Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

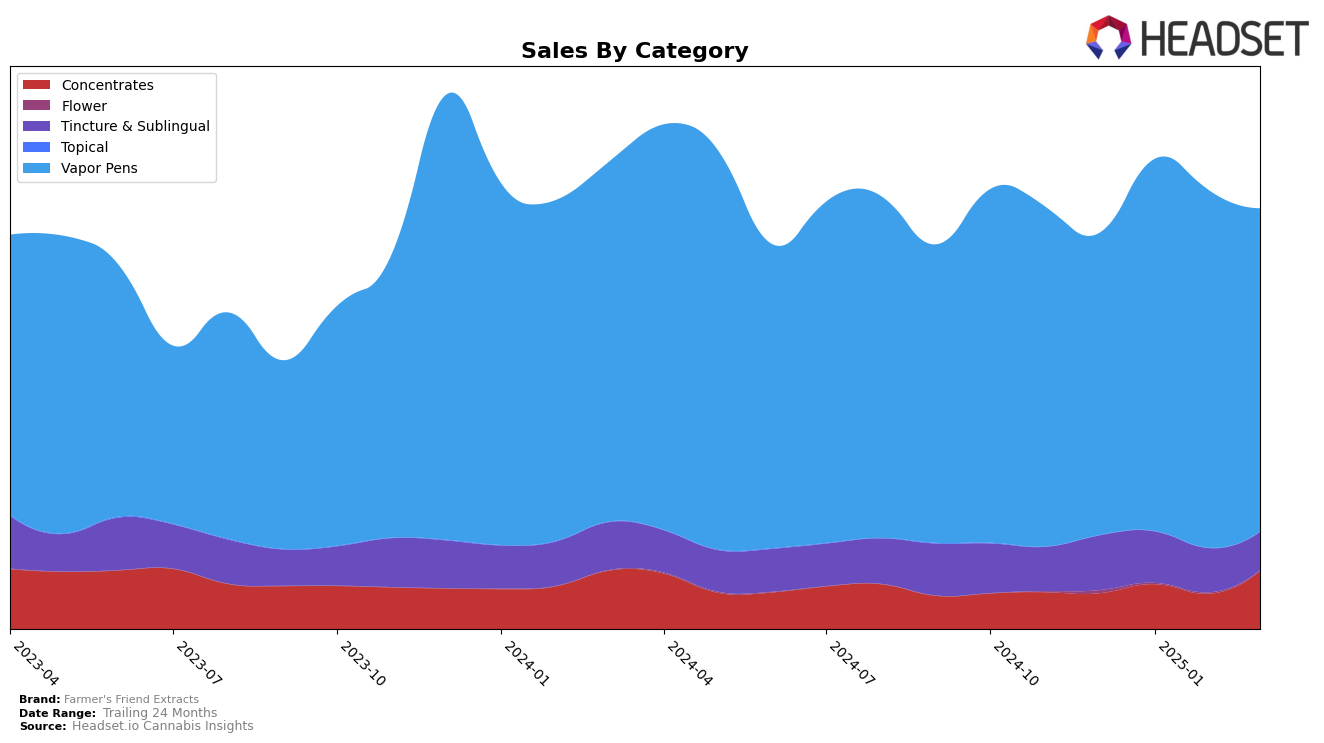

In the Oregon market, Farmer's Friend Extracts has shown notable performance across different product categories. Within the Concentrates category, the brand has experienced an upward trend, moving from the 25th position in December 2024 to the 18th position by March 2025. This positive movement suggests a growing consumer preference or increased market penetration in this category. Conversely, their Vapor Pens have seen fluctuating rankings, peaking at 7th place in January 2025 but slightly dropping to 9th by March. Despite these fluctuations, the brand maintains a strong presence in the top 10, indicating a consistent demand for their vapor pen products.

The Tincture & Sublingual category presents a different narrative for Farmer's Friend Extracts in Oregon. The brand has consistently held the 2nd position from December 2024 through March 2025, showcasing a stable and strong foothold in this category. However, the steady ranking does not necessarily indicate growth, as sales figures have shown a decline over the months. This could imply market saturation or increasing competition, which might require strategic adjustments from the brand to maintain or improve their position. Overall, while Farmer's Friend Extracts displays resilience and adaptability in certain categories, other areas may require attention to sustain their competitive edge.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Farmer's Friend Extracts has demonstrated a dynamic presence, consistently ranking within the top 10 from December 2024 to March 2025. Despite fluctuations, Farmer's Friend Extracts maintained a competitive edge, moving from 10th to 7th place in January 2025, before settling at 9th in March 2025. This performance is noteworthy when compared to competitors like Echo Electuary, which trailed behind, only reaching 10th place by March 2025, and Rogue Gold, which fluctuated outside the top 10 for most of the period. Meanwhile, Higher Cultures and FRESHY consistently outperformed Farmer's Friend Extracts, with FRESHY maintaining a strong position in the top 7 throughout the period. These insights suggest that while Farmer's Friend Extracts is a formidable player, there is room for strategic improvements to climb higher in the rankings and close the gap with leading brands.

Notable Products

In March 2025, Farmer's Friend Extracts' top-performing product was the Jack Herer Full Spectrum CO2 Cartridge (1g) in the Vapor Pens category, securing the number one rank with notable sales of 1197 units. The Grape Head CO2 Full Spectrum Cartridge (1g) followed closely in second place, demonstrating strong market presence. The Pink Runtz CO2 Glass Cartridge (1g) climbed to third place, showing improvement from its consistent fourth-place rankings in December 2024 and January 2025. Robot Junky Full Spectrum CO2 Glass Cartridge (1g) debuted in fourth place, while Grape Pie CO2 Cartridge (1g) rounded out the top five. This month's rankings indicate a competitive landscape, with some products gaining traction while others maintain steady positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.