Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

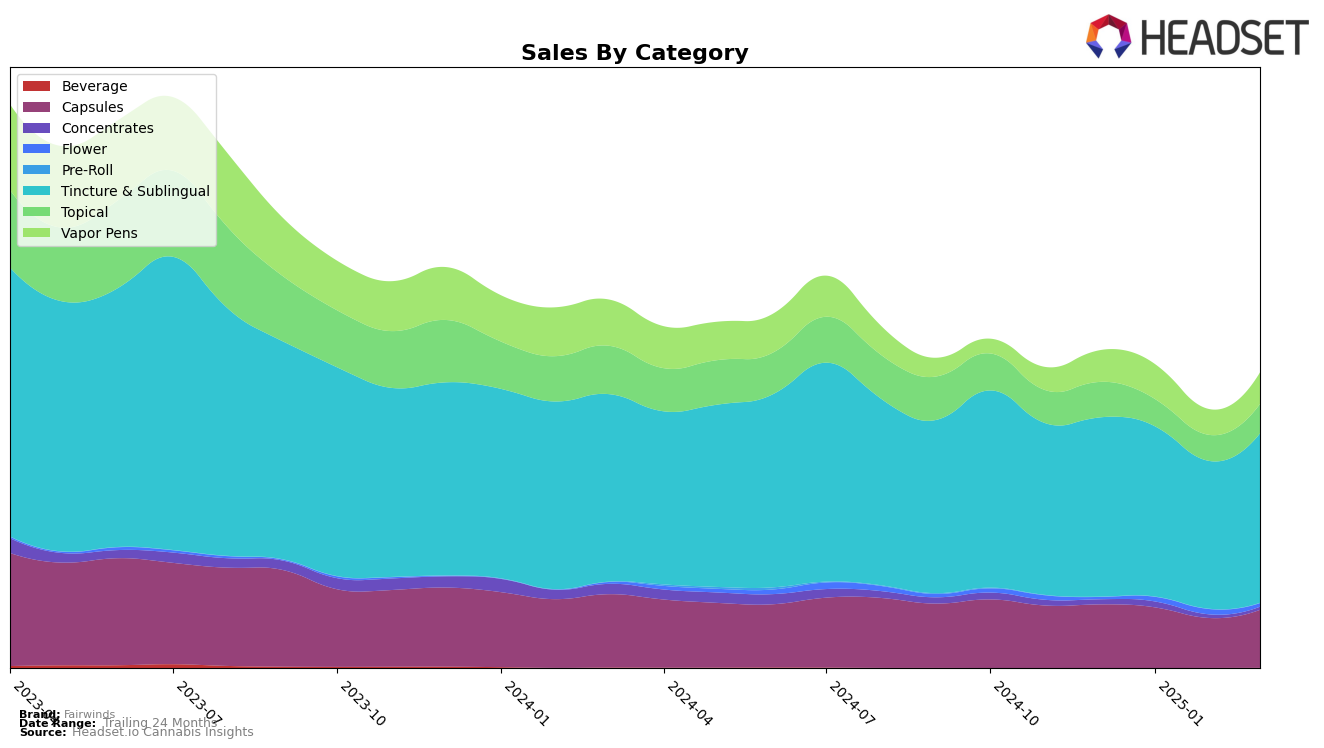

In the state of Washington, Fairwinds has consistently maintained a strong presence in the Capsules and Tincture & Sublingual categories. The brand has held the second position in the Capsules category from December 2024 through March 2025, demonstrating a steady performance. Meanwhile, in the Tincture & Sublingual category, Fairwinds has dominated the market by maintaining the top position throughout the same period. Despite a noticeable dip in sales from December to February, Fairwinds managed to recover slightly by March, indicating a potential rebound or stabilization in consumer demand.

Conversely, Fairwinds' performance in the Topical and Vapor Pens categories in Washington tells a different story. The brand consistently held the fourth position in the Topical category, suggesting a strong foothold, albeit not leading. However, in the Vapor Pens category, Fairwinds did not break into the top 30, with rankings hovering in the 90s, indicating a challenging market presence. The fluctuation in rankings and sales in the Vapor Pens category highlights an area where Fairwinds might need to strategize for better market penetration and consumer engagement.

Competitive Landscape

In the Washington Tincture & Sublingual category, Fairwinds has consistently maintained its top position from December 2024 through March 2025, showcasing its dominance in this market segment. Despite a slight dip in sales from December to February, Fairwinds rebounded in March, indicating resilience and strong brand loyalty. Competitors like Green Revolution and Ceres have consistently held the second and third ranks, respectively, throughout the same period. While Green Revolution closely trails Fairwinds in sales, the gap remains significant enough to secure Fairwinds' leading position. Ceres, on the other hand, shows a much lower sales volume, reinforcing Fairwinds' stronghold in the market. This consistent ranking and sales performance highlight Fairwinds' robust market strategy and customer preference, making it a formidable leader in the Washington Tincture & Sublingual category.

Notable Products

In March 2025, the top-performing product from Fairwinds was the CBD/THC 5:1 Companion Savory Bacon 64x Tincture, maintaining its first-place rank for four consecutive months with a sales figure of 1597. The CBD/CBN/THC 5:5:1 Deep Sleep Tincture also held steady in second place, though its sales decreased to 1142. The CBD/THC 5:1 Companion Savory Bacon 32x Tincture remained third, showing a sales recovery to 963. Notably, the CBD/CBG/THC FECO High Potency 20-Pack rose to fourth place, having not been ranked in February. Meanwhile, the CBD/THC 1:1 Ratio Tincture slipped to fifth, continuing its decline in sales from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.