Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

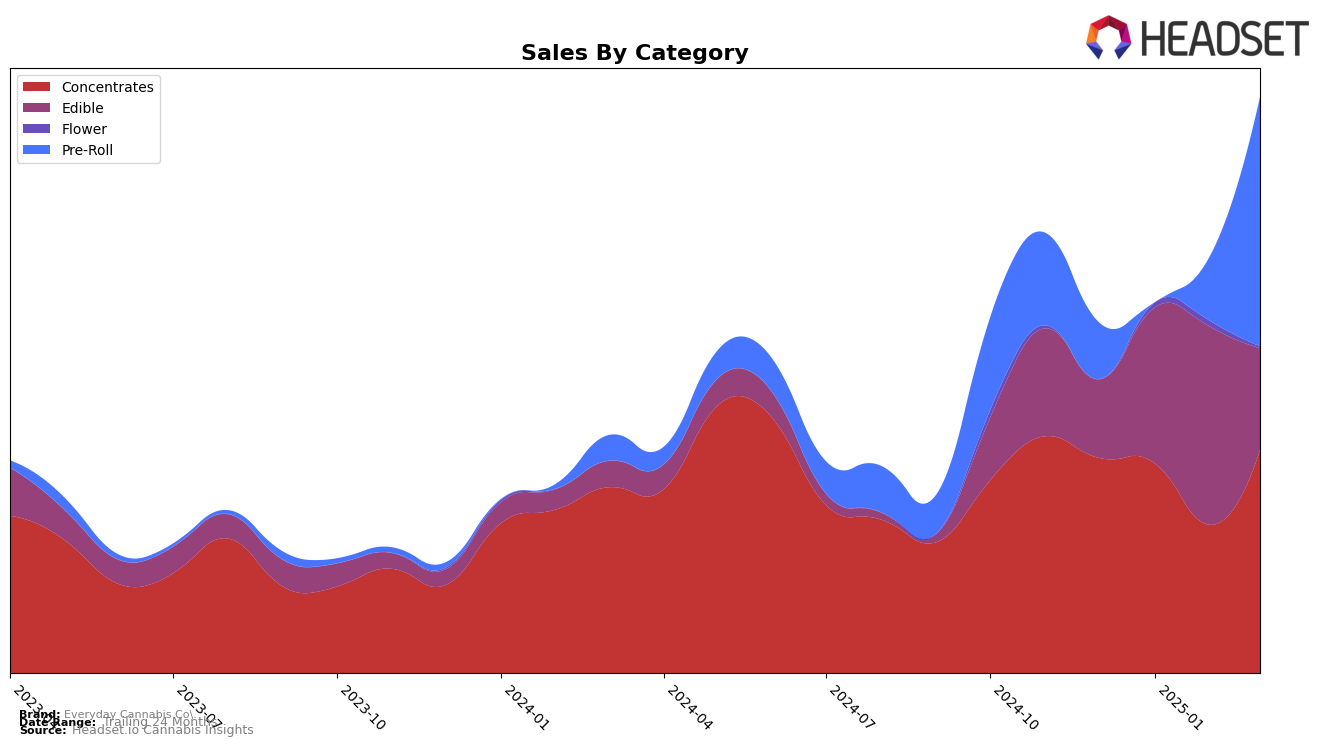

Everyday Cannabis Co. has shown varied performance across different product categories in California. In the Concentrates category, the brand maintained a consistent presence, holding the 14th position in December 2024, January 2025, and March 2025, with a slight dip to 19th in February 2025. This stability, coupled with a rebound in sales in March, suggests a solid foothold in the concentrates market. On the other hand, the Edible category saw more fluctuation, with the brand climbing from 38th in December to 26th in February before dropping to 33rd in March. Such movements indicate a dynamic market presence, with potential for growth if trends are leveraged strategically.

In terms of Pre-Rolls, Everyday Cannabis Co. was not ranked in the top 30 until February 2025, when it entered the list at 90th and made a significant leap to 35th by March. This rapid ascent highlights a strong market entry and growing consumer interest, which could be pivotal for future expansion. However, the absence of a ranking in earlier months underscores the competitive nature of the pre-roll segment in California. Overall, while the brand demonstrates resilience and growth potential across categories, it faces challenges in maintaining consistent top-tier rankings, particularly in the highly competitive edible and pre-roll markets.

Competitive Landscape

In the competitive landscape of the California Pre-Roll market, Everyday Cannabis Co. has demonstrated a remarkable upward trajectory. After not being in the top 20 for December 2024 and January 2025, the brand surged to rank 90 in February 2025 and further climbed to 35 by March 2025. This significant rise in rank suggests a strong increase in market presence and consumer preference. In contrast, Raw Garden experienced a decline, dropping from 29 in December 2024 to 37 in March 2025, indicating a potential loss of market share. Meanwhile, Cookies improved its position from 52 in December 2024 to 36 in March 2025, reflecting a recovery in sales momentum. Eighth Brother, Inc. maintained a relatively stable rank, hovering around the low 30s, while Quiet Kings showed a consistent upward trend, moving from 88 to 33 over the same period. This dynamic market environment highlights Everyday Cannabis Co.'s impressive growth and suggests a strategic opportunity to capitalize on its rising popularity against fluctuating competitors.

Notable Products

In March 2025, Everyday Cannabis Co.'s top-performing product was the Everyday Hitter - Sour Green Apple Live Resin Gummy (100mg), maintaining its first-place rank from February with sales of 9111 units. The Everyday Hitter - Sour Blue Raspberry Live Resin Gummy (100mg) followed closely in second place, a slight improvement from its third-place position in February. Notably, Everyday Slugger - LA Kush Cake Infused Pre-Roll (1.5g) entered the rankings for the first time in March, securing the third spot. Everyday Slugger - God's Gift Infused Pre-Roll (1.5g) and Everyday Slugger - Death Star Infused Pre-Roll (1.5g) also appeared in the rankings for the first time, taking fourth and fifth places, respectively. This marks a significant shift in sales dynamics, with pre-roll products making a strong entrance into the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.