Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

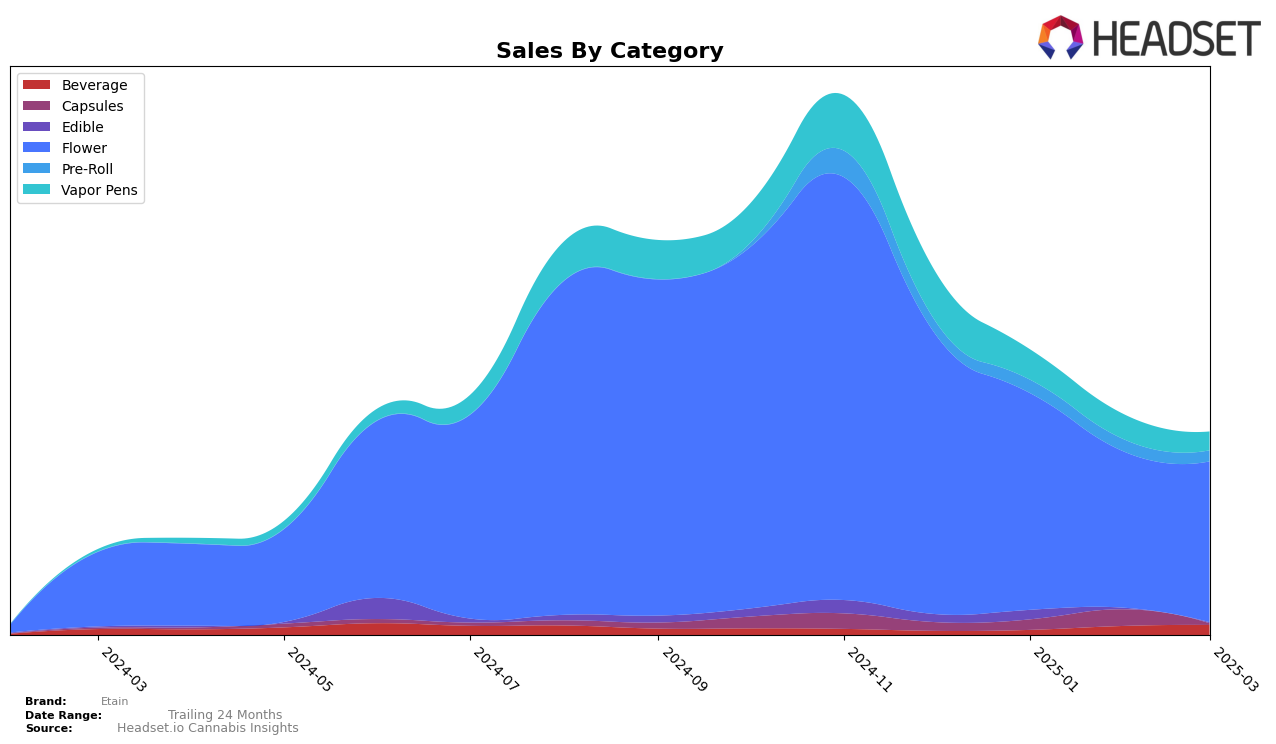

Etain has shown a notable performance in the capsules category within New York, securing the third position in March 2025. This marks a significant entry into the top rankings, as the brand was not listed in the top 30 in the preceding months. This upward movement suggests a strong market acceptance and increasing consumer demand for their capsule products. In contrast, Etain's performance in the flower category in New York has seen a decline over the months, dropping from rank 34 in December 2024 to 56 by March 2025. The consistent drop indicates potential challenges in maintaining consumer interest or facing increased competition within the flower segment.

In the vapor pens category, Etain's ranking in New York has been on a downward trajectory, starting at rank 64 in December 2024 and falling to rank 80 by March 2025. This decline highlights the brand's struggle to capture market share in a competitive vapor pen landscape. Despite this, Etain's strategic focus on capsules could be a pivotal factor in balancing the brand's overall performance within the state. The absence of Etain in the top 30 rankings across other states or categories suggests a concentrated effort or limited reach beyond New York, which could either be a strategic choice or an area for potential growth and expansion.

Competitive Landscape

In the competitive landscape of the New York flower category, Etain has experienced a notable shift in its market positioning from December 2024 to March 2025. Initially ranked at 34th in December 2024, Etain saw a decline in rank to 56th by March 2025, indicating a downward trend in its market presence. This shift is underscored by a decrease in sales over the same period. In contrast, House of Sacci maintained a relatively stable position, albeit with a slight decline from 39th to 53rd, while Ithaca Organics Cannabis Co. experienced a more pronounced drop from 37th to 60th. Interestingly, Ruby Farms entered the top 100 in February 2025 and improved its rank to 58th by March, showcasing a positive growth trajectory. These dynamics suggest that while Etain is facing challenges in maintaining its competitive edge, emerging brands like Ruby Farms are gaining traction, potentially reshaping the competitive landscape in New York's flower market.

Notable Products

In March 2025, Velvet Lushers (3.5g) emerged as the top-performing product for Etain, climbing from the fifth position in January and third in February to secure the number one rank, with notable sales of 1209 units. The CBD/THC 1:20 Forte Dissolvable Powder maintained its second-place position consistently from February to March. Forte - Zkittles made its debut in the rankings by securing the third position in March. Hooch held steady in fourth place from February to March. Forte - Girl Scout Cookies entered the rankings in March, achieving fifth place in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.