Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

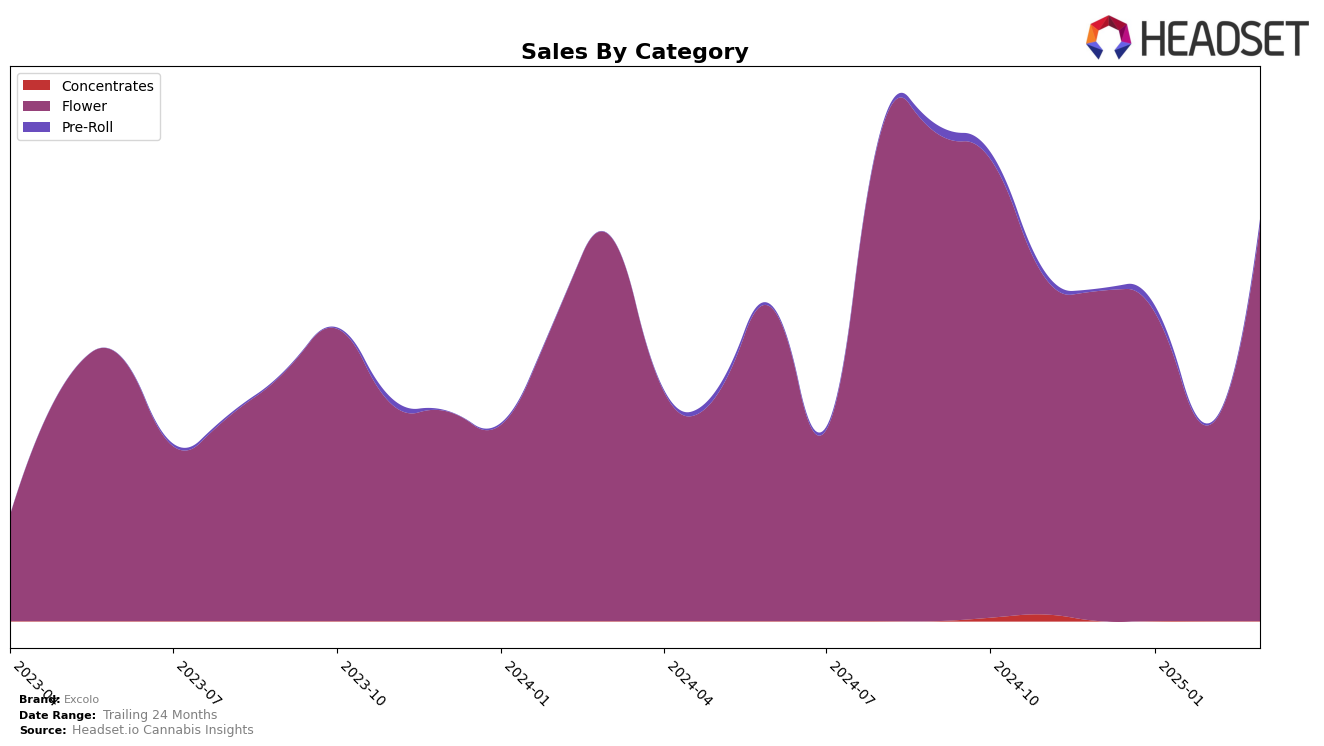

Excolo's performance in the Oregon market has shown notable fluctuations across the Flower category over the past few months. In December 2024, Excolo was ranked 35th, and by March 2025, it had climbed to 28th, indicating a positive movement within the state. However, February 2025 saw a dip in their ranking to 55th, suggesting a temporary setback in their market positioning. This volatility could be attributed to various factors, including seasonal demand changes or competitive pressures. Despite the dip in February, the brand's sales rebounded strongly in March, reaching $195,998, which is a significant recovery from the previous month.

Interestingly, Excolo's presence in the top 30 brands in the Flower category was not consistent throughout this period, as evidenced by their absence from the top 30 in February 2025. This could be considered a setback for the brand, highlighting the competitive nature of the market in Oregon. The brand's ability to regain its position by March, however, underscores its resilience and potential for growth. Tracking these trends can provide insights into how Excolo might strategize to maintain and improve its market standing in the future.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Excolo has experienced notable fluctuations in its rankings from December 2024 to March 2025. Starting at rank 35 in December, Excolo saw a slight improvement to rank 33 in January, but then dropped significantly to rank 55 in February, before recovering to rank 28 in March. This volatility in ranking is mirrored in its sales performance, which saw a dip in February but rebounded strongly in March. In comparison, Alter Farms demonstrated a remarkable climb from rank 66 in December to rank 29 in March, with a significant sales surge in March. Similarly, Evan's Creek Farms improved from rank 38 in December to rank 26 in March, also showing a strong sales increase. Meanwhile, Frontier Farms and Cosmic Treehouse maintained relatively stable positions, with Frontier Farms experiencing a slight dip in March. These dynamics suggest that while Excolo has potential for growth, it faces stiff competition from brands like Alter Farms and Evan's Creek Farms, which are gaining momentum in both rank and sales.

Notable Products

In March 2025, Excolo's top-performing product was Sticky Glue (Bulk) in the Flower category, maintaining its position at rank 1 with notable sales of 7130 units. Sour Apple Cookies (Bulk) also performed strongly, holding steady at rank 2, showing significant growth from its January rank of 2. Oregon Trails (Bulk) emerged as a new contender, securing the third position in March. OG 33 (Bulk) demonstrated a consistent performance, maintaining its rank at 4 from February to March. Meanwhile, Oregon Mac B-Buds (Bulk) experienced a slight drop from rank 2 in February to rank 5 in March, indicating a shift in consumer preference or market dynamics.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.