Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

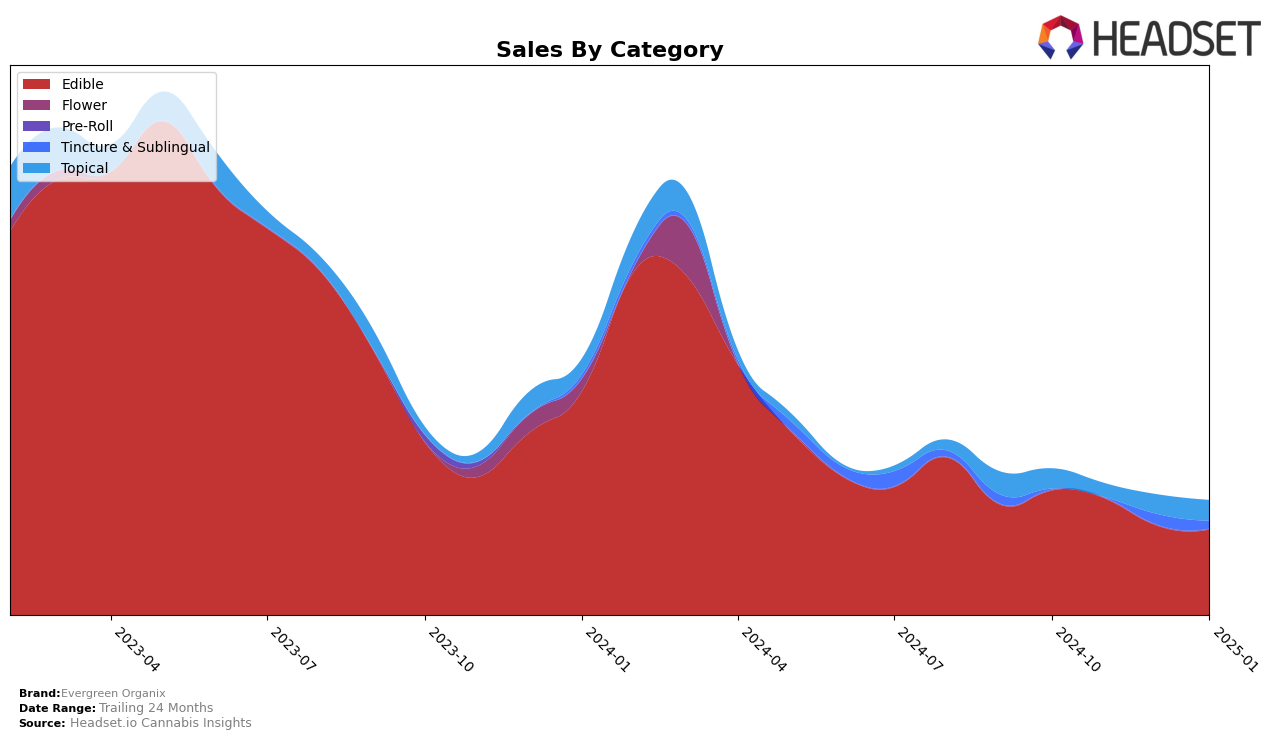

Evergreen Organix, a notable player in the cannabis market, has shown varying performance across different states and product categories over recent months. In the Edible category within Nevada, the brand has experienced a gradual decline in its ranking, moving from 18th in October 2024 to 24th by January 2025. This downward trend in rankings is accompanied by a decrease in sales, indicating potential challenges in maintaining market share in this category. Despite this, Evergreen Organix remains within the top 30 brands, which suggests a resilient presence in the competitive Nevada market.

The absence of Evergreen Organix from the top 30 rankings in other states or categories could imply either a strategic focus on specific markets like Nevada or a need for expansion and increased competitiveness elsewhere. The brand's ability to stay in the rankings in Nevada, albeit with a declining trend, highlights its established presence but also underscores the need for innovation or strategic adjustments to regain upward momentum. This performance snapshot provides insights into the brand's current positioning and potential areas for growth, leaving room for further exploration into how Evergreen Organix can leverage its strengths to improve its standings across different markets.

Competitive Landscape

In the competitive landscape of the Nevada edible cannabis market, Evergreen Organix has experienced fluctuations in its ranking over the past few months, indicating a dynamic market environment. As of January 2025, Evergreen Organix holds the 24th position, having dropped from 18th in October 2024. This decline in rank suggests increased competition, particularly from brands like Cheeba Chews, which improved from 28th to 25th over the same period, and Deep Roots Harvest, which entered the top 20 by January 2025. Despite these challenges, Evergreen Organix's sales have remained relatively stable, with a slight increase from December 2024 to January 2025, indicating resilience in its customer base. The brand faces competition from emerging players like BITS and Chillers, both of which have recently entered the rankings, highlighting the need for Evergreen Organix to innovate and differentiate to maintain its market position.

Notable Products

In January 2025, the top-performing product for Evergreen Organix was the Cookies & Cream White Chocolate Bar 10-Pack (100mg), which climbed to the number one spot with sales reaching 199 units. The Espresso Dark Chocolate Bar 10-Pack (100mg) debuted impressively at the second rank, showcasing its growing popularity. The Chocolate Chip Cookies 5-Pack (100mg) slipped to third place from its December 2024 top position, indicating a slight drop in sales momentum with 154 units sold. Meanwhile, the Milk Chocolate Crunch Bar (100mg) appeared in the rankings for the first time at fourth place, suggesting a positive reception. The Chunk Chocolate Brownie 10-Pack (100mg), which consistently held top positions in previous months, fell to fifth place, reflecting a notable decrease in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.