Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

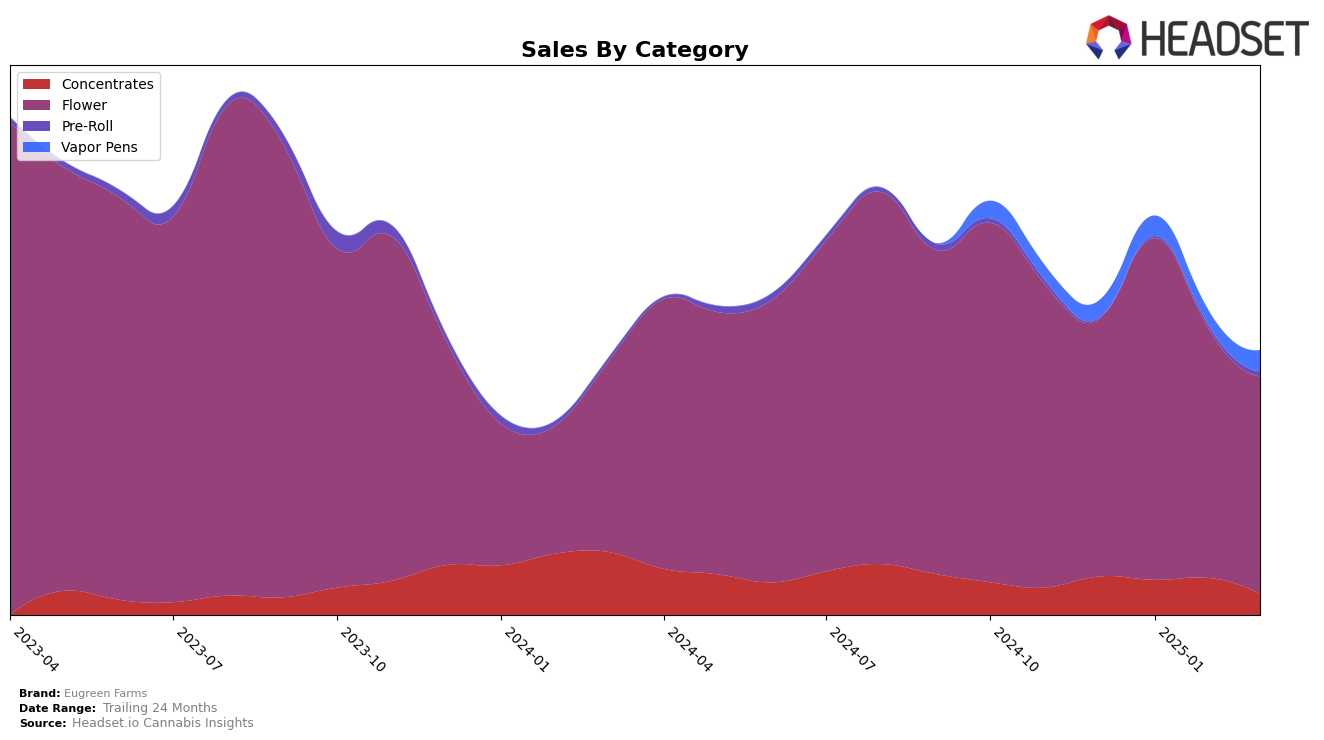

In the Oregon market, Eugreen Farms has shown varied performance across different product categories. In the Concentrates category, the brand experienced a notable fluctuation in its rankings, starting at 31st in December 2024, moving up to 25th by February 2025, but then dropping to 43rd in March 2025. This indicates a volatile market presence, possibly influenced by competitive pressures or shifts in consumer preferences. On the other hand, the Flower category has been relatively stable, maintaining a top 15 position throughout the months, although there was a slight decline from 7th in January 2025 to 15th in March 2025. This suggests that while Eugreen Farms has a strong foothold in the Flower category, there is room for improvement to regain higher rankings.

The performance in the Vapor Pens category has been less impressive, with Eugreen Farms consistently ranking outside the top 30, peaking at 61st place in both January and March 2025. Despite this, there was a positive trend in sales from January to March, indicating potential growth opportunities if the brand can improve its market visibility and consumer engagement. The absence of Eugreen Farms from the top 30 in this category highlights a challenge for the brand to enhance its competitive edge. Overall, while Eugreen Farms shows strength in certain areas, particularly in the Flower category, there are significant opportunities for growth and improvement in other product lines.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Eugreen Farms has experienced notable fluctuations in its ranking over the past few months, reflecting dynamic market conditions. Starting from a strong position in December 2024 at rank 9, Eugreen Farms climbed to rank 7 in January 2025, demonstrating a positive momentum. However, this upward trend was not sustained as the brand slipped to rank 11 in February and further to rank 15 in March 2025. This decline in rank coincided with a decrease in sales from January to March. Meanwhile, Cultivated Industries showed resilience, maintaining a relatively stable presence, peaking at rank 12 in January before dropping to rank 14 in March. PDX Organics demonstrated a positive trajectory, improving its rank from 22 in December to 13 in March, potentially capturing market share from competitors like Eugreen Farms. Additionally, Dog House made a significant leap from rank 29 in December to 17 in March, indicating a competitive threat. These shifts highlight the competitive pressures Eugreen Farms faces in maintaining its market position and the importance of strategic adjustments to regain its earlier momentum.

Notable Products

In March 2025, Eugreen Farms saw Space Ballz (Bulk) leading the sales charts as the top-performing product, with a substantial sales figure of 2146 units. Following closely, Jimmy Hoffa (Bulk) secured the second position, while Tegridy (1g) maintained a strong presence in third place. Gary Poppins (Bulk) and Zandiez (3.5g) rounded out the top five, ranking fourth and fifth, respectively. Notably, Space Ballz (Bulk) showed a significant upward trend, as it was not ranked in previous months, indicating a surge in popularity. Similarly, Jimmy Hoffa (Bulk) also entered the top ranks without prior listings, suggesting a successful marketing or distribution strategy.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.