Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

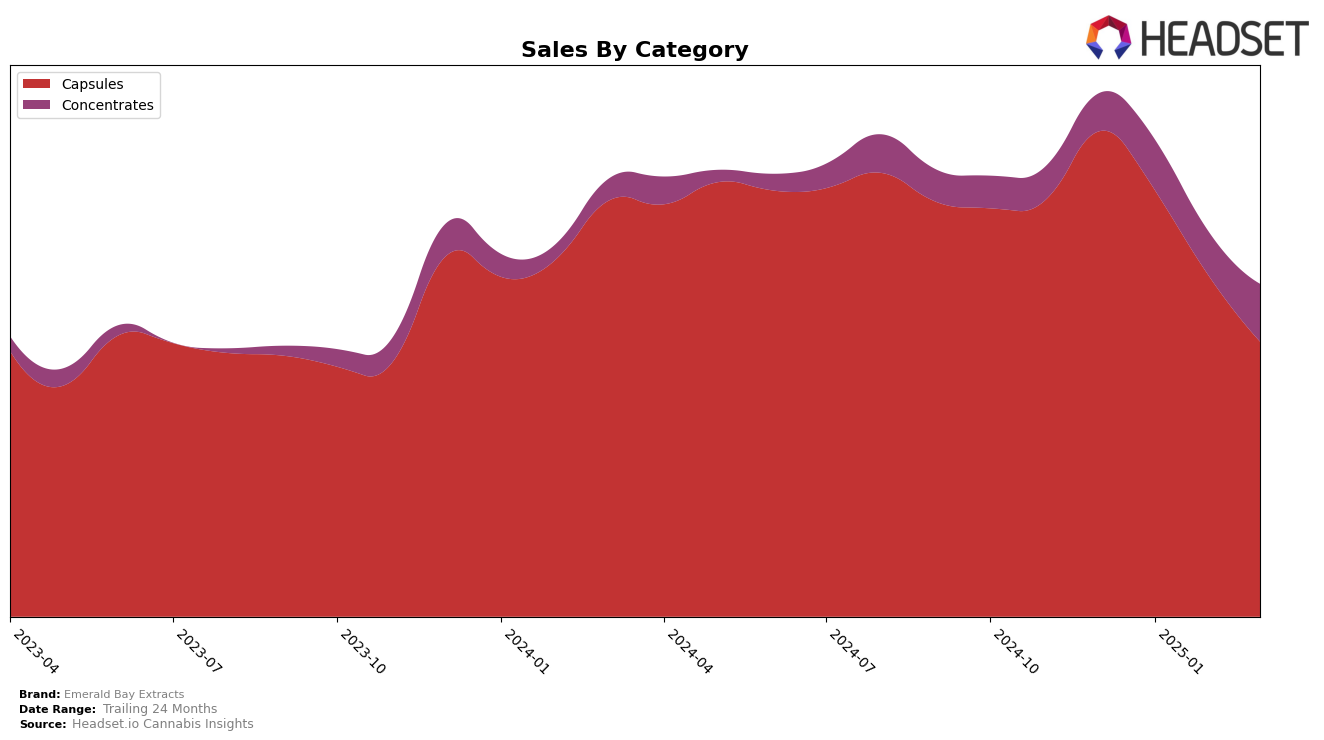

Emerald Bay Extracts has shown a consistent presence in the California market, particularly in the Capsules category. Despite a gradual decline in sales from December 2024 to March 2025, where sales dropped from $875,230 to $534,131, the brand maintained its position within the top 5, slipping only slightly from 3rd to 4th place. This stability in ranking amidst declining sales suggests a strong brand loyalty or limited competition in the top ranks for Capsules within California. However, the downward trend in sales could indicate potential challenges in maintaining market share if the trend continues.

In the Concentrates category, Emerald Bay Extracts has demonstrated positive momentum in California. From December 2024 to March 2025, the brand improved its ranking from 22nd to 16th, reflecting a strategic gain in market position. This upward movement is accompanied by a notable increase in sales, particularly between February and March 2025, where sales rose from $159,566 to $181,838. This suggests that Emerald Bay Extracts is gaining traction and possibly expanding its consumer base in the Concentrates segment, which could be a promising area for future growth. Notably, the absence of rankings in other states or categories indicates the brand's concentrated focus on the California market, which could be both a strength and a limitation depending on broader market dynamics.

Competitive Landscape

In the competitive landscape of the California cannabis capsules market, Emerald Bay Extracts has experienced a notable shift in its market position from December 2024 to March 2025. Initially ranked third in December 2024, the brand saw a decline to fourth place by January 2025, maintaining this position through March 2025. This change in rank can be attributed to the competitive pressure from brands like ABX / AbsoluteXtracts, which consistently held the third position, and Breez, which dominated the market in the second position throughout this period. Despite a strong start, Emerald Bay Extracts faced a downward trend in sales, contrasting with the more stable or growing sales figures of competitors like Kikoko and Buddies, which maintained their ranks at fifth and sixth, respectively. This competitive analysis highlights the importance for Emerald Bay Extracts to strategize effectively to regain its market share and improve its sales trajectory in the coming months.

Notable Products

In March 2025, the top-performing product from Emerald Bay Extracts was Ice Cream Cake RSO (1g) in the Concentrates category, maintaining its number one rank for three consecutive months with notable sales reaching 2175 units. Blue Dream RSO Syringe (1g) also held steady at the second position, showing a consistent rise in popularity since its absence in January. The Blue Dream RSO Tablets 40-Pack (1000mg) ranked third, unchanged from February, indicating stable demand. CBG White RSO Tablets 40-Pack (1000mg CBG) remained in fourth place, with a slight recovery in sales from February. The OG Kush Full Spectrum RSO Tablets 40-Pack (1000mg) entered the top five for the first time, suggesting emerging interest in this product line.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.