Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

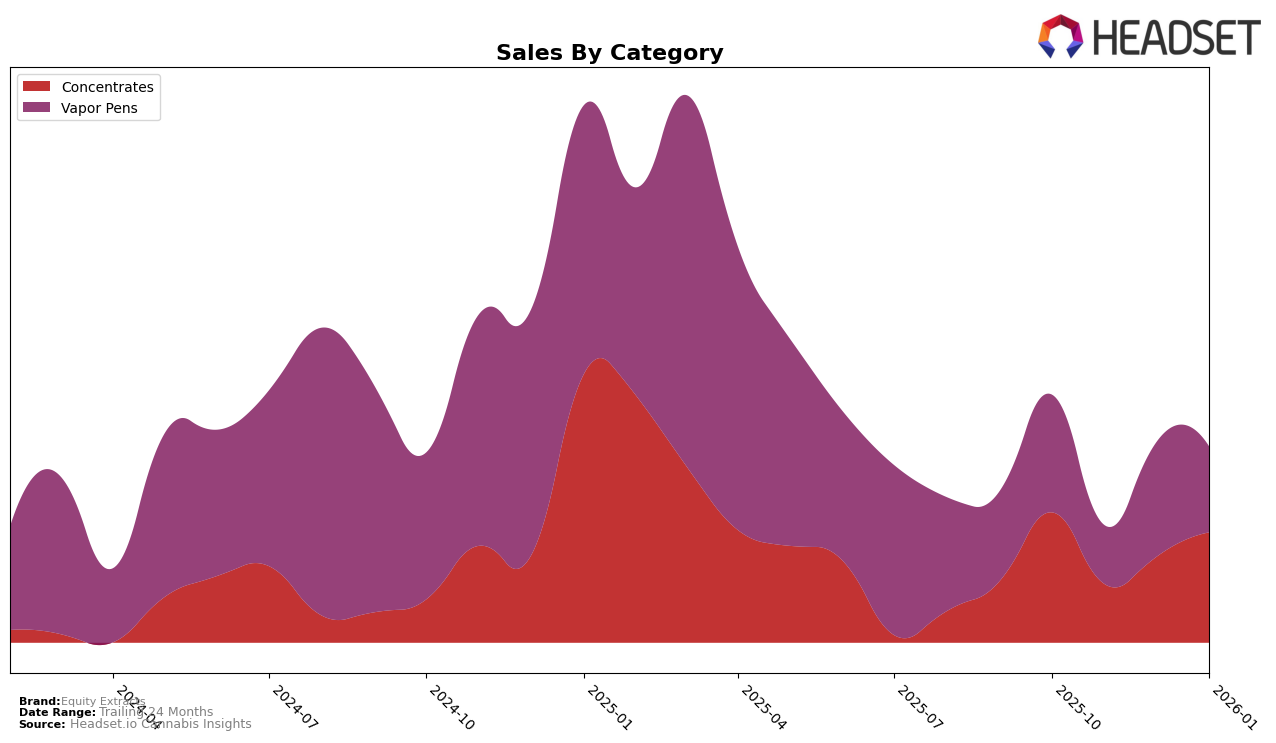

Equity Extracts has shown a notable presence in the Maryland market, particularly in the Concentrates category. Over the four-month period from October 2025 to January 2026, the brand has maintained a consistent ranking, hovering around the mid-teens. Despite a dip in November, where it fell to 18th place, Equity Extracts rebounded back to 15th by January. This resilience in the rankings is accompanied by a fluctuating sales performance, with a significant dip in November followed by a recovery in the subsequent months. Such trends suggest a potential for growth if the brand can stabilize its sales figures.

In contrast, the Vapor Pens category has been more challenging for Equity Extracts in Maryland. The brand's ranking in this category has been less stable, with positions ranging from 33rd to 41st, indicating a struggle to maintain a strong foothold. The absence from the top 30 highlights a competitive landscape that may require strategic adjustments to improve their standing. Despite these challenges, there was a notable improvement in December, where the brand climbed to 33rd place, suggesting a potential opportunity to capitalize on this upward momentum.

