Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

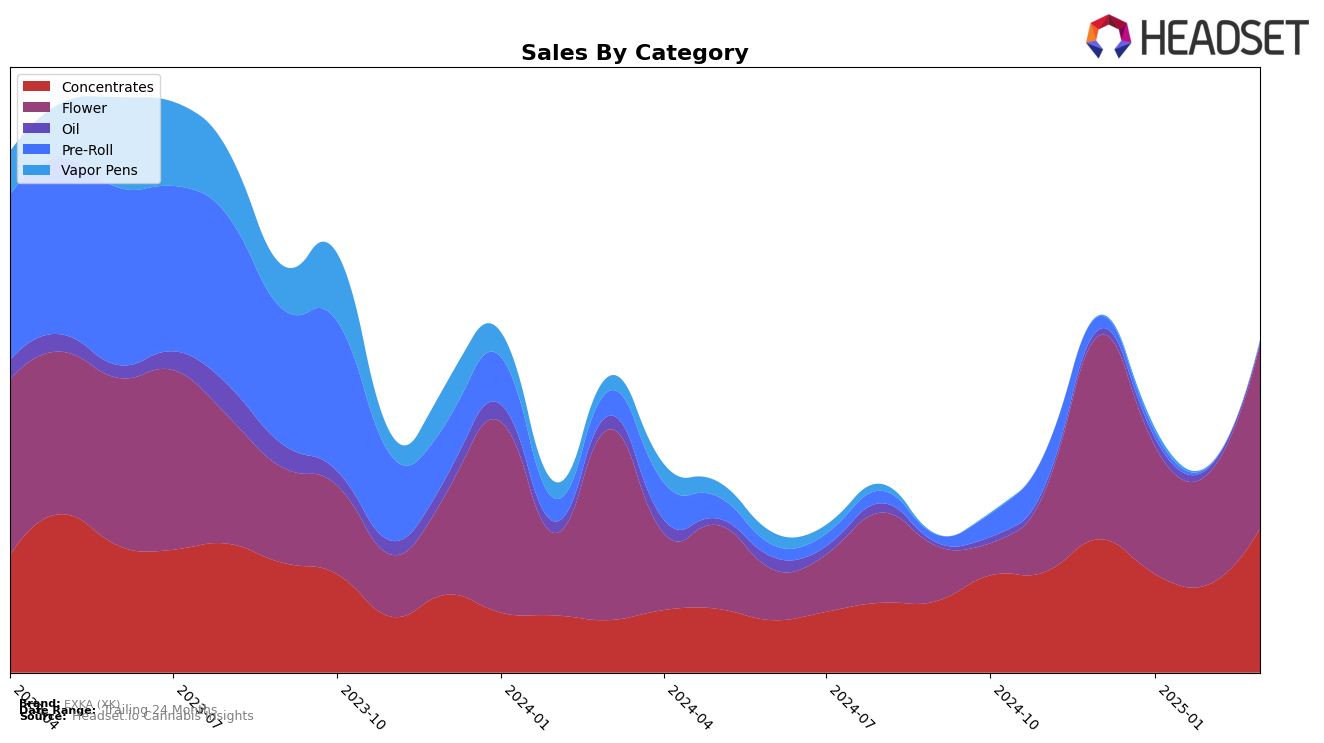

EXKA (XK) has shown a notable presence in the Concentrates category in Ontario. Over the observed months, the brand has experienced fluctuations in its rankings, starting at 35th in December 2024 and improving to 30th by March 2025. This upward trajectory indicates a positive trend in consumer reception and market penetration within Ontario's competitive concentrates market. The brand's sales also reflect this movement, with a significant increase in March 2025 compared to the previous months, suggesting effective strategies or increased consumer demand.

Despite the progress in Ontario, EXKA (XK) does not appear in the top 30 brands in any other states or provinces for the Concentrates category during the same period. This absence from other markets could indicate either a strategic focus on Ontario or challenges in expanding the brand's footprint beyond this region. Understanding the dynamics of how EXKA (XK) navigates these markets could provide deeper insights into their growth strategies and potential areas for improvement. Such insights would be crucial for stakeholders looking to capitalize on the brand's momentum or identify opportunities for market expansion.

Competitive Landscape

In the Ontario concentrates market, EXKA (XK) has demonstrated a notable upward trajectory in its rankings, moving from 35th in December 2024 to 30th by March 2025. This improvement is particularly significant given the competitive landscape, where brands like Kolab and Double J's have seen a decline or stagnation in their rankings during the same period. Notably, Terra Labs experienced a similar upward movement, climbing to 28th in March 2025, indicating a competitive push among lower-ranked brands. Meanwhile, Polar maintained a relatively stable position, hovering around the high 20s. EXKA (XK)'s sales saw a significant rebound in March 2025, aligning with its improved rank, suggesting effective strategies in capturing market share amidst fluctuating performances from its competitors.

Notable Products

In March 2025, Candy Kush (7g) from EXKA (XK) emerged as the top-performing product, climbing to the number one rank with notable sales of 1198 units, a significant leap from its third position in February. Haschtag Premium Hash (2g) maintained its consistent second-place ranking across all months, showcasing steady demand. Happy Hour (7g) experienced a decline, dropping from the top spot in previous months to third place in March. Haschtag- Strawberry Hash (2g) held steady at fourth place, reflecting stable sales performance. Rosin 30 Live Hash Rosin (1g) remained in fifth place, indicating a consistent but less dynamic sales trend compared to other products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.