Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

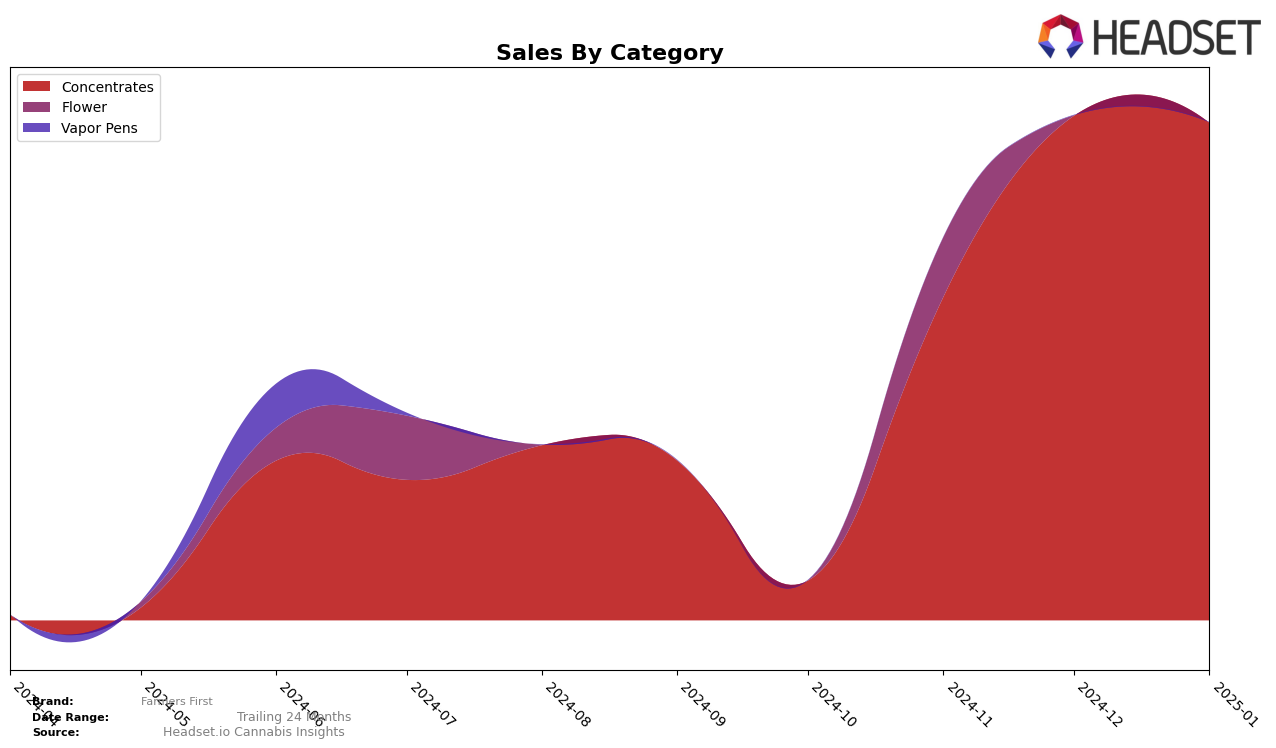

Farmers First has shown a notable upward trajectory in the Concentrates category within Oregon. After not making it into the top 30 brands in October 2024, Farmers First climbed to 35th in November and continued its ascent to 26th place by December and maintained this ranking in January 2025. This consistent improvement suggests a growing acceptance and popularity of Farmers First's concentrate products among consumers in Oregon. The brand's ability to break into the top 30 and maintain its position indicates strategic growth and effective market penetration in this competitive category.

While the brand's rise in Oregon is commendable, it's important to note the absence of Farmers First in the top 30 rankings in other states or categories during the same period. This could imply either a lack of presence or competitive pressure in other regions or categories. The sales figures from Oregon, which showed a significant increase from October to November, highlight the potential for Farmers First to replicate this success in other markets if similar strategies are employed. The brand's performance in Oregon could serve as a case study for expansion efforts into other states or into different product categories.

Competitive Landscape

In the Oregon concentrates market, Farmers First has shown a notable improvement in its competitive standing over recent months. Starting from an unranked position in October 2024, Farmers First climbed to 35th in November, and further improved to 26th by December, maintaining this rank into January 2025. This upward trajectory indicates a positive trend in sales performance, contrasting with brands like Dirty Arm Farm, which experienced a fluctuating rank, peaking at 24th in January after a low of 59th in November. Meanwhile, Grape God showed a strong performance in December, reaching 24th but dropped slightly to 28th in January. Chromatic also displayed variability, peaking at 23rd in November but falling to 27th by January. These dynamics suggest that while Farmers First is gaining ground, the competitive landscape remains volatile, with several brands experiencing significant rank fluctuations, highlighting the importance of strategic positioning and consistent product quality to maintain and improve market presence.

Notable Products

In January 2025, the top-performing product from Farmers First was Sugar Berry Scone Crumble (1g) in the Concentrates category, securing the number one rank with sales of 1249 units. Lemon Tree Cured Resin (1g) followed closely in second place, showing strong performance in the same category. Cocoa Kush Sugar Wax (1g) rose to third place from fifth in December 2024, indicating a notable increase in popularity. Sunset Sherbert Sugar Wax (1g) debuted in the rankings at fourth place, while Gorilla Glue #4 Sugar Wax (1g) dropped to fifth from its previous top position in October 2024. This shift in rankings highlights a dynamic change in consumer preferences for Farmers First's concentrate products over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.