Competitive Landscape

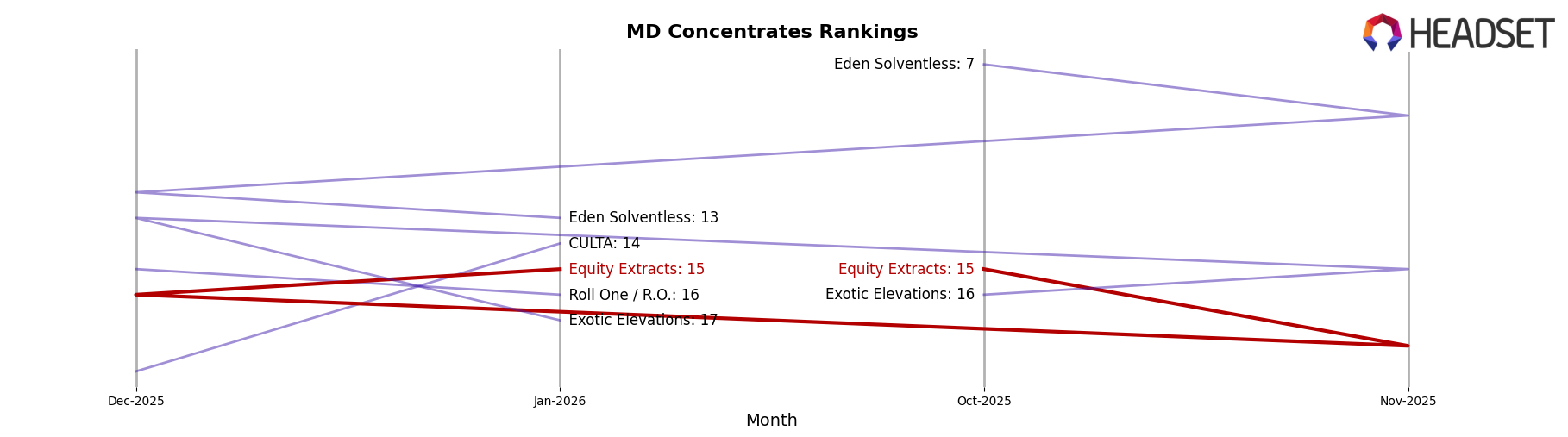

In the Maryland concentrates market, Equity Extracts has experienced fluctuating rankings and sales over the past few months, indicating a competitive landscape. Starting from October 2025, Equity Extracts held the 15th position, but dropped to 18th in November, before climbing back to 16th in December and 15th in January 2026. This pattern suggests a recovery in market presence, potentially driven by strategic adjustments or product offerings. In contrast, Eden Solventless consistently maintained higher rankings, though it showed a downward trend from 7th in October to 13th by January, possibly indicating a decline in consumer preference or increased competition. Meanwhile, Exotic Elevations and CULTA have shown varied performance, with Exotic Elevations peaking at 13th in December before dropping to 17th in January, and CULTA re-entering the top 20 in December at 19th and improving to 14th by January. These dynamics highlight the competitive pressures Equity Extracts faces, as well as opportunities for growth if they can capitalize on the shifting market trends.

Notable Products

In January 2026, Equity Extracts' top-performing product was Orange Guava Shatter (1g) in the Concentrates category, which secured the number one rank with notable sales of 730 units. Rainbow Push Pop Shatter (1g) climbed to the second position from the third in December 2025, showing an increase in popularity. Peach Runtz Shatter (1g), which held the top spot in December 2025, slipped to third place in January 2026. Cherry Slushee Shatter (1g) debuted at the fourth position, while Guava Sherbert Shatter (1g) followed closely in fifth place. These shifts highlight a dynamic change in consumer preferences within the Concentrates category for Equity Extracts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.