Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

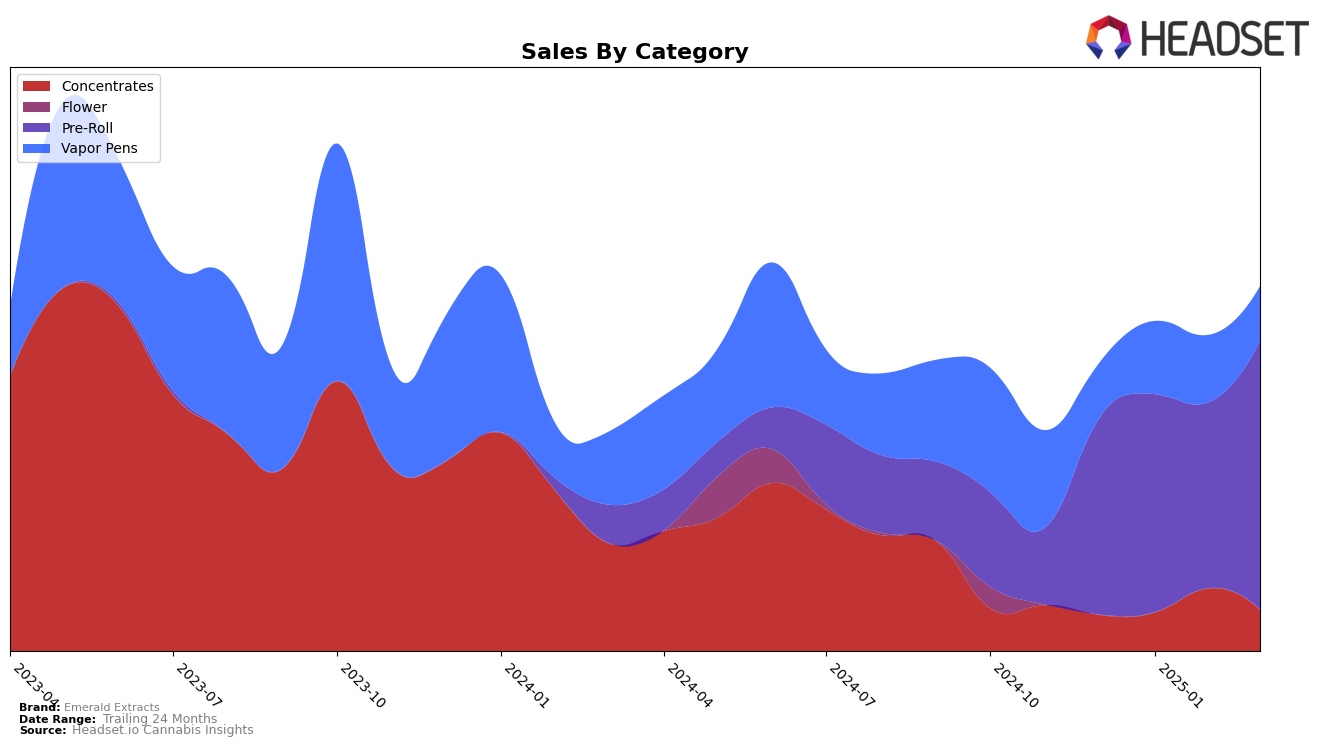

Emerald Extracts has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand experienced a notable fluctuation in rankings, starting at 60th in December 2024 and peaking at 41st in February 2025 before dropping back to 52nd by March. This suggests some inconsistency in their market presence within this segment. In contrast, the Pre-Roll category demonstrated more stability and improvement, with Emerald Extracts climbing from 34th to 25th over the same period. The brand's ability to maintain a position within the top 30 in Pre-Rolls is a positive indicator, especially as sales figures remained robust, hinting at a strong consumer preference for their offerings in this category.

On the other hand, the Vapor Pens category presented challenges for Emerald Extracts in Oregon. The brand's rankings hovered mostly outside the top 50, with a brief improvement to 58th in January 2025, only to fall back to 68th by March. This consistent underperformance suggests that the brand may need to reassess its strategy or product offerings in this category to better capture consumer interest. The inability to break into the top 30 in Vapor Pens indicates a competitive market landscape or potential gaps in product appeal. These insights into Emerald Extracts' category performance across Oregon provide a nuanced view of their market dynamics, highlighting areas of strength and opportunities for growth.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Emerald Extracts has shown a notable upward trajectory in its rankings, moving from 34th in December 2024 to 25th by March 2025. This improvement is indicative of a strategic gain in market share, particularly when compared to competitors like Altered Alchemy, which also improved its rank but remained slightly behind Emerald Extracts by March. Meanwhile, Dougie maintained a consistent presence just ahead of Emerald Extracts, highlighting a competitive edge in sales growth. Despite this, Emerald Extracts outpaced SugarTop Buddery, which saw a decline in rank, indicating a potential opportunity for Emerald Extracts to capture additional market share. The data suggests that while Emerald Extracts is gaining ground, the competitive environment remains dynamic, with brands like Smokes / The Grow maintaining a strong position, necessitating continued strategic efforts to sustain and enhance its market position.

Notable Products

In March 2025, the top-performing product for Emerald Extracts was the Apple Sherbert x Banana Bomb Diamond Infused Pre-Roll 2-Pack (1.5g) in the Pre-Roll category, maintaining its number one position from February. The Apples and Bananas x Garlikoff Infused Pre-Roll 2-Pack (1.5g) debuted at the second position with notable sales of 2282 units. The Candied Lemons x Strawguava Infused Pre-Roll 2-Pack (1.5g) saw a slight drop to third place, after being second in February. Goldilocks x College Park Infused Pre-Roll 2-Pack (1.5g) remained steady, moving up to fourth place from third in February. Lastly, the Queso x Gary Payton Infused Pre-Roll 2-Pack (1.5g) held its position at fifth, consistent with its February ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.