Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

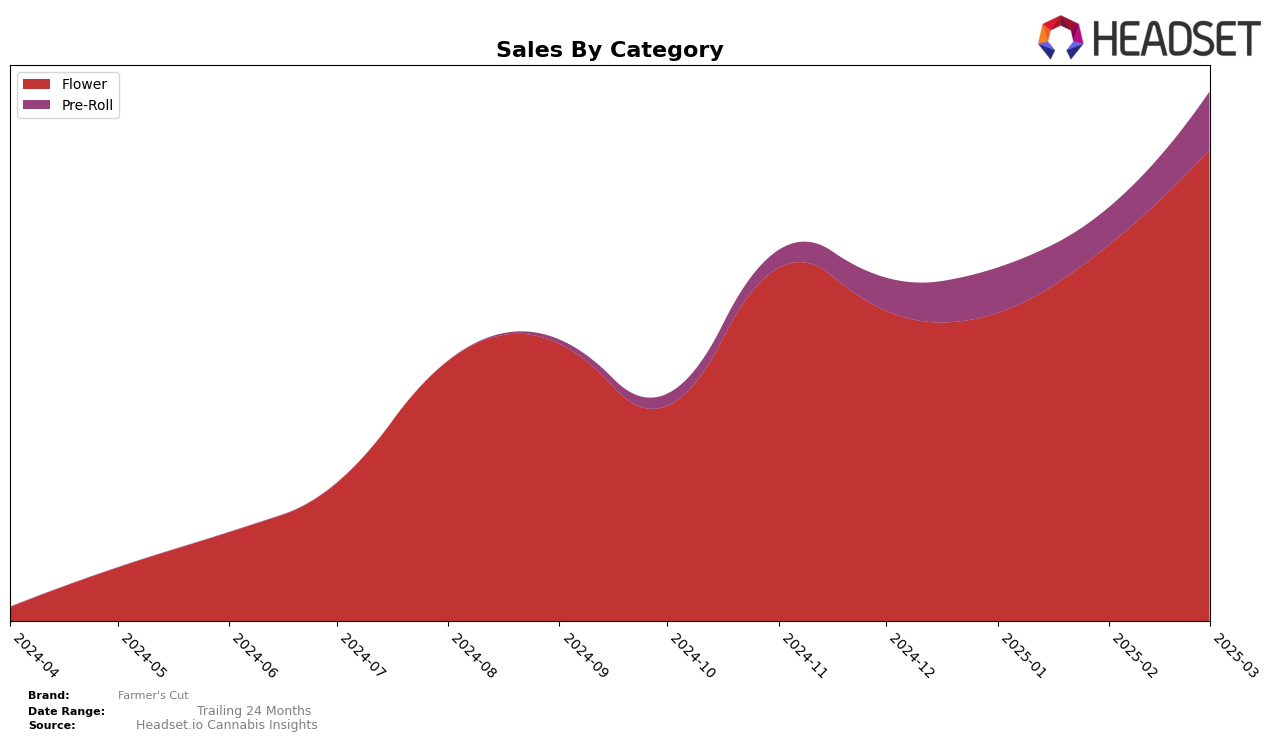

In the Massachusetts market, Farmer's Cut has shown notable performance in the Flower category. Starting from December 2024, the brand maintained a strong position, ranking 6th, and despite a slight dip to 7th in January 2025, it rebounded to secure the 4th position in both February and March 2025. This upward trajectory is supported by a significant increase in sales from approximately $1.35 million in January to over $2 million by March. Such a trend indicates a growing consumer preference for Farmer's Cut in the Flower category, suggesting effective brand strategies or product offerings that resonate well with the local market.

Conversely, in the Pre-Roll category within Massachusetts, Farmer's Cut has faced more variability. Initially positioned outside the top 30 in December 2024, the brand climbed to 29th in January 2025, reflecting a positive shift. Although it slipped to 35th in February, Farmer's Cut made a significant leap to 24th by March. This fluctuation, coupled with the increase in sales to $254,394 in March, suggests that while Farmer's Cut is gaining traction, there remains room for improvement to consistently secure a top position. The brand's ability to break into the top 30 from an unranked position is commendable, yet it highlights the competitive nature of the Pre-Roll market in this state.

Competitive Landscape

In the competitive landscape of the flower category in Massachusetts, Farmer's Cut has demonstrated notable resilience and growth. From December 2024 to March 2025, Farmer's Cut improved its rank from 6th to 4th, indicating a positive trajectory in market positioning. This upward movement is particularly significant given the stable performance of competitors like High Supply / Supply, which consistently held the 2nd rank, and Perpetual Harvest, maintaining 3rd place throughout the period. Meanwhile, Ozone experienced fluctuations, dropping to 7th in February before recovering to 5th in March, which may have opened opportunities for Farmer's Cut to gain ground. The brand's sales growth, particularly the significant increase in March 2025, suggests a strengthening market presence and potential for continued advancement in the rankings.

Notable Products

In March 2025, Blue Poison Pre-Roll 1g maintained its top position as the leading product from Farmer's Cut, achieving sales of $11,791. Powder Peach Pre-Roll 1g made a notable entry, securing the second rank. Rancid Rainbow Pre-Roll 1g saw a slight drop from second to third place compared to February. Disco Boss 3.5g retained its fourth position, showing consistent performance over the past two months. Snap Sprinklez Pop Pre-Roll 1g also held steady at fifth place, indicating stable demand within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.