Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

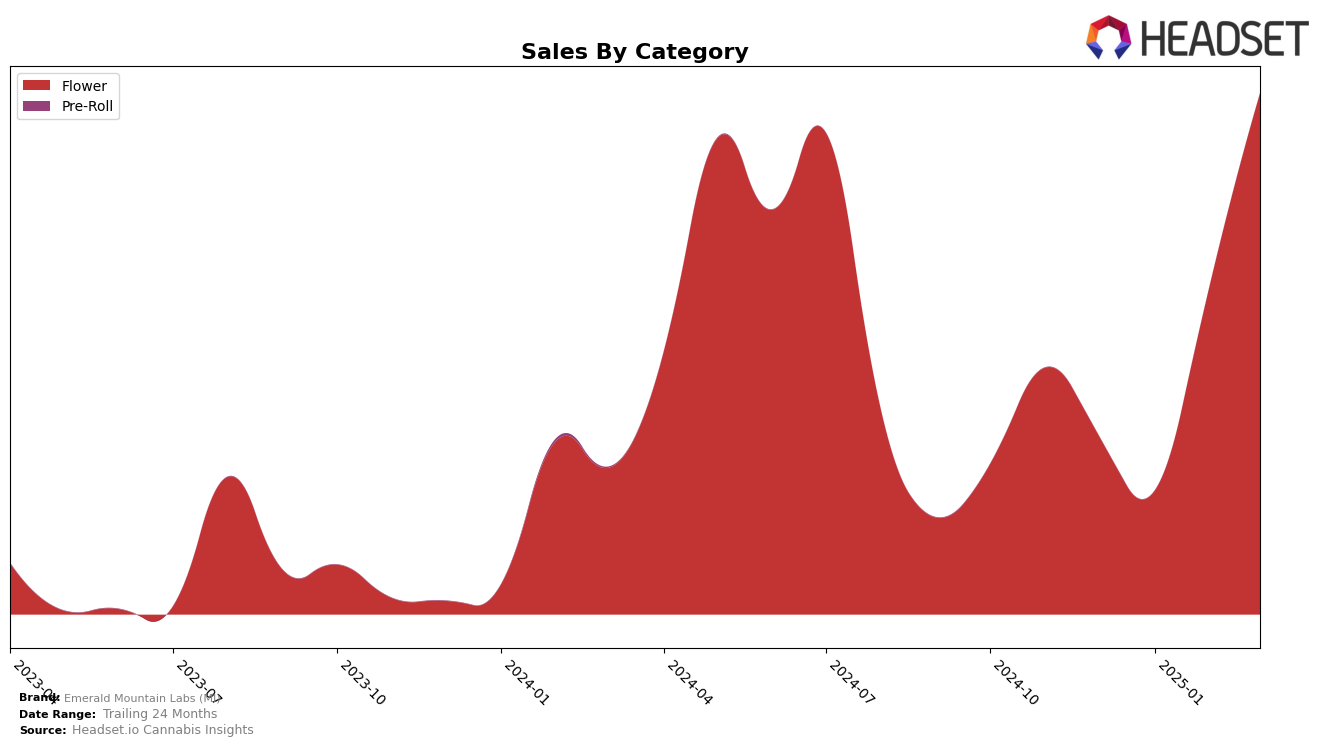

Emerald Mountain Labs (MI) has shown a remarkable trajectory in the Flower category within the state of Michigan. Starting from a position outside the top 30 brands in December 2024, the brand made a significant leap to rank 31st by February 2025, and further improved its standing to 24th in March 2025. This upward movement indicates a strong growth in market presence and consumer preference, as evidenced by a substantial increase in sales from January to March. The brand's performance in Michigan's Flower category suggests a strategic push that has resonated well with consumers, allowing it to break into the competitive top tier of brands.

While Emerald Mountain Labs (MI) has seen notable success in Michigan, it is important to recognize that the brand did not rank within the top 30 in December 2024 and January 2025. This initial absence from the top rankings may have been a result of market entry challenges or competitive pressures. However, the subsequent leap into the rankings by February and March is indicative of a successful turnaround strategy or increased consumer engagement. The brand's ability to overcome these hurdles and gain traction in a competitive market highlights its potential for sustained growth and influence in the Flower category within Michigan.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Emerald Mountain Labs (MI) has shown a remarkable upward trajectory in recent months. Starting from a rank of 68 in December 2024, the brand surged to 24 by March 2025, indicating a significant improvement in market presence and consumer preference. This rise is particularly notable when compared to competitors like Dog House, which saw a decline from 16 to 23 over the same period, and Fluresh, which consistently remained out of the top 20 after December. Meanwhile, Glacier Cannabis and Dubs & Dimes maintained relatively stable positions but did not exhibit the same upward momentum as Emerald Mountain Labs (MI). This positive trend for Emerald Mountain Labs (MI) suggests a growing consumer base and effective market strategies, positioning it as a rising contender in the Michigan flower market.

Notable Products

In March 2025, the top-performing product from Emerald Mountain Labs (MI) was PPP x Jealousy (3.5g) in the Flower category, achieving the highest sales with 7,915 units sold. Blue Zushie (3.5g) and Garlic Cocktail (3.5g) followed in second and third place, respectively. Notably, Doritoz Smalls (3.5g) improved its rank from fifth in February to fourth in March, indicating a positive sales trend. Gush Mintz Smalls (3.5g) maintained its position at fifth. These rankings reflect a shift in consumer preference, with PPP x Jealousy (3.5g) consistently leading the sales for the month.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.