Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

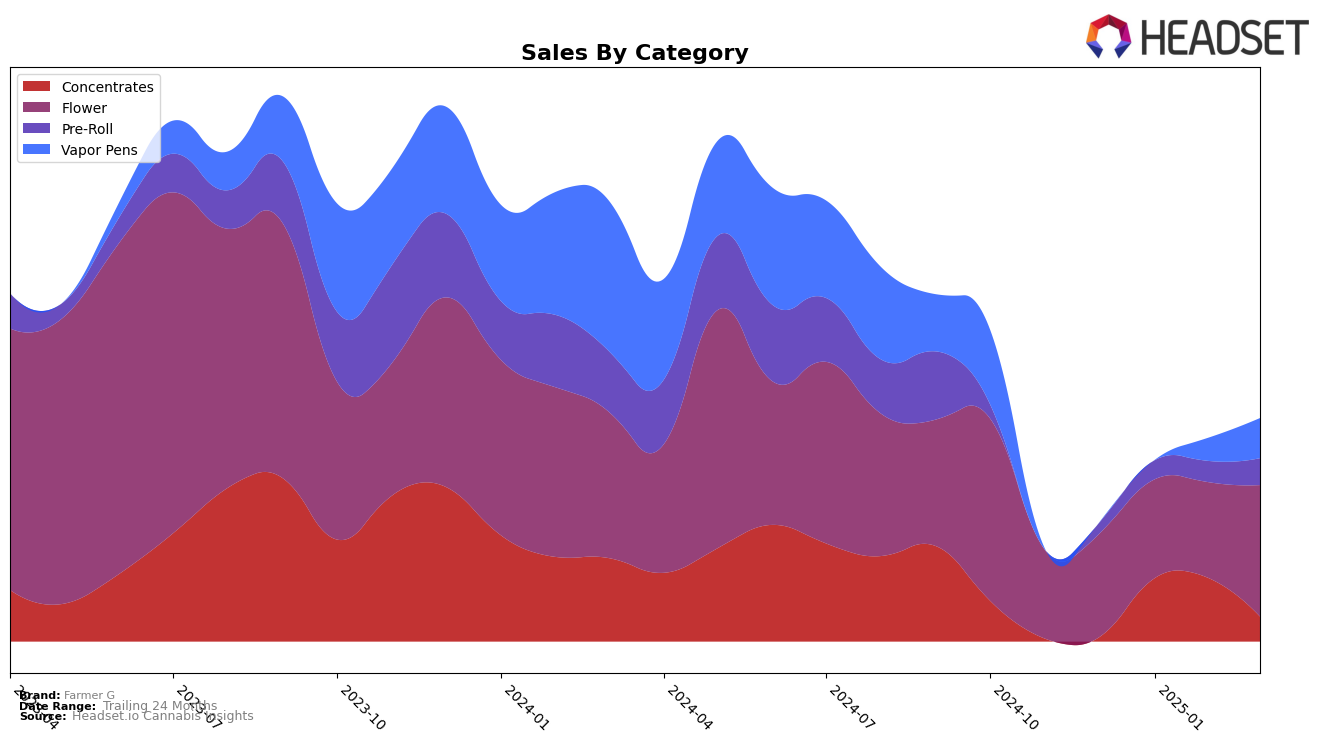

Farmer G's performance in the Missouri cannabis market showcases a varied trajectory across different product categories. In the Concentrates category, the brand entered the top 30 in January 2025, starting at rank 21 and climbing to 19 by February before slipping to 28 in March. This indicates a volatile yet promising potential in this segment. Meanwhile, the Flower category saw Farmer G hovering around the 37th position from December 2024 to February 2025, before dropping to 41 in March. This suggests a stable yet slightly declining presence in the Flower category, which could be an area for strategic improvement.

In the Pre-Roll segment, Farmer G experienced a steady climb, starting from rank 57 in December 2024 and improving to 50 by March 2025, reflecting a consistent upward trend that could be indicative of growing consumer interest. The Vapor Pens category presents an intriguing picture, as Farmer G was not in the top 30 until February 2025, debuting at rank 57 and advancing to 53 in March. The absence from the top 30 in the earlier months signals a late but potentially impactful entry into this category. These movements across categories highlight Farmer G's diverse performance, with some areas showing strong potential for growth.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Farmer G has experienced a dynamic shift in its market position from December 2024 to March 2025. Initially ranked 37th, Farmer G saw a slight dip to 39th in January 2025, before regaining its 37th position in February, only to drop to 41st by March. This fluctuation suggests a competitive pressure from brands like Curio Wellness, which entered the top 20 in February and improved its rank to 37th by March, and Belushi's Farm, which climbed from 52nd in January to 40th by March. Despite these challenges, Farmer G's sales showed resilience with a notable increase in March, surpassing competitors such as Willie's Reserve and Cubano, indicating potential for Farmer G to leverage its sales momentum to reclaim higher rankings in the coming months.

Notable Products

In March 2025, Farmer G's top-performing product was Champagne Patties (3.5g) in the Flower category, securing the number one rank with sales of 1980 units. Baby Yoda Pre-Roll (0.5g) followed as the second best-selling product, while Strawberry Mac (3.5g) claimed the third spot, both also in the Flower category. Grape Gasoline (3.5g) ranked fourth, showing strong performance within the same category. Notably, Baby Yoda Pre-Roll (1g) dropped to fifth place from its previous first-place position in February 2025, indicating a shift in consumer preference. Overall, the rankings reveal a consistent demand for Flower products, with a slight decline in pre-roll sales for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.