Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

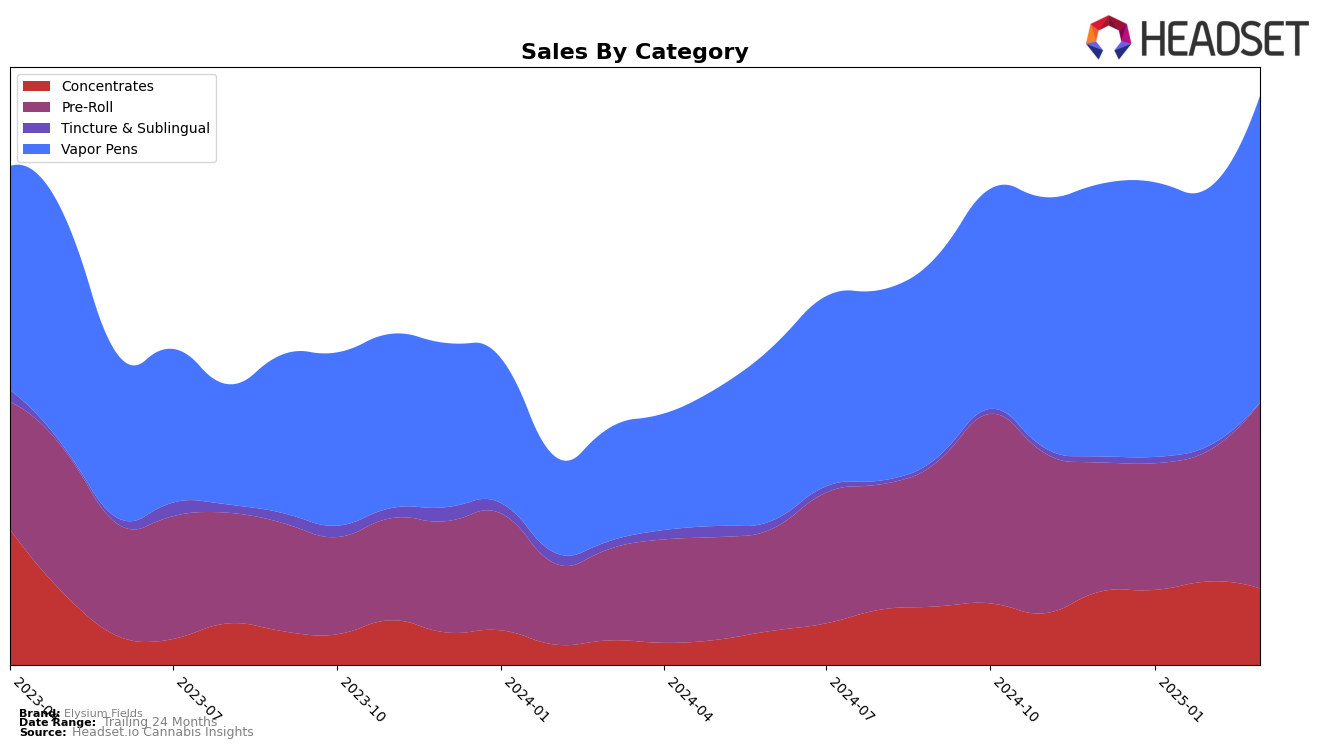

Elysium Fields has shown a varied performance across different product categories in Oregon. In the Concentrates category, the brand held a steady position at rank 22 in December 2024 and January 2025, briefly improving to rank 19 in February before slipping back to rank 23 in March. This fluctuation suggests a competitive market where Elysium Fields is maintaining a presence but facing challenges in gaining a higher foothold. Meanwhile, in the Vapor Pens category, Elysium Fields has maintained a more stable ranking, hovering around the 20th and 21st positions over the months. This consistency indicates a reliable consumer base in this segment, even as sales volumes exhibit some variability.

The Pre-Roll category, however, presents a more dynamic story for Elysium Fields in Oregon. Starting at rank 25 in December 2024, the brand has made significant strides, climbing to rank 16 by March 2025. This upward movement is particularly noteworthy as it suggests a successful strategy or product offering that resonates well with consumers in this category. The increase in rank, coupled with a notable rise in sales figures in March, underscores a strengthening position in the Pre-Roll market. Such trends are crucial for stakeholders to monitor as they reflect the brand's evolving market strategy and consumer preferences in this specific category.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Elysium Fields has shown a dynamic performance, particularly in the first quarter of 2025. Despite not making it into the top 20 in December 2024 and January 2025, Elysium Fields climbed to the 20th position in February 2025, before slipping back to 21st in March 2025. This fluctuation highlights the brand's struggle to maintain a consistent top-tier ranking amidst strong competition. Notably, Sauce Essentials and Feel Goods have been key competitors, with Sauce Essentials experiencing a decline from 19th to 23rd, while Feel Goods improved their rank from 22nd to 19th over the same period. Meanwhile, Private Stash demonstrated a positive trajectory, moving from 23rd to 20th, indicating a potential threat to Elysium Fields' market share. The sales trends show that while Elysium Fields experienced a notable increase in March 2025, competitors like Feel Goods also saw significant sales growth, suggesting a highly competitive environment where maintaining rank requires continuous strategic efforts.

Notable Products

In March 2025, the top-performing product from Elysium Fields was Hawaiian Durban Pie Pre-Roll (1g) in the Pre-Roll category, securing the number one spot with notable sales figures of 3566 units. Dr. Pineapple Pre-Roll (1g) maintained its strong performance, ranking second, consistent with its previous ranking in December 2024. Frozen Bananas Pre-Roll (1g) emerged as a new contender, achieving the third position. Oregon Mac Pre-Roll (1g) and Blueberry Octane Pre-Roll (1g) followed closely in fourth and fifth positions, respectively. The rankings indicate a dynamic shift, with new entries such as Frozen Bananas Pre-Roll gaining traction in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.