Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

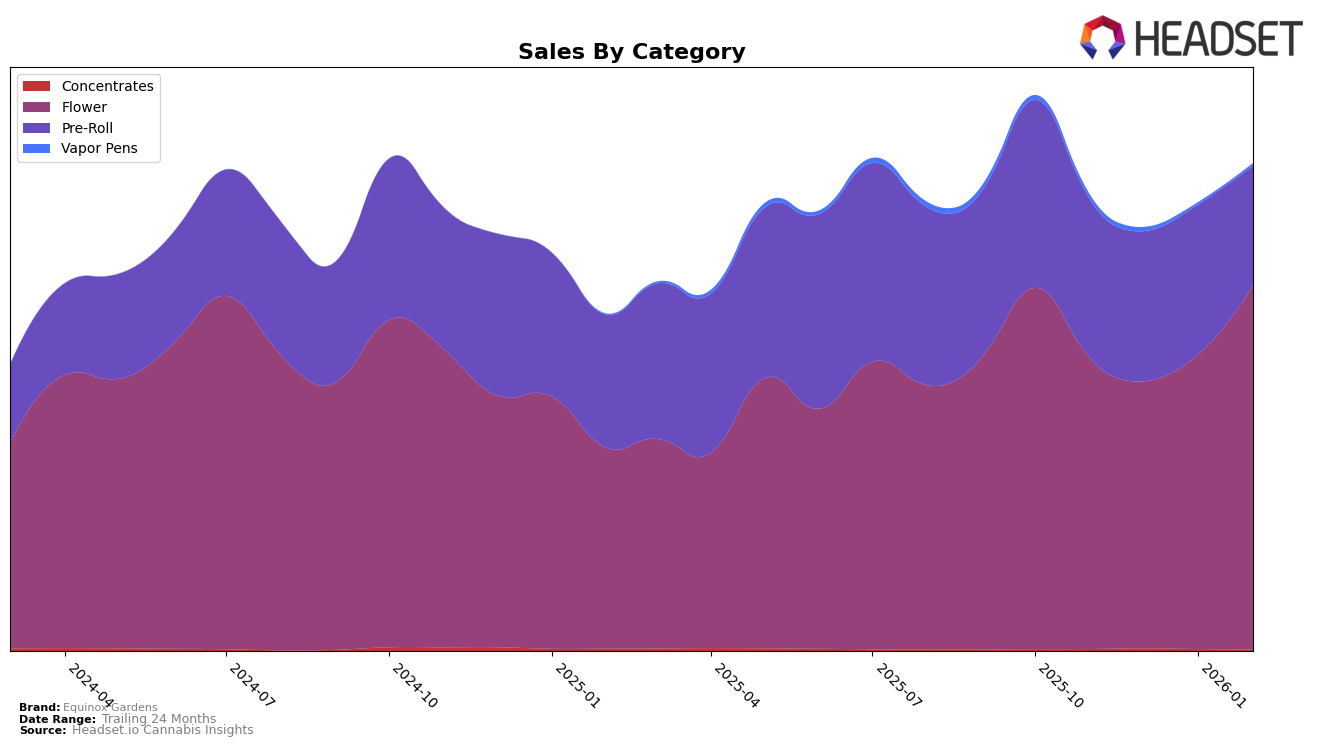

Equinox Gardens has shown a notable performance in the Colorado flower category, where it improved its ranking from 12th in December 2025 to 5th by February 2026. This upward trajectory indicates a strong market presence and growing consumer preference in the state. The consistent improvement in rankings, coupled with a significant increase in sales from December to February, underscores the brand's strategic positioning and effective market strategies in Colorado. In contrast, their absence from the top 30 in November 2025 highlights a remarkable turnaround and suggests that the brand has been successful in capturing market share over the winter months.

In Washington, Equinox Gardens presents a mixed picture. While the brand did not make it to the top 30 in the flower category, landing at 96th in December 2025 and slightly improving to 84th by February 2026, their performance in pre-rolls has been relatively stable. Maintaining a consistent 11th place ranking through January 2026 before slipping to 13th in February suggests a steady demand for their pre-roll products, despite a slight decline in sales. This indicates a potential area for growth if the brand can leverage its existing popularity in pre-rolls to improve its standing in the flower category, where it currently struggles to make a significant impact.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Equinox Gardens has shown a notable upward trajectory in its rankings, particularly from December 2025 to February 2026. Initially ranked 12th in December 2025, Equinox Gardens improved to 10th in January 2026 and further climbed to 5th by February 2026. This upward movement suggests a positive reception and increased consumer demand for their products. In contrast, competitors like In The Flow experienced fluctuating ranks, dropping to 16th in January 2026 before rebounding to 7th in February 2026, indicating potential volatility in their market presence. Meanwhile, 14er Boulder maintained a relatively stable position, moving from 11th in November 2025 to 6th by February 2026. The consistent top-tier presence of Green Dot Labs and Triple Seven (777), both consistently ranking within the top 4, underscores the competitive pressure in this market segment. Equinox Gardens' recent rank improvement suggests a successful strategy in capturing market share, potentially at the expense of some mid-tier competitors.

Notable Products

In February 2026, Divorce Cake (3.5g) emerged as the top-performing product for Equinox Gardens, leading the sales with a notable figure of 3111 units sold. Super Lemon Haze (3.5g) followed closely in second place, showing strong demand with 3030 units sold. Strawberry & Cream (3.5g) secured the third position, while Key Lime Pie (3.5g) and Pink Zkittlez (3.5g) rounded out the top five. This ranking marks the first time these products have been tracked for monthly performance, indicating a fresh analysis for the brand. The flower category clearly dominated the sales for February, with all top products belonging to this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.