shown notable performance variations across different categories and states. In Ohio, the brand has consistently improved its ranking in the Edible category, moving from 32nd in April 2024 to 30th by July 2024. This upward trend indicates a steady increase in consumer demand for their edible products. However, the Vapor Pens category in Ohio presents a different story. ELXR Extracts ranked 39th in April 2024 but fell out of the top 50 in June before rebounding to 33rd in July. This fluctuation suggests a volatile market presence in the Vapor Pens category, highlighting potential areas for strategic improvement.

While the Edible category shows a positive trajectory, the overall sales figures indicate some inconsistencies. For instance, sales in the Edible category peaked in June 2024 but saw a decline in July. On the other hand, the Vapor Pens category experienced a significant sales increase in July, despite earlier months showing a downward trend. This mixed performance across categories and months suggests that while ELXR Extracts is gaining traction in certain areas, there are still challenges to address in maintaining consistent growth. The brand's ability to navigate these fluctuations will be crucial for its long-term success in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of Vapor Pens in Ohio, ELXR Extracts has experienced notable fluctuations in rank and sales over recent months. While ELXR Extracts started at rank 39 in April 2024, it saw a dip to 45 in May and further to 51 in June, before rebounding significantly to rank 33 in July. This volatility contrasts with the more stable performance of competitors such as Old Granger, which consistently improved from rank 35 in April to 27 in July, and Lighthouse Sciences, which ascended from rank 46 in April to 29 in July. Despite these fluctuations, ELXR Extracts managed to achieve a substantial sales increase in July, suggesting a potential recovery or successful marketing push. However, the brand still trails behind Meigs County Grown and Magnitude in terms of rank stability and overall market presence. These insights indicate that while ELXR Extracts has the potential for growth, it faces stiff competition and must strategize effectively to maintain and improve its market position.

Notable Products

In July 2024, the top-performing product for ELXR Extracts was Lembas Dough Distillate Luster Pod (0.84g) in the Vapor Pens category, with a notable sales figure of 652 units. This product climbed from the second position in June to the top spot in July. Second Breakfast Distillate Luster Pod (0.84g) maintained a strong performance, ranking second both in April and July 2024. Electric Peanut Butter Cookies Distillate Luster Pod (0.84g) secured the third position, showing consistent sales growth. Dual OG Distillate Cartridge (0.84g) moved up to fourth place from its fifth position in June, indicating an upward sales trend.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.