Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

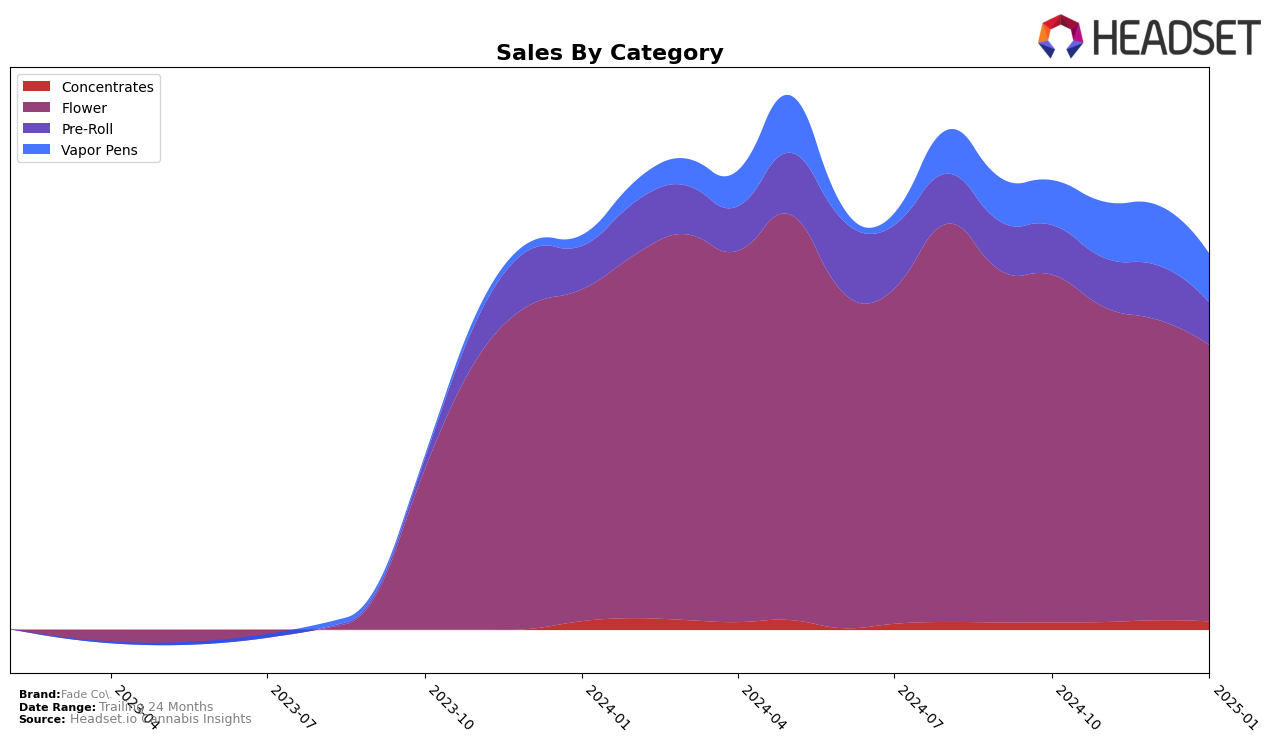

In the state of Arizona, Fade Co. has shown a commendable performance across multiple product categories. Notably, in the Concentrates category, Fade Co. entered the top 10 in January 2025, marking a significant rise as they were not ranked in the top 30 in the preceding months. In the Flower category, the brand maintained consistent rankings, hovering around the 11th to 13th positions over the last four months, with a noticeable sales increase in January 2025. However, the Pre-Roll category saw a decline in visibility, as Fade Co. was absent from the top 30 rankings in January 2025, signaling a potential area for improvement. Meanwhile, the Vapor Pens category demonstrated a fluctuating yet generally positive trend, with Fade Co. reaching as high as 13th place in December 2024 before settling at 15th in January 2025.

In Maryland, Fade Co. has established a strong presence, particularly in the Flower category, where it consistently held the 2nd position from October to December 2024 before slipping to 4th in January 2025. This shift might be attributed to a gradual decline in sales over the months. The Pre-Roll category also saw some movement, with rankings fluctuating between the 4th and 7th positions, indicating a competitive market environment. Despite this, the brand maintained a solid foothold. In the Vapor Pens category, Fade Co. consistently held the 14th position from November 2024 onwards, suggesting a stable but less dominant presence compared to other categories. This stability, despite not being in the top 10, indicates a loyal customer base and steady demand in the Vapor Pens segment.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Fade Co. has experienced notable shifts in its market position over recent months. Initially holding a strong second-place rank from October to December 2024, Fade Co. saw a decline to fourth place by January 2025. This drop in rank correlates with a consistent decrease in sales over the same period. Meanwhile, District Cannabis made a significant leap from fifth to second place by January 2025, indicating a robust growth trajectory in contrast to Fade Co.'s downward trend. Additionally, SunMed, which briefly held the top rank in November 2024, also saw a decline to fifth place by January 2025, suggesting a volatile competitive environment. Strane maintained a steady presence, moving up to third place, which highlights its growing influence in the market. These dynamics suggest that while Fade Co. remains a key player, it faces increasing competition from brands like District Cannabis and Strane, necessitating strategic adjustments to regain its previous standing.

Notable Products

In January 2025, Rainbow Guava (3.5g) emerged as the top-performing product for Fade Co., maintaining its position from December 2024 with sales of 4,935 units. Zoap (3.5g) secured the second spot, showing a strong entry into the rankings. Han Solo Hashplant (3.5g) followed closely in third place, indicating a competitive performance among the top flower products. Granddaddy Purple Pre-Roll 2-Pack (1g) achieved the fourth rank, highlighting a notable presence in the pre-roll category. The fifth position was taken by Permanent Marker (3.5g), rounding out a diverse selection of high-performing products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